The manufacturing world is going through some tremendous changes in dynamics. After the 2008-2010 global economic recession and years of flat demand, manufacturing firms have no choice but to finally chase every potential dollar of value they can extract from their market using pricing. After years of cost cutting and expense optimization, business executives in many of these organizations have realized that they cannot cut their way to prosperity and that managing the business for value and pricing excellence has become inevitable. They also know that fighting solely on price never ends well.

The New Reality in B2B

1. Costs are creeping up: labor, utilities, raw materials, health benefits.

2. Customers are demanding more for less: price concessions, credit terms, service levels, etc.

3. Low-cost competition is putting lots of pressure on price levels.

4. Competitive intensity makes price increases very hard to justify and capture

5. Traditional demand/supply and cost/price cycles are no longer valid.

6. Traditional distribution/retail channels are getting disrupted.

As a result, many financial analysts on Wall Street have started looking at firms’ pricing levels. Success stories of pricing power masters have emerged in the financial news (Apple, Starbucks, Lego, Disney, 3M and more). In March, “Mad Money” host Jim Cramer stated: "Sometimes, it just comes down to figuring out who has pricing power: who can raise prices and who can't.”

He went on to say, "You can't compete with the lowest-cost producer on price and not expect your stock to get clobbered.”

There you have it. Pricing power is formally on Wall Street’s radar.

This trend begs the following questions: What is pricing power? How can it be calculated? What are the drivers positively or negatively influencing pricing power? What is the relationship between pricing power and profit performance?

Pricing Power Explained

In November 2011, Warren Buffet said:

“The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10%, then you’ve got a terrible business”.

This definition is not too far from reality. Pricing power refers to the ability to increase overall pricing levels without losing demand and while maintaining business levels. While the definition is clear, the materialization of pricing power in practice is not. What does it mean to be able to increase prices or move pricing levels upwards? Through my research of literature and experience in pricing strategy, I identified six items or activities helping with that:

- Ability to successfully defend our price premium versus competitors: Often negotiations with B2B accounts and their buyers can become difficult in terms of pricing pressure. A firm’s ability to maintain price premium through value-selling is often challenged. Defending premium versus the competition and not giving in to negotiation tactics is a sign of great pricing power. Especially when one competes against low-cost manufacturers.

- Ability to make price moves first in the marketplace: Pricing leadership is being able to make price moves and establish norms and anchors in the marketplace.

- Ability to capture a large share of the value delivered to customers: Firms with great pricing power understand the value pool they make available to share with customers and intend to keep a large share of it. And they do not hide the fact that they capture much of that value pool.

- Ability to price and launch innovative and differentiated offerings at a premium: Pricing power masters introduce superior technologies, products, and services that create true value for customers. With these, they can introduce innovations at a higher price, sometimes cannibalizing previous generations of products.

- Ability to raise prices consistently every year without losing demand: Pricing power masters base price increases on delivered value and consistently focus on raising prices to capture value.

- Ability to capture a large share of our intended price increases: Previous research from Simon Kucher & Partners showed that on average, for every intended dollar in price increase, firms only capture 50 to 53 cents of it. Increasing prices and making increases stick is a materialization of superior pricing power.

The Dimensions of Pricing Power

My research into pricing power uncovered six critical dimensions influencing positively or negatively pricing power.

- Market conditions (+) refers to the overall health of markets, including markets that are rich in opportunities, that are growing or stable, that are attractive for differentiated offerings, and that present long-term predictability.

- Customer dynamics (+) relates to the behavior of customers with regards to value, perception of price/quality ratio, value co-creation, and segmentation opportunities.

- When customer dynamics are favorable, firms can maintain or expand their innovation position (+) by introducing lots of innovation to market, by uncovering customers’ hidden needs, by responding to customer willingness to pay, and by capturing greater value through pricing. Innovation position is also a potential positive influencer of pricing power.

- When the innovation process is managed with customer value at its center, the result leads to superior differentiation position (+). Premium can be more easily justified. Differentiation can be demonstrated and accepted by customers. Technical and marketing switching costs allow B2B suppliers to maintain long term pricing levels.

- Competitive pressure (-) includes concepts of overall price aggressiveness of suppliers, the presence of low-cost competitors, the presence of tight RFP process, and a general culture of price competition in the eco-system.

- Product Life cycle (-) encompasses the rate of product obsolescence in the marketplace, the rate of technological change, and the overall production capacity available for supply.

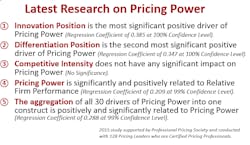

In 2016, I launched a research project focused on identifying the dimensions with the greatest influence level on pricing power. I wanted to provide a first analysis on the relationship between pricing power and firm performance. I gathered input from 128 Certified Pricing Professionals from 128 distinct organizations with the support from Professional Pricing Society. The summary of the research is shown in the table below.

Bottom line, innovation and differentiation positions lead to superior pricing power. This is not a real surprise, but it reinforced the need for manufacturing and B2B firms to focus on these two dimensions and to invest in a robust pipeline. More interesting is the lack of significance of the relationship between competitive intensity and pricing power. Often, leaders in B2B firms succumb to competitive pressures and wave the “white flag” when faced with pricing issues. The study also demonstrates that there is a positive link between pricing power and firm performance.

The Impact of Pricing Power is Real

Best in class manufacturing companies with superior pricing power are often mentioned in financial news (3M, BASF, Parker, Medtronic, Honeywell). They all enjoy a higher EBITDA (earnings before interest, taxes, and depreciation) versus their peers and grow year after year. What makes them different? First, they have robust innovation strategies. Second, they have intentional strategies to manage pricing. Third, they have developed sustainable capabilities to manage their integrated value process: innovation > differentiation > pricing > profit!

The reality is that it is not easy. Pricing power does not come on its own. The key word in the paragraph below is the word intentional. Indeed, a firm might have the necessary position in the marketplace to capture pricing power through innovation, differentiation, and customer management. In the end, these firms and its leader will have to understand there pricing power resides and how to capture it fully. For that, these leaders must invest in the right tools and systems to identify the pockets of pricing power. Essential to this process is the deployment of advanced pricing systems which allow business leaders to conduct the critical activities presented below: scientific segmentation, pricing analytics, pricing optimization, deal management, value-based pricing.

The combination of pricing tools, pricing systems and pricing capabilities driven by a robust pricing strategy can become you next competitive weapon to outlast and outperform your competitors.

What Does that Mean for you?

If you work for manufacturing company today and you have not gotten started yet , what do you do first? I propose 5 steps

1. Attention to and intention towards Pricing Power: “Where focus goes, energy flow,” Tony Robbins. This is probably the first step, which is a make or break for pricing teams. They must generate enough attention in the C-suite and then convince leaders to manage pricing power with intention and impact. This is half the battle.

2. Bring attention to the topic of pricing by finding who is involved in the pricing process and who makes decisions. Gather these stakeholders in a meeting to discuss potential areas of collaboration, exchange, and improvements. Make a group commitment to get better at it collectively!

3. Understand where you are starting from by conducting a formal Pricing Power Assessment: “What gets measured, gets managed,” Peter Drucker: before getting to the pricing power zone, you need to understand where you get started from. A Pricing Power Assessment (PPA