Brookings' Muro Makes the Case for Advanced Manufacturing

Mark Muro doesn’t build cars or circuit boards at the Brookings Institution, one of Washington’s venerable think tanks, but he is building the case that manufacturing, particularly in its more advanced forms, is a vital component of the United States economy and critical to its future.

Muro, who heads the Metropolitan Policy Program at Brookings, released an update August 4 to the think tank’s research on advanced industries in the U.S. Brookings defines “advanced” industries as those “in which R&D spending per worker ranks among the top 20% of industries and the share of workers with a high level of STEM knowledge exceeds the national average.”

Based on that definition, Muro and his colleagues have identified 50 industries as advanced - 35 in manufacturing, 3 in energy, and 12 service industries. The advanced manufacturing sector includes industries such as aerospace, automotive, medical devices and pharmaceuticals.

When Brookings issued its first report in 2015, focusing on the immediate aftermath of the Great Recession, it found that the 50 industries in 2013 had about 9% of U.S. employment but accounted for 17% of GDP. It also discovered that this set of industries “employs 80%of the nation’s engineers; performs 90% of private-sector R&D; generates approximately 85% of all U.S. patents; and accounts for 60% of U.S. exports.” These industries, Brookings concluded,” encompass the country’s best shot at supporting innovative, inclusive, and sustainable growth.”

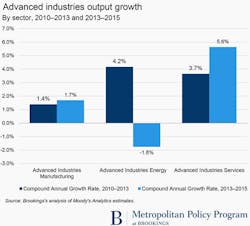

In the new report, Brookings found that advanced manufacturing continued to add jobs and increase its output in the years 2013-2015, though growth slowed.

We spoke recently with Muro about his updated research and the changing face of U.S. manufacturing. Here are excerpts from that interview.

IndustryWeek: How would you characterize the advanced industries (manufacturing)?

Mark Muro: “The advanced sector is where we can see the promise of the U.S. economy. The virtues of the advanced sector are what we want more of for our economy.”

How so?

“They are the single most important source of innovation. These industries dominate the private sector expenditure on R&D. They provide 60% to 70% of exports. These are the most highly productive industries we have at a time when there is a lot of concern about drifting productivity in the country. And because of this, they also pay well. There is a wage premium for people of all education levels. Half the people in the advanced industries don’t have a college degree, yet they are enjoying those wage premiums too…It’s innovative, it’s productive, it exports, it pays well and it is inclusive.”

How is advanced manufacturing doing?

“The advanced manufacturing sector was really laboring against tough conditions the last two years with a strong dollar and essentially a global depression going on everywhere but here. And yet it still increased output and saw employment growth. That really signals the vitality of the industry.”

But there is change afoot, right?

“We have had seven years of growth, it is late in the business cycle and we are beginning to see some signs of weakening in auto. We see slowing of job growth in auto and some softening of output. And meanwhile a number of other industries have not been turning in the same growth as they did those first three years. In that sense, we are now depending on auto for the bulk of our manufacturing employment growth. I think there are some signs for concern about the depth of the advanced manufacturing economy now.”

Have we provided advanced manufacturing with the investment it needs to prosper?

“Over time, we have not properly valued the importance of manufacturing and in particular of advanced manufacturing. We haven’t, therefore, invested sufficiently in manufacturing-relevant R&D, not just basic science but applied, very practical product and process investment.”

How are we doing with preparing a workforce for advanced manufacturing?

“The country has done a bad job of preparing workers for manufacturing. The difficulties commodity manufacturing has had over the past 25 years has created the sense in regions, in households and even in training organizations that this is a dying sector of the economy so we shouldn’t really be training people for it. And then this country doesn’t do a good job of linking its training efforts, often at the state and regional level, with what is going on in state and local industries. We haven’t done the things over 20 years that would have left us with a bigger sector.”

Your report mentions an inclusive benefit to advanced manufacturing. Why that conclusion rather than manufacturing will become the realm of a technical elite?

“Upskilling is happening in the advanced manufacturing sector. It is not sufficient to just show up at the plant and do the same thing all day for 250 days a year. It is a more collaborative, more creative and more technical set of activities. That doesn’t mean that one has to have a college degree. Employees will require a modicum of digital skill. So much of this is about automation, computerization, CNC operation and so on. But remember that we have a lot of people retiring. There is going to be demand for workers to staff what are going to be highly productive and hopefully growing industries.”

You have highlighted the importance of manufacturing to metropolitan areas. In recent decades, manufacturers have often sought sites in rural areas. Will manufacturing be returning to urban areas?

“We do see this. With new technologies allowing more craft-type of high-end production, often in small batch runs using technologies like 3D printing and so on, it is possible to return to the city for a number of smaller scale but higher value manufacturing…The new technologies allow a kind of craft manufacturing that looks and feels more like a small software company. There are examples. Lear Corp., the auto parts manufacturer, is returning to Detroit, in part because there are workers there. The managers of these companies are extremely aware that the millennial generation is more oriented to cities.”

“The federal government has a responsibility which it is best positioned to deliver on which is to expand substantially our R&D investment in manufacturing-relevant technologies with the focus on practical use. We have seen the launch of the manufacturing institutes that the Obama administration has been pushing. There is more work to be done in ensuring that there is a strong base of manufacturing research going on. These industries are driven by innovation on one hand and technically skilled people.

States and regions do have a huge role, though. Manufacturing ecosystems are spatially located. Supply chains are within states and metro areas. So supporting technical innovation investments at the state level is important. The states and regions are the lead on education and training. Having a strong education system from K-12 into the universities that is focused on STEM training – science and math and technical skills and especially coding now should be part of the standard education.

We know what works on the training side. That is industry-oriented focus on growing locally relevant industries. States and regions need to be setting up community colleges that are highly responsive to, if not co-designed with, industry and that are highly focused on technical, practical experience. So they use internships or apprenticeships, experiences in the factory to help young workers get a sense of the industry. Then a real focus on the specific technical skills that industries need, using the particular kinds of equipment needed. We need an all-hands-on-deck focus here. I do think industry has to be more actively involved in sorting out and improving our training system…If they feel there is not a pipeline, it is partly on them.”

Some communities in recent years have had little interest in fostering manufacturing. What is your sense of that now?

“I think that is changing. It has become clear that the most vibrant manufacturing is essentially a technology pursuit. Some of these companies look and operate like software companies…They are much more dynamic, engaged with other industries like biotech or software or device making. Today’s manufacturing is in fact a different animal and very clean, high-tech. There is also greater understanding since the recession that these are high productivity industries, they have huge supply chains and they are sources of prosperity. In the last five years, there is a greater understanding of the value of manufacturing.”

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.