Selling Direct-to-Consumer Is Increasingly an Attractive Option

What do Goodyear Tire & Rubber, Mattel and iRobot have in common? Over the past five years, they’ve all started or expanded a direct-to-consumer (DTC) e-commerce strategy and sell (some or all products) directly to their customers online. These manufacturers may serve different markets, but they know what their buyers want and how customers' expectations are changing, and they’re capitalizing on it.

They’re not necessarily saying goodbye to current dealers or retailers, but they are sending a message that they want to expand their reach and have other options. As a result, they have realized huge savings on restrictive margins (where a 3rd party sets the price which reduces/restricts the margins you can earn.), gained control of their brands and are generating significant revenue with a personalized e-commerce direct-to-consumer (DTC) sales strategy.

Consider this pre-pandemic stat from Forrester Research: Over 40% of buyers want to buy directly from manufacturers, and they’re willing to pay up to 20% more to be able to do so. Now just imagine what these numbers are today. Consumers expect the manufacturer to be the best source of information about their products and are likely doing their research on the manufacturer’s website. What a frustrating experience it is for them to find exactly what they want and then be told to go somewhere else to buy it.

Third-party sites like Amazon limit the amount of product information a manufacturer can present. Their goal is to move product fast and profitably. This kind of thinking doesn’t put the manufacturer first and can result in diminished brand loyalty. Manufacturers may not be able to keep up with Amazon’s next-day shipping offers, but buyers have shown a willingness to adjust their expectations to buy direct if they can get the detailed product information they need.

Consider the economic impact

Online sales forecasts look good for the economy. A significant indicator comes from McKinsey and Company, which reports that more than 75% of buyers and sellers now prefer remote human engagement over face-to-face interactions and plan to continue the self-serve business model post-pandemic.

The B2B world is catching up with retailers. Additional research from McKinsey says that nearly 9 out of 10 B2B leaders report that omni-channel retail is as, or more effective than traditional methods and predict it to be the most common sales role within their organizations over the next three years.

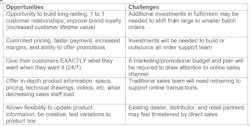

The Opportunities and Challenges of Selling Direct

Transforming Processes

Technology enables manufacturing companies to create a direct, self-serve experience. This in no way suggests by-passing traditional channels; it’s about creating a new channel that replaces what’s not producing results.

A direct-to-consumer strategy is not just about changing sales. Manufacturers need to consider the whole customer buying experience. No longer are they dropping product at the distributor/dealer’s loading dock—they are now shipping smaller batches directly to their customer. This is a partial transformation of the entire back-end logistics and customer service operations and requires an investment in both people and processes. The gains in both margin and data can be invaluable.\

Manufacturers also get a front row seat to their customer’s buying experience, allowing them to make quick sales improvements and gather valuable 1st party data to target marketing spend more appropriately. They can also develop new products to match data insights and make better business decisions. This is a huge competitive advantage.

Legacy Companies Take the Lead

Building a successful e-commerce channel requires a thoughtful, collaborative strategy that incorporates all of the key players in a manufacturer’s supply chain, from customer service to production to delivery. This kind of change won’t work unless it is embraced by the top.

Look at Goodyear—they are not only selling tires and related parts online, but installing them locally. They are giving customers exactly what they want—new tires, fully installed at their homes or workplaces. And Mattel is reporting big increases in online revenue during earnings calls.

iRobot, which was founded on a DTC premise, is leading in otherwise “cluttered” markets as a result of their flexibility and ability to consistently deliver a superior buying experience for customers.

On a smaller scale, VersaTube, a Tennessee-based manufacturer of DIY steel building kits, allows buyers to configure the exact product they want (e.g., garage doors, carports, etc.), buy it online and have it delivered to their doorstep. This kind of creativity is setting a new gold standard for manufacturers.

At the end of the day, changing consumer expectations are compelling manufacturers to deliver on the entire buying experience – and that’s a good thing for both sellers and buyers.

Dusty Dean is a former manufacturing executive and co-founder of BITCADET.