We finally have recovered most of the jobs that were lost in the Great Recession. Politicians and public-policy makers are celebrating the fact that unemployment is under 5%.

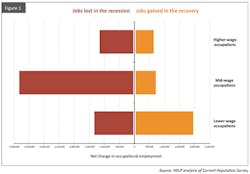

However, the Great Recession primarily wiped out the mid-wage jobs, and the strongest growth during the recovery has been in low-wage jobs.

The National Employment Law Project found in 2012 that 58% of the recovered jobs were in low-wage occupations, with median hourly wages from $7.69 to $13.83 an hour. Mid-wage occupations, with median hourly wages from to $13.84 an hour to $21.13 per hour, were the big losers—60% of all jobs lost in the recession. The higher wage jobs, from $21.14 to $54.55 per hour, lost 19% during the recession, but have recovered 20% and are doing well. In essence the poor economy has replaced good jobs with bad ones.

Today's jobs report indicates that this trend continues.

Further, the Bureau of Labor Statistics data shows that there are 7.9 million people still unemployed. Another 2.1 million are long-term unemployed (those jobless for 27 weeks or more), while 1.7 million people are considered marginally attached to the labor force, and 6.1 million people are involuntary part–time workers.

So is the economy really recovering?

Five percent unemployment sounds great, but when you add it up, 17.8 million people need a job or want a better job. I don’t think it is time for a celebration. These numbers made me want to look deeper into the statistics coming out of the recovery.

This recovery is defined by the loss of mid-wage jobs in construction, manufacturing and other industries that offered family-wage jobs. The result is that the middle household income declined from $55,627 in 2007 to $51,017 in 2012. Workers who had mid-wage jobs before the recession and were laid off have been forced to take jobs in food services, retail and other low paying or minimum-wage jobs.

The NELP report notes that durable manufacturing, with growth of its mid-wage occupations, has been "one of the key drivers of the U.S. recovery," but also that it is not showing enough growth to offset the greater number of low-wage jobs.

This trend of low-wage jobs growing faster than mid-wage jobs is not just bad for middle-class workers, it is bad for the economy."

This trend of low-wage jobs growing faster than mid-wage jobs is not just bad for middle-class workers, it is bad for the economy. American workers no longer make the wages they need to buy all of the products and services America can make. They don’t have the purchasing power to energize our consumption economy, which has led to low GDP growth and low investment in manufacturing plants and equipment.

What's Slowing Manufacturing Job Growth, and What's the Solution?

The Economic Policy Institute reports that 5.4 million manufacturing jobs and 82,100 manufacturing establishments were lost between 1997 and 2014. It asserts that most of the jobs were lost due to growing trade deficits with our trading partners. The primary reasons for the loss of manufacturing and service jobs are currency manipulation, outsourcing and trade agreements.

Granted, these are not the only reasons for lost jobs and lowered wages. Other factors like automation, deregulation, the loss of unions and the decrease of the minimum wage by 30% since 1979, have also had a big effect on house hold incomes.

For his second term, President Barack Obama set a goal of creating 1 million new manufacturing jobs in his second term. At the beginning of his second term in December 2012, manufacturing had 11,951,000 jobs. With only one year to go in his second term, only 371,000 manufacturing jobs have been created. It seems any real chance at creating mid-range jobs is becoming academic.

President Obama had also said, in 2008, that he was going to get tough with China on currency manipulation, but he now ignores the problem completely. However, his administration is now funding manufacturing hubs around the country to spark innovation and create jobs. His latest budget calls for $1.9 billion to fund 29 new manufacturing institutes between 2018 and 2025.

Hillary Clinton’s only proposal for improving manufacturing is to offer tax incentives to spur investment in communities that are suffering from factory closures. The Republican candidates are just as weak on manufacturing, so there doesn’t appear to be a manufacturing presidential candidate.

Manufacturing hubs and tax incentives are not going to create manufacturing jobs, because the solution is not domestic. We must address international problems like currency manipulation and the growing trade deficit.

Strengthening and growing U.S. manufacturing can be done, and the model for how to do it is Germany. Germany pays its manufacturing workers almost one-third more in wages, yet they have lost only 4.7% of their manufacturing jobs, while the U.S has lost 31%. Every year, Germany runs a trade surplus and makes good use of a value-added tax to keep its imports and exports balanced.

The Trickle-Down "Solution"

Well it is campaign time again, and the candidates are ramping up to dazzle voters with new slogans and catchy generalizations. Since the economy is still slowly emerging from the Great Recession and jobs that pay a living wage are rare, the creation of jobs will be a big issue. I can almost assure you that one of the solutions that will be offered by conservatives is the notion that lowering taxes for the wealthy automatically creates jobs.

