Strategizing the 'What Ifs': Scenario Modeling in 2025

The business world is bursting with what-if scenarios. One needs to look back no further than the 2020 pandemic to understand that companies must plan for a variety of situations. What if we don’t get that expected contract? What if certain regulations are suddenly expanded or eased? What if a hurricane threatens our plant?

Several approaches used for both immediate and long-term planning help companies set expectations, budgets, production targets and staffing requirements while preparing for business challenges.

Time Series Analysis predicts future business performance based on historical data patterns. By analyzing trends, seasonality, and cyclic behaviors in data, companies can forecast future sales, demand or financial metrics.

The Delphi Method gathers insights from a panel of experts to predict future events or trends. Independent forecasts are aggregated and iterated upon until a consensus is reached.

Regression Analysis models quantify relationships between variables and forecast future outcomes by analyzing how independent variables affect dependent ones. This highly mathematical method works best when there are established causal relationships.

Insights gained from such methods provide the framework to forecast growth while developing contingency. However, none can offer reliable answers in the face of shifting variables. Consequently, a growing number of manufacturers are adopting a more dynamic approach.

Scenario Modeling

Combining qualitative and quantitative approaches, scenario modeling allows stakeholders to test and measure the financial ramifications of a set of alternatives and draw data-driven conclusions to navigate or leverage threat or opportunity. Because reliable insight comes from identifying and measuring the effects of various what ifs, it’s important to create and compare multiple iterations. Plans can be continually evaluated and refined as situations change or progress.

Automotive suppliers, for example, employ scenario modeling to blend customer releases to the plants against order volumes, vehicle inventories and vehicle sales. This is especially beneficial in balancing procurement and production with inadequate sales projections and vulnerable supply lines.

For instance, automotive components suppliers use scenario modeling to forecast the financial impact of manufacturers pivoting from electric to hybrid vehicles. Scenario modeling can help determine the need to shift resources away from electric vehicle programs being cancelled or postponed, and the implications for suppliers’ program revenue, parts volume, workforce staffing and other profitability variables.

Scenario modeling can also prepare manufacturers for a wide variety of potential events. To what degree, for example, would a call to military action deplete a manufacturer’s pool of skilled laborers, and how would this impact production and profitability? What would the financial impact be of the loss of a plant due to fire? What would be the flow of inventory should a major port become blocked? How would a flawed product release affect consumer demand?

Election Results

Local, state and national election results can have a long-term impact as incoming administrations change or eliminate mandates, regulations, tariffs and taxes. It’s possible to model the effects of these possibilities and test and re-testing contingency plans so that a company can react quickly.

On a national level, President-elect Donald Trump has promised rollback of electrification incentives and emission rules. Consequently, suppliers anticipate that internal combustion engine (ICE) vehicles will continue at higher volumes while electric vehicles (EV) that might have replaced them under different circumstances are delayed. But the future of automotive suppliers relies on accounting for all possible outcomes. What happens if certain states double down and uphold these mandates? And how do rising European Union regulations impact demand and production targets?

Scenario modeling aids in layering what types of vehicles might sell or be produced in the coming months. A supplier who has been investing in tooling and labor for an expected surge in EV production might suddenly find that, with rolled-back mandates, contracts are being modified or cancelled. Suddenly, that supplier must be prepared to evaluate the options and pivot if needed. This might include introducing new revenue streams, eliminating capital investments and making workforce changes.

How It Works

In scenario modeling, analysts change variables, observing the impact of these inputs on key metrics to explore potential outcomes. Ideally, multiple versions of these models are created to account for different or extreme scenarios, such as optimistic, pessimistic and worst cases.

Identifying and quantifying key parameters that influence outcomes early in the process ensure a comprehensive and accurate representation of the system being modeled. Multiple attributes, such as economic, resources, technical factors and so on must align with primary objectives and be interconnected to simulate realistic conditions.

By using a range of variables and scenarios, models account for potential variability, uncertainty and dependency. Robust data sources, consistency in measurement and sensitivity analysis are essential to refining attributes and predicting complex outcomes accurately. Sensitivity analysis assesses how changing one variable affects outcome. This identifies which variables have the most significant impact on the result, helping decision-makers better understand risks, trade-offs and impacts.

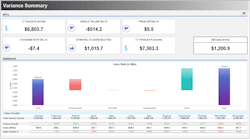

Here’s a baseline budget created for a long-range plan of forecasted vehicles, applying current/potential opportunities from a third-party market volume source. What if the predicted market for electric vehicle volumes goes up, due to relaxed EV requirements?

Using the “Modify Scenario” functionality in this automated approach, a search for ICE models can be made across the forecast, applying a factor to represent the increase in volumes. Revenues are recomputed using the new data, and the forecast can be saved as a “What-If” forecast and compared against the baseline forecast in variance reporting.

Additionally, other key input variables besides volume can be adjusted, such as material indexes, prices and exchange rates, saved as a “What-if” forecast and compared against the baseline forecast. Variance reporting will show the effect of the scenario outcomes on important company KPIs.

AI and Scenario Modeling

Artificial intelligence (AI) is adept at quickly handling what-if analyses across multiple variables, uncovering possible futures under varying conditions. Advanced algorithms generate multiple scenarios based on historical, real-time and projected data offering insights to support critical decision-making in uncertain environments.

AI’s biggest contribution is the ability to continually learn and repeatedly model and refine scenarios as new data becomes available.

Financial forecasting: AI analyzes historical and real-time market data to predict future trends and simulates the impact of events like interest-rate changes, geopolitical tensions or stock splits. Predictive models are continually refined using feedback loops based on actual outcomes compared to predictions.

Supply chain optimization: AI accesses data from shipping, inventory and market demand and evaluates the impact of disruptions like natural disasters, supplier delays and market demand shifts. The program provides real-time recommendations and logistical strategies based on feedback from real-world supply chain performance.

Climate Modeling: AI models are trained on climate data to predict patterns and evaluate potential interventions, modeling such variables as the impact of reduced carbon emissions, deforestation rates or alternative energy adoption. AI continuously updates models with new data, such as satellite imagery and recent climate records.

About the Author

Dan Meyer

President & CEO, Campfire Interactive Inc.

Dan Meyer is president & CEO of Campfire Interactive, Inc. The company’s solutions help manufacturers identify, plan, develop and execute their product portfolios, including quantifying the financial impact of events.