China's efforts to slow economic growth were not evident on this year's IW 1000 ranking of the world's largest public manufacturers. China posted the greatest average revenue gain among countries with at least 30 companies appearing on the 2011 IW 1000 list. The Chinese government has been trying to stave off inflation by tightening lending rules and temper an overheating economy.

But revenue for IW 1000 manufacturers based in China still grew an average of 47% in 2010. The nation's oil, steel and automotive sectors continued to advance in 2010, led by companies such as China Petroleum & Chemical Corp. (No. 4),Angang Steel Co. Ltd. (No. 282) and SAIC Motor Co. Ltd. (No. 76).

South Korea is another Asian country that posted strong gains in 2010, with an average revenue increase of 20%. One of the country's leading manufacturers is 12th-ranked Samsung Electronics Co. Ltd. Samsung was one of several manufacturers from the semiconductor industry that rebounded with healthy profit increases in 2010. The company's profit grew 65% in 2010, driven by smartphone and memory semiconductor sales. Samsung's momentum carried into this year's second quarter when Strategy Analytics reported that the company, along with Apple Inc. (No. 48), toppled Finland's Nokia Corp. (No. 61) as a leading smartphone provider.

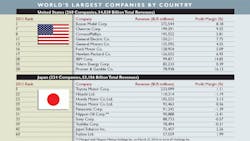

U.S. IW 1000 revenues grew an average of 14%. The United States led all countries represented on the IW 1000 with 266 manufacturers making the annual ranking. Irving, Texas-based Exxon Mobil Corp. took the top spot with revenue of $372.5 billion.

Meanwhile, many Japanese companies struggled in 2010, which was reflected in the country's average IW 1000 revenue declining 8%. Fifth-ranked Toyota Motor Corp., which ended the last fiscal year on March 31, 2010, dropped a spot behind China Petroleum & Chemical. The company's revenue declined 7.7% in a year marred by recalls, but the company returned to profitability after posting a loss the previous fiscal year.

Major manufacturing sectors that showed significant revenue increases in 2010 include petroleum and coal products, motor-vehicle parts, and computers. Motor-vehicle parts revenues totaled $326 billion and grew at an average of 21% in 2010. The largest IW 1000 sector is the petroleum and coal products industry, with $4.8 trillion in total revenues. The industry realized average revenue increases of 17.8%, with many oil producers benefiting from higher fuel prices and energy demand. Computers and other electronics products companies achieved average revenue gains of 15.4%. Included in this sector, with $2.2 trillion in total revenue, are makers of semiconductors, smartphones and personal computers.

The chemicals sector was the fourth-largest IW 1000 category with $1.2 trillion in total revenue. The sector achieved a more modest average growth of 5.3%. But global chemical production in 2010 reached the precrisis level, according to a BASF SE (No. 34) industry report.

The industry benefited from high demand and inventory restocking in key customer industries, BASF reported. Construction-related industries continued to struggle, including companies in the stone, clay, glass and concrete products sector. The industry had one of the smallest average revenue gains at 2.6%.

See Also:

• The Rapid Rise of India's Steel Industry

About the Author

Jonathan Katz

Former Managing Editor

Former Managing Editor Jon Katz covered leadership and strategy, tackling subjects such as lean manufacturing leadership, strategy development and deployment, corporate culture, corporate social responsibility, and growth strategies. As well, he provided news and analysis of successful companies in the chemical and energy industries, including oil and gas, renewable and alternative.

Jon worked as an intern for IndustryWeek before serving as a reporter for The Morning Journal and then as an associate editor for Penton Media’s Supply Chain Technology News.

Jon received his bachelor’s degree in Journalism from Kent State University and is a die-hard Cleveland sports fan.