Four Strategic-Planning Scenarios for 2025

The incoming Trump administration has put forth a wide-ranging agenda, including tariff and tax changes, tightened immigration, and relaxed regulations. Each has the potential to reshape major sectors of the U.S. economy.

How might these policy changes affect GDP growth and inflation, and what could that mean for manufacturers?

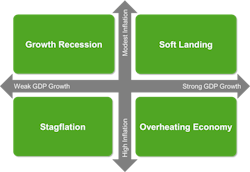

There are four possible economic scenarios—from a soft landing to stagflation—that manufacturers should consider as they plan for 2025 and beyond.

Policy Impact on GDP Growth and Inflation

The economic impact of Trump’s proposed policies depends on what is enacted and when. Overall, U.S. growth is forecast to range from 0.8% to 3%, with inflation possibly exceeding 2.5%.

GDP growth

The economic effect of the combined tax and tariff proposals could increase long-run GDP by 0.8% while increasing the 10-year budget deficit between $2.5 trillion and $3.0 trillion, according to a new study by the Tax Foundation.

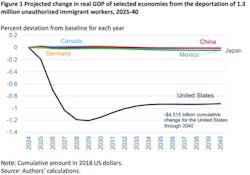

Plans to deport up to 1.3 million unauthorized immigrant workers could reduce the potential labor supply by 0.8%, which would reduce GDP by 0.2% through 2025 and up to 1.2% by 2028, estimates the Peterson Institute for International Economics. As the pool of workers shrinks, labor costs and prices will rise.

If a wave of deregulation is enacted, banks will avoid higher capital reserve requirements, which could free up capital that could be deployed in loans. B2B companies that waited to borrow may see their patience pay off with more favorable rates for expansion.

Inflation

Many economists worry that Trump’s policies could reignite inflation. The Federal Reserve Bank of Cleveland estimates inflation, measured by Personal Consumption Expenditures, will exceed the Fed’s 2% target.

Rising inflation will result in higher prices for everyone. Many customers remain resentful over price increases throughout the pandemic. Consumer inflation expectations have fallen from 4.5% to 2.6%, so further price increases could cause significant resistance. If inflation resurges, the Federal Reserve will hike interest rates, potentially as early as the January 29, 2025, Open Market Committee meeting.

Changing Market Conditions: Four Possible Scenarios

Exact policy details remain elusive as compromises are brokered. In the meantime, manufacturers should prepare for four potential economic scenarios.

1. Soft Landing: Strong Growth, Modest Inflation

In a soft landing, the economy achieves steady GDP growth of around 2%, which is close to the historical long-run average, while inflation stays close to the Federal Reserve’s 2% target. This scenario provides an ideal environment for manufacturers to grow without major disruption.

In this low-risk scenario, manufacturers can confidently launch new products and enter new markets. With stable demand and favorable borrowing conditions, it’s an ideal time to scale production or test new offerings aligned with market trends.

Profitability can be strengthened through targeted price adjustments that focus on willingness-to-pay segments, avoiding broad price hikes that could alienate customers. A strategic pricing approach ensures steady growth while maintaining strong customer relationships.

The tight labor market, intensified by reduced immigration, makes attracting and retaining top talent a priority. Competitive compensation packages, career growth opportunities and strong employer branding will be essential to secure and retain skilled workers.

Indicators to Watch:

GDP growth consistently near 2%

Inflation reports from the Federal Reserve at or below 2%

Unemployment rate in line with historical norms of 4.5% to 5.5%

2. Overheating Economy: High Growth, High Inflation

In an overheating economy, GDP growth and inflation surge past 3%. Manufacturers face the dual challenge of elevated demand and rising costs, requiring swift action to protect margins and manage customer relationships.

To combat inflation, manufacturers should proactively address rising input costs and monitor customer cost-to-serve metrics. Adjusting operations to reduce waste, renegotiating supplier contracts and exploring alternative materials can help offset mounting expenses.

Inflationary price changes must be passed through immediately to avoid falling behind on rising supplier costs. Transparent customer communication will be key to maintaining trust while keeping pace with volatile pricing conditions.

