MSC Scours the Industrial 'Attic' for $100 Billion in Waste

The Great Recession saw manufacturing “flipped on its head,” Erik Gershwind, president and CEO of MSC Industrial Supply, tells a reporter at the IMTS trade show in Chicago. As a $2.5 billion distribution company that both buys from, and sells to, manufacturers, MSC had a close-up view of the pain inflicted on the industry, and has used the insights it gained from that experience to fuel a new sense of mission.

Gershwind’s grandfather started the company in 1941, selling cutting tools from the trunk of his car to job shops around New York’s Lower East Side. MSC’s close relationship with manufacturing served it well as both grew over the ensuing decades, but that same relationship meant MSC also felt the sting of the business downturn that started in 2008.

“We had quarters where revenues were down 25%, profits were down 35%,” he recalled.

Though a public company, MSC has a large family ownership interest which allows it to take a longer view of its business. Wall Street wanted the company to cut personnel during the recession. Company managers saw that as a short-term fix with long-term repercussions. When business improved, they believed, it would leave them with the task of hiring inexperienced employees who did not know its customers. Instead, MSC decided to use the downturn to not only hold onto staff, but make investments in its business systems and website.

Gershwind and other executives also spent a good deal of time examining the company’ strategy and how it would drive growth for the next decade. Prior to the recession, says Gershwind, manufacturer’s purchasing activities had been focused on price and global sourcing. But with the recession, he said, “Cash became paramount.”

Companies began to look at their supply chains and found that they had excessive amounts of cash tied up in inventory. They were eager to find ways to reduce those non-productive assets. Yet, manufacturers frequently were operating with smaller staffs. In many cases, they didn’t have the time or expertise to root out waste. Those constraints provided an opportunity for MSC.

“We rallied around the mission of improving and optimizing the plant floor,” said Gershwind.

While companies had put a good deal of focus on their direct materials costs, they often gave less attention to indirect materials – everything from hand tools to cleaning supplies. Gershwind likens indirect materials to the attic in a house – out of sight, messy, neglected. MSC’s says a lack of visibility into the supply chain results in nearly $100 billion in MRO inventory waste annually for U.S. companies.

The company says it can help companies clean up their “attic” in three ways:

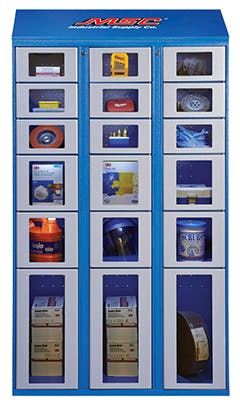

- Look for time savings. Save time and financial savings will follow. MSC worked with a packaging company that had a large plant in the southeast with a central storeroom for supplies. MSC audited the facility and found that machine operators were walking a total of a mile to the storeroom and back to get a tool – and doing it sometimes 3 to 4 times a day, at $20 per hour. MSC installed 150 industrial vending units, providing visibility into supply usage and putting the supplies close to workers, eliminating the long walks. The company saved more than $1 million with the new system.

- Use technology as a flashlight. MSC offers an inventory management system called ControlPoint which provides companies better visibility into the products they purchase and where they are used. ZF, the German manufacturer of driveline and chassis parts, implemented the system. At one of the pilot plants, production increased 20%, but consumption of cutting tools dropped by 20%. Gershwind said the visibility the system provided allowed ZF to reduce their cutting tool inventory from eight weeks to two weeks. The time spent on reporting on cutting tool inventory and costs was reduced from 8 hours to 15 minutes.

- Get another set of eyes. “Several hundred of our sales people are metalworking experts,” Gershwind said. “These are people with machinist backgrounds who come out of a manufacturing environment.” On one site assessment, he recalled, one of MSC’s experts watched a machine operator who was drilling and then reaming holes in parts. When asked why he was doing the extra work, the operator explained that the drill couldn’t provide the tight tolerances needed for the part. MSC’s expert contacted a supplier and found a custom drill that could do the work. The result: the machine shop saved $30,000 annually in labor and raw materials costs.

MSC Invests in Technical Training for Staff

Gershwind said his customers have invested in technology for improved productivity but are still hesitant to add staff. Providing technical expertise, not just supplies, is particularly valuable for today's leaned-out manufacturers.That’s one of the reasons MSC has invested in training for its sales force of 2,000. Gershwind said the company has established a certificate program with Tooling U to help ensure that its specialists have the right technical skills.

So, one wonders, if MSC is helping manufacturing customers reduce consumption of cutting tools, for example, isn’t it reducing its own sales? Gershwind says it’s just the opposite. By implementing the ControlPoint system, MSC and customers establish a partnership where MSC typically provides a greater share of the many products a plant uses.

“While their consumption of cutting tools should go down, there is a lot of other stuff they are buying to keep their plant running. By establishing a partnership, we dramatically increase our share of wallet,” he said.

Of course, it helps that MSC stocks more than 1 million products and has five major warehouses encompassing over 2 million square feet. The company promises customers that it can get any of those products to them the next day if they order by 8 pm. Gershwind said more than 90% of sales are in the United States, though it plans further expansion in North America. MSC grew its footprint substantially when it purchased Barnes Distribution North America, a distributor of fasteners and other products, for $550 million in April 2013.

Surrounded by the bustle of the IMTS show in Chicago, we asked Gershwind how U.S. manufacturing was doing. He described current conditions as “solid but not booming.” But looking farther ahead, he was more optimistic.

“I think the long-term prognosis for U.S. manufacturing is quite good,” Gershwind says. He cites two principal reasons for his optimism. One is the energy revolution going on in the U.S. which is lowering costs for many manufacturers. The other is that an increasing number of U.S. manufacturers want their supply base close by in order to reduce production and delivery times for the domestic market.

“After the recession, manufacturers are really focused on speed to market,” said Gershwind. “Time is money.”

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.