Tales From the Transcript: Executives Temper Expectations, Fret About Labor Costs

The picture is growing fuzzier.

Our latest analysis of quarterly conference call transcripts of 50 members of the 2022 IndustryWeek U.S. 500 list of public companies shows executives growing more conflicted in their assessment of customer demand. Many are also still fretting about inflation, albeit for a different reason than a year ago.

As we’ve done before—click here to read our report from May—we’ve tallied forward-looking sentiments about inflation, the labor market, supply chains and demand from executives leading the five largest companies in 10 sectors of the IndustryWeek 500. We rated that commentary on a five-notch spectrum from fully positive to fully negative and then computed composite scores.

A breakdown of each category follows below but a headline takeaway from the second-quarter earnings calls is that more leadership teams have parts of their businesses doing very well while others are lagging or, at best, treading water. Early this year, we tallied just three companies out of our group of 50 providing such commentary about various end markets. In the spring, eight executive teams were making such distinctions. During this earnings season, which started in June, that figure climbed to 12.

Conflicting economic data can’t be helping: The Federal Reserve Bank of Atlanta’s GDPNow tool is predicting a bumper Q3—even if its earlier estimates drop off, the economy is likely to end up growing at more than 3%--but S&P Global’s latest flash purchasing managers’ index came in at a six-month low. No wonder Duke Energy Corp. CFO Brian Savoy recently told analysts the utility is seeing its largest users tread lightly.

“We’re in regular dialogue with our large customers. We understand that, with the uncertain economic backdrop, there’s some prudent inventory management going on,” Savoy said. “They’re like, ‘Well, looking forward, there could be some clouds coming. So let’s just be prudent.’ So we’ve seen a slight dial down in usage, but we don’t see that persisting into the long term.”

That underlying optimism shines through much of the fuzziness in our research, too. Here’s what else our calculations turned up, starting with the category that has for the past year consistently been the most negative.

Inflation: -0.11 (versus -0.08 in Q1 and -0.22 in Q4)

The first is that higher input costs continue to make their way through the system. American Axle & Manufacturing Holdings Inc. CFO Chris May told analysts early this month that several of the company’s suppliers are still looking to pass through inflationary pressures. In addition, May said—as did executives from Danaher, Procter & Gamble and Weyerhauser–labor cost increases are growing into an issue. (More on that just below.)

The second element to watch in the coming quarters is just how much manufacturers can direct those ongoing inflationary pressures into higher prices for their goods—and thus possibly stoke inflation heading into 2024. At Northrop Grumman Corp., Chairman, President and CEO Kathy Warden labeled the defense contractor’s initiative as “working to drive additional discipline in our bid approaches” but Anne Noonan, her peer at Summit Materials Inc., was more blunt.

“We expect and you can expect to see us in the marketplace with January price increases across all lines of business,” Noonan said Aug. 2.

Labor: -0.09 (versus 0.03 in Q1 and 0.00 in Q4)

"The labor market has gotten better from our perspective. I think we’ve also gotten better [at] retention and how we handle that,” he said. “Still a challenge, but much improved from where it was over the last couple of years.”

Lockheed Martin Corp. CFO Jay Malave also praised his team’s work on the labor front, noting that the aviation titan is hiring more people than six months ago but also, crucially, losing fewer employees to competitors.

“We’re fairly confident that that will stick and that also bodes well for the rest of the industry, particularly [the] supply chain,” Malave added.

Demand: 0.16 (versus 0.25 and 0.04)

Some leaders were very positive about their demand trends: David Gitlin at Carrier Corp. said backlogs and new order activity across his company’s commercial, HVAC and fire/security groups remain strong while OI Glass Inc.’s Andres Lopez said several end markets look set to rebound late this year and into 2024.

Other executives are resolutely looking farther down the road, displaying some of the confidence reported in a recent Grant Thornton survey of CFOs. At Stanley Black & Decker Inc., President and CEO Donald Allan said his team’s recent work on cutting costs and restructuring some divisions have set it up to go after growth again.

John Morikis, chairman and CEO of Sherwin-Williams Co., put it even more pithily: “We’re not interested in trying to time the economic recovery. What we are interested in is taking full advantage of it when it eventually arrives. This means investing in our growth now.”

Still, the overall tone on this round of earnings calls was more cautious than in the spring. Several executives pointed to macro conditions—higher interest rates, tighter credit conditions and slow growth, if any, in China—to justify being less aggressive in the coming quarters. Zachary Coughlin, CFO at PVH Corp., summarized that approach well: “We continue to plan [...] with a healthy balance of optimism and prudence.”

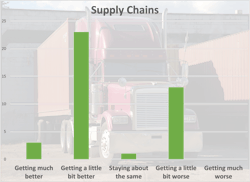

Supply chains: 0.20 (versus 0.25 and 0.15)

It’s not that things are perfect. But they are nearly universally getting better and on track for more improvements. Damon Audia, CFO of farm equipment maker AGCO Corp., put it this way: “If we were dealing with 10 suppliers per factory last year at this time, we are still dealing with one or two […] So there’s still opportunity for further productivity.”

That feeling of opportunity also showed up in comments from Lear Corp. President and CEO Ray Scott, who said his team also still has work to do but added that “these are things that we can control and we’re good at.” In that respect, companies have come a long way from the dark months when COVID-19 paralyzed so much of the world economy.

“We are for all intents and purposes at this point back to where we were before the pandemic,” W.W. Grainger Inc. Chairman and CEO D.G. Macpherson told analysts July 27. “Those should stay […] Those won’t reverse.”

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has been in business journalism since the mid-1990s and writes about public companies, markets and economic trends for Endeavor Business Media publications, focusing on IndustryWeek, FleetOwner, Oil & Gas Journal, T&D World and Healthcare Innovation. He also curates the twice-monthly Market Moves Strategy newsletter that showcases Endeavor stories on strategy, leadership and investment and contributes to other Market Moves newsletters.

With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati in 1997, initially covering retail and the courts before shifting to banking, insurance and investing. He later was managing editor and editor of the Nashville Business Journal before being named editor of the Nashville Post in early 2008. He led a team that helped grow the Post's online traffic more than fivefold before joining Endeavor in September 2021.