GM CFO Says EV Losses Will Shrink By At Least $2B in ’25

General Motors Corp. executives expect that losses from the automotive giant’s electric-vehicle operations will shrink by up to $4 billion in 2025 compared to this year as the company scales production and benefits from efficiencies in battery manufacturing.

Speaking to an Oct. 8 investor presentation GM hosted at its Spring Hill, Tennessee, manufacturing complex, CFO Paul Jacobson said EV savings from this year to next will be between $2 billion and $4 billion. That number will be influenced both by consumers’ appetite—Jacobson and other GM leaders repeatedly said they will not raise production of EVs if the appropriate demand isn’t there—as well as pricing trends. (GM doesn’t break out the finances of its EV operations and Jacobson wouldn’t go into detail on actual numbers beyond trends.)

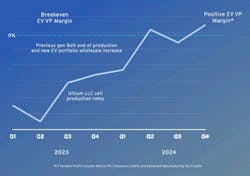

The expected shrinking of EV losses and a mid-single-digit EBIT margin on electric operations will come even though GM is likely to produce fewer units than Jacobson and Chair and CEO Mary Barra have forecast in recent quarters. Speaking in Spring Hill, they forecast that GM will finish this year having made about 200,000 EVs, a number that’s at the low end of their previous guidance of 200,000 to 250,000 units—which was itself cut from up to 300,000. That, Jacobson said, will happen because GM is growing into massive investments it has made in recent years and remains on a path toward variable profitability this quarter.

“We dug a bigger hole very intentionally … and we’re scaling out of that,” Jacobson said of GM’s EV infrastructure, including a network of battery factories. “And that scaling is happening at an increasing rate.”

Among other notable items from GM Oct. 8 were:

- The company will build another battery research and development center at its complex in Warren, Michigan. Vice President Kurt Kelty said the added development capacity will help GM more quickly identify possible issues and cut the time needed to get from testing to commercialization by up to a year. Plans call for the new Warren facility to begin production in 2027.

- As other OEMs have, GM is making significant cuts to the number of parts needed to build its cars. President Mark Reuss said such work has allowed GM teams to take out an average of 10 parts per car in recent years.

- On that re-engineering note, Reuss also poked his peers at Ford Motor Co. in the ribs over the latter’s work on developing its next-generation of EVs: “We don’t need to create a skunkworks to create affordable electric vehicles.”

- The company is dropping the Ultium brand rolled out in 2020 for its batteries and other EV components. A new name hasn’t been announced and GM’s two joint-venture plants with LG Energy Solution will continue to operate under the name Ultium Cells LLC.

At a high level, Jacobson said GM’s leaders expect 2025 U.S. auto sales to be right around 16 million, essentially flat from the market’s pace over the past year. GM’s EBIT, he added, will also be in line with 2024’s but he sought to emphasize the company’s progress on expense management—it has trimmed some $2 billion in fixed costs over the past two years and postponed several investment plans—and said those effects will become more apparent in coming quarters.

That transformation journey, Jacobson said, “is becoming very observable. It’s becoming quantifiable.”

Shares of GM (Ticker: GM) finished trading Oct. 8 pretty much flat from the evening before. Around midday Oct. 9, however, they were up nearly 4% to $47.83. Over the past six months, they have risen about 7%, growing the company’s market capitalization to nearly $54 billion.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has been in business journalism since the mid-1990s and writes about public companies, markets and economic trends for Endeavor Business Media publications, focusing on IndustryWeek, FleetOwner, Oil & Gas Journal, T&D World and Healthcare Innovation. He also curates the twice-monthly Market Moves Strategy newsletter that showcases Endeavor stories on strategy, leadership and investment and contributes to other Market Moves newsletters.

With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati in 1997, initially covering retail and the courts before shifting to banking, insurance and investing. He later was managing editor and editor of the Nashville Business Journal before being named editor of the Nashville Post in early 2008. He led a team that helped grow the Post's online traffic more than fivefold before joining Endeavor in September 2021.