Supply Chain & Logistics: Hours of Service Changes Add to Summer of Logistics Discontent

Now is the summer of our discontent, at least when it comes to transportation management. While the amount of freight hauled in June 2013 was virtually the same as that in May (only a barely visible uptick in June of 0.09%), freight expenditures were up 3.4%, based on analysis conducted by Cass Information Systems Inc.

"The upward drift in expenditures has more to do with heavier loadings and the commodity mix than an upward trend in rates," explains transportation analyst Rosalyn Wilson of Delcan Corp. "Most carriers in all sectors have reported strong downward pressure on rates, and competition in the intermodal arena remains strong."

"As long as freight levels continue to inch upward, truck rates are likely to begin a more significant pattern of increases," adds Jonathan Starks, director of transportation analysis for FTR Associates. "If nothing else, fleets will be looking to cover their increased operating costs for drivers, in addition to taking advantage of the reduction in spare capacity that generally drives upward movement in truck rates."

| Stay up to date on the latest in lean thinking at www.industryweek.com/blog/lean-supply-chain. |

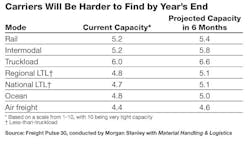

Meanwhile, rates are expected to be on the rise as well. According to the Freight Pulse study, shippers (i.e., companies with freight that needs to be moved) expect rail rates to increase by 2.4% over the next six months, as the railroads (the least expensive mode) are projected to see an uptick in volumes by 3.4%, mostly at the expense of truckload carriers. Truckload, meanwhile, will see rates increasing by 1.7%, national less-than-truckload (LTL) by 1.8%, regional LTL by 1.6% and intermodal by 1.5% .

About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.