Trickle-down Economics (TDE) has been a popular economic theory for Republicans since the Laffer curve days of President Ronald Reagan in the early 1980s. It assumes that there should be no or few barriers to the accumulation of wealth, because if the rich do well, the benefits will trickle down to the rest of us. As the story, goes lower taxes for high-income people—in terms of tax rates, estate taxes, capital gains—will benefit everyone by increasing GDP growth, wages and jobs.

President Reagan said that "all boats would rise" by giving huge tax cuts for the wealthy, and during his administration he did get two big tax cuts through Congress. But his claim of all boats rising did not happen. The majority of boats stayed the same or sank, while only 5% of the boats actually rose.

The big lesson here is that there are no simple answers to complex economic problems."

The promotion of TDE is still a fundamental plank in the Republican platform. During the last election, vice-presidential candidate Paul Ryan offered a plan to cut taxes for the wealthiest Americans and at the same time cut expenditures for entitlement programs, education, health care, environmental programs, infrastructure, consumer protection and scientific research. Even though the recommended tax cuts would leave an enormous gap in revenues, he said “they would pay for themselves by creating a huge, rapid spurt of economic growth of 5 to 10%.”

During the Vice Presidential debate, Ryan said that “Republicans expect tax cuts to create somewhere between 7 and 12 million jobs, grow the tax and balance the budget.” If you take his plan literally, you can assume that cutting taxes for the wealthiest people would actually increase tax revenue for the government. The mysterious equation for Ryan’s magical growth spurt growth seems very similar to Reagan’s Laffer curve and Bush’s dynamic scoring.

After 40 years, there is no proof that TDE works. For years, I have been looking for an independent and quantitative study from a non-political group to prove TDE right or wrong. Finally, in recent years, quantitative studies have been showing up in the media.

The Congressional Research Service (CSR) is a nonpartisan entity associated with the Library of Congress that does academic-quality research to answer difficult policy questions. The CRS released a study in 2012 that concluded, as follows:

“The reduction in top tax rates appears to be uncorrelated with saving, investment, and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie. However the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution. The report notes that tax rates were at the highest when growth was at its peak, and that the reduction in tax rates has not had any discernible impact on the types of investment that lead to growth.”

Rather than acknowledge the findings the Congressional, Republicans pressured the CRS to withdraw the report.

David Stockman, President Reagan’s budget director, also confirmed that TDE was a sham. He was one of the architects of supply-side economics who finally turned against the doctrine. To get the Reagan tax cuts passed, he helped design a policy that would give tiny tax cuts for most Americans and big tax cuts to the wealthy. Stockman said:

“Giving small tax cuts across the board to all brackets was simply a 'Trojan Horse' that was used to get approval for the huge top brackets cuts. Trickle Down was a term used by Republicans that meant giving tax cuts to the rich.

“There is no realistic way for 'Trickle-Down' economics to work and increase the income of the working classes of America. In fact, I am certain that the developers of the theory of 'Trickle-Down' economics were fully aware of this and that 'Trickle-Down' has in fact worked as intended. This means that the intent behind implementing 'Trickle-Down' was to benefit the wealthiest Americans at the expense of working class Americans. 'Trickle-Down' hasn't failed, as many modern economists have suggested, it has succeeded in its goals, which is the increase of economic inequality and the shift of a greater portion of America's wealth into the hands of the wealthiest Americans."

I have always wondered why so many voters accepted the notion of TDE for so long. In fact, many Americans still believe in TDE doctrine as a matter of faith. Yes, there is some truth to the concept. If there is increasing demand in terms of sales and companies make more profit, then they are more likely to hire more workers. However, job creation is based on demand not tax cuts.

The big lesson here is that there are no simple answers to complex economic problems. The simple idea that cutting taxes would lead to economic growth and eventually increase tax revenue was a simple answer that was accepted by many citizens for 33 years. The psychologist Paul Ginnetty calls this type of reasoning, “the potent narcotic of reassuring simplicity.” Politicians will always take advantage of our addiction to simplistic answers to their own benefit by simply telling people what they want to hear.

If we are going to have a shot at creating mid-wage jobs, our best bet is to make the growth of manufacturing a top priority. This means taking politicians to task on their general solutions. It also means discrediting the notion of trickle-down economics, and the people who still push the notion of TDE as an answer.

Remember, it is not only the quantity of jobs needed, but also the quality of jobs—those that pay decent wages.

Vote for people who are willing to face up to the real reasons for lost jobs—currency manipulation, outsourcing, and trade deficits.