Eighteen years ago, I was working on my PhD in Organization, Strategy & International Management at the University of Texas at Dallas – my, how time flies. Back then I spent quite a bit of time studying patterns of foreign direct investment abroad and attempting to develop a more cohesive theoretical framework for how these FDI decisions were made. The data I was using was mostly comprised of product companies looking to make captive investments abroad to lower factor input costs, or to gain access to raw material markets or end markets for their products. In 1995 the Electronics Manufacturing Services (EMS) industry globally was less than $30 billion, and much more of the world’s production was within the four walls of product companies.

So much of the academic work on FDI of 20 years ago has become a bit less relevant with the prevalence of outsourced manufacturing for everything from pharmaceuticals, to consumer packaged goods, to electronics. Today the global EMS industry alone is roughly a $440 billion business, producing well over half of the world’s electronic products. There are EMS providers in more than 40 countries, but the lion’s share of this industry today is concentrated in four countries: China, the United States, Malaysia, and Mexico. China alone represented about 53% of the global production value of the EMS industry in 2012. Within China, most of this business has traditionally been concentrated in coastal regions with major concentrations around Shanghai and Shenzhen; Shenzhen boasts the world’s largest EMS cluster and is by far the most developed electronics manufacturing supply chain center in the world.

China is the world’s electronics factory; a fact that is not likely to change much over the next five to seven years. But there are a number of interesting trends developing in China and more broadly in Asia that will undoubtedly change the makeup of Asian manufacturing, and will influence many companies’ approach to manufacturing in Asia.

Trend 1: China is Getting More Expensive

Rapid economic growth and central government policies in China have resulted in rising costs and a dramatic increase in wages. In particular, developed coastal regions such as the Pearl River Delta and the areas around Shanghai have experienced wage inflation that exceeds that of interior Chinese regions and far surpasses those of neighboring countries in Southeast Asia. At Riverwood Solutions we often hear from OEMs that are wrestling with the issue of rising costs in China. The strategies that these OEMs employ to cope with this trend, in order of the frequency that Riverwood sees them, are as follows:

1. Do nothing. China is still the lowest total cost solution for many products.

2. “Go West young man.” Relocate to less expensive inland areas in China such as Chengdu.

3. Investigate alternative Asian locations. Somebody will be the next China – right???

Southeast Asia contains several emerging outsourced manufacturing locations, most with wage levels below those of coastal Chinese EMS clusters.

4. Selectively near-shore or on-shore production. The trend is my friend and managing China is difficult.

Despite some gains by other Asian countries in outsourced manufacturing and a modest transition towards on-shoring production, China will continue as the world’s factory for many years. This is largely due to the powerful cycle of improving productivity that China’s EMS industry reaps from being the largest and most developed EMS cluster in the world. Workers are continually becoming more productive from rich EMS industry experience and greater technology integration. Inbound logistics costs are low and continue to fall as suppliers become even more concentrated in the enormous EMS clusters. Furthermore, as China’s appetite for electronics products grows, China becomes increasingly attractive as an end market.

Trend 2: Asia is Becoming More Accessible for SMBs with Lower Production Volume

Many of the challenges to small and medium sized businesses (SMBs) that sought to outsource production have been overcome. Up until recently, outsourced manufacturing services in Asia were not feasible for many SMBs.

- Many tier 1 EMS providers only really began serving SMBs with smaller pieces of business to place ($2 million to $5 million) in Asia after the big industry downturn in 2008.

- Previously communicating with providers on the other side of the world and coordinating operations was cumbersome. However, new capabilities, systems, processes, technology and communications have all improved dramatically over the past five to seven years.

- Specialized, independent firms have sprung up to help smaller OEMs bridge innovation with production and help manage outsourced manufacturing and suppliers half a world away. The daunting task of selecting an Asian EMS provider from the thousands available and trying to work with Asian providers unfamiliar with complexities of interfacing with design and product management teams had previously discouraged many SMBs from considering Asian production.

Outsourcing manufacturing half a world away clearly has significant inherent challenges. However, firms that are the most successful tend to have local “feet on the street” independent of their manufacturing partner. As one wise man said, “In China you don’t always get what you negotiate, you get what you manage.”

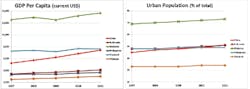

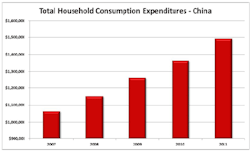

Trend 3: Industrialization Creates Urbanization which Creates Consumption

In developing and industrializing economies, urbanization is strongly correlated with economic growth. Urban areas typically bring greater income earning opportunities which lead to higher disposable incomes. Consequently, consumption increases. This is precisely the situation occurring in China and many other Asian nations. GDP per capita, the most common measure of standard of living, is steadily growing in these countries.

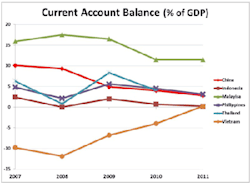

Trend 4: Industrializing Countries are Becoming Net Importers – or Trending in that Direction

This cycle of industrialization leading to consumer-led consumption can benefit the U.S. Much of the world’s production equipment used by Asian manufacturers is imported from the U.S. Furthermore, increases in Asian consumer spending will create a wave of aspirational buyers. These newlyTrend 5: Asian Production – In Part to Meet Asian Demand

Whereas traditionally EMS providers primarily served end consumers in the West, emerging patterns of consumption in Asia are altering supply chain design. Outsourced manufacturing in Asia increasingly involves specific calculus from OEM customers around regional patterns of consumption. Major markets such as China, Indonesia, Malaysia, Thailand and India are becoming significant consumers of industrial, commercial and consumer goods. Designing supply chains to consider both existing Western consumption and significant Asian consumption adds new dimensions of complexity to the decision-making process. This makes minor opportunities to lower key factor input costs less significant in the overall order of importance.

Contributing Editor Ron Keith is chief executive officer for Riverwood Solutions, a supply chain consulting and managed services firm. Special thanks to Xander Kameny at Riverwood for his help on this article.

About the Author

Ron Keith

Chief Executive Officer

Ron Keith brings more than 24 years of operations experience to Riverwood Solutions including engineering, manufacturing and executive management positions at Westinghouse, Wavetek, Rockwell, Alcatel and Flextronics International. Ron has a reputation as an innovator, team builder, creative problem solver and strategic thinker who delivers straight talk and strong results to Riverwood's clients. He has run international EMS operations with annual sales in excess of $1.4B and has managed manufacturing, product development, and program management personnel in numerous countries.

Ron has advised more than four dozen companies on their manufacturing operations, supply chain, and outsourcing strategy including more than a dozen Global Fortune 500 companies. He has previously consulted for four of the top 10 EMS (Electronic Manufacturing Services) companies and has advised hedge funds, private equity funds and strategic investors on a number manufacturing services related investments. Ron has published more than 30 articles on various manufacturing, technology and business related topics including strategy, operations, quality management, technology trends, and supply chain management.

Prior to founding Oreamnos Partners and Riverwood Solutions, Ron served as Vice President and General Manager at Flextronics International, where he started and ran several divisions in both the EMS and ODM (Original Design Manufacturer) spaces during his more than eight year tenure. He worked with, and ran manufacturing operations for, a number of leading OEMs at Flextronics including Cisco, Motorola, JDS Uniphase, Nortel. W.L. Gore, Kyocera and others.

Ron has undergraduate degrees in both Electronic Engineering and Manufacturing. He received an MA in International Management and an MBA in Operations Research from the University of Texas at Dallas, where he also completed the majority of coursework towards a Ph.D. in Organization, Strategy & International Management (OSIM).