With the Federal Reserve likely to increase interest rates, borrowing costs will rise, making large-scale investments less appealing. Manufacturers should focus on improving cash flow and prioritizing projects that can weather economic turbulence.

Indicators to Watch:

Inflation exceeding 3% and rising

Federal Reserve announcements on rate hikes

Sharp increases in energy, material, and labor costs

3. Growth Recession: Weak Growth, Modest Inflation

In a growth recession, GDP growth stagnates at 0.5%–1.5%, and inflation remains moderate, hovering around 2%. While cost pressures may be low, manufacturers face limited opportunities for expansion and heightened uncertainty. Success hinges on focusing resources on the most promising opportunities while remaining agile.

Manufacturers should de-risk projects by starting small and collecting quick wins. By piloting initiatives, refining assumptions and cautiously expanding scope, companies can minimize financial exposure while preparing for market recovery. This measured approach ensures flexibility as economic conditions shift.

With inflation under control, improved pricing strategies can unlock profitability. Manufacturers should focus on underperforming segments or tail-end products to optimize pricing without alienating core customers. A data-driven review of the product portfolio and customer buying patterns will help uncover where strategic price improvements can deliver the most value.

Finally, agility is essential. Growth recessions can turn quickly into recoveries or deeper downturns. Monitoring economic indicators like consumer spending, business investment and labor market trends will help manufacturers adapt their strategies to emerging conditions.

Indicators to Watch:

Flattening GDP growth data below 2%

Early signs of recovery or further downturn, such as increased housing or manufacturing output

Shifts in consumer confidence or business investment trends, such as delayed or cancelled orders

4. Stagflation: High Inflation, Weak Growth

Stagflation, marked by inflation surging above 4%, GDP growth falling below 1% and unemployment rates above 5%, is one of the most challenging economic environments for manufacturers. Companies face dual pressures of rising costs and sluggish demand, requiring resilience and a highly focused approach to survive.

Manufacturers should prioritize high-performing core segments that deliver consistent value while avoiding unnecessary risks. Focus resources on proven products or markets to ensure stability during uncertain times, while minimizing exposure to underperforming or speculative ventures.

To combat rising costs, aggressively renegotiate supplier contracts and streamline operations. Identifying production, logistics, or procurement inefficiencies can help manufacturers reduce expenses and improve cash flow. Partnerships with suppliers should focus on securing favorable terms to ease the pressure from elevated input costs.

While passing through inflation-driven price increases is necessary to preserve margins, manufacturers must remain open to sharing the pain. Retaining price-sensitive customers may require holding back on certain increases or introducing value-based pricing models to maintain loyalty in a highly competitive market.

A weakening labor market allows companies to prepare for future growth by acquiring skilled talent or upskilling current employees, positioning them for success as economic conditions improve.

Indicators to Watch:

Persistent inflation exceeding 4% despite Federal Reserve intervention

Unemployment creeping above 5%

Declining consumer sentiment and reduced business investment activity

Agility Is the Key

Deregulation, lower taxes, reduced immigration and varying GDP growth and inflation present both risk and reward. The four resulting scenarios—ranging from strong growth with modest inflation to stagflation—make agility essential for success in 2025 and beyond.

According to the 2025 Pricing for Profitable Growth Outlook, 78% of manufacturers and distributors are concerned about the speed with which they can react to changing market forces, and just 25% rely on a market-based approach to pricing. As the campaign promises coalesce into policy, businesses should prioritize resilience, closely monitor economic indicators and prepare to adapt.

About the Author

Dan Cakora

Pricing Economist, Vendavo

Dan Cakora is a pricing economist and business consultant with vendavo, a SaaS market leader in B2B pricing, selling and rebate solutions. Dan has worked in various aspects of pricing for over 15 years. He started his career as a field economist, responsible for helping to measure inflation for the federal government. Before joining the Vendavo team, Dan was a customer at a large, international B2B distributor. He has led pricing teams, developed pricing and sales enablement products, and has a passion for data visualization. Dan has an MBA from DePaul University and a BS in economics from Purdue University.