Supply Chain and Logistics: Transportation Rate Hikes to Be as Modest as Economic Recovery

Transportation is a huge expense for U.S. industry, amounting to over $1 trillion per year in business logistics costs. It’s a delicate balancing act to manage exactly when materials and supplies should arrive at the plant, as well as shipping out products to other plants, distributors and end-users. A common tactic used by companies is a modal shift: moving freight from one transportation mode (e.g., airfreight) to a less expensive mode (e.g., ocean cargo). The tradeoff, of course, is that the cheaper the mode, the longer the in-transit time.

Motivating these modal shifts is the cyclical fluctuation of capacity throughout the industry. If there are more transportation carriers available than the amount of freight to be shipped, then transportation costs need to come down (or at least become more readily negotiated); if there is more freight that needs to be hauled than available carriers to haul them, then costs tend to go up. That’s pretty much Logistics 101, but of course with ever-increasing customer demands for faster deliveries, no two freight transactions are ever alike.

“The freight logistics industry was tested in 2012 by severe weather events, strikes and capacity issues,” points out Rosalyn Wilson, senior business analyst with Delcan Corp. A drought in the Midwest not only reduced grain shipment volumes but lowered the water levels in some sections of the Mississippi River, hampering navigability. She adds, “A lack of available funding caused infrastructure investment to fall behind, and the year saw a number of road and bridge failures.”

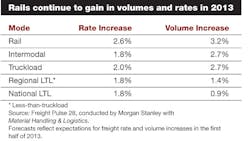

Nearly half (46%) of respondents say they plan to shift at least some freight volume from truckload to rail over the next six months, while only 14% say they’ll be shifting from rail to truckload. Other modal shifts to be aware of in the first half of 2013 include the shift of some volume from less-than-truckload (LTL) to truckload, as 39% of respondents plan to make this move; conversely, only 16% anticipate shifting from truckload to LTL. Also, 16% of respondents look to shift from airfreight to LTL, while only 4% plan the opposite shift. The only other modal shift that saw responses in the double-digits was the shift from airfreight to ocean, at 14%; only 5% will be shifting any volumes from ocean to airfreight.

“The rails show most improvement in service and value for dollar among all modes,” notes Morgan Stanley analyst William Greene. Capacity expectations, he adds, “remain broadly unchanged across modes.”

Wilson’s take is that the first half of 2013 will mirror what we saw in 2012, which she characterizes as “an unremarkable year.” Pointing to record high inventories, Wilson thinks it is unlikely that we will see an increase in new orders placed for goods in 2013. “Strong economic growth,” she says, “is still the elusive prize over the hill.

About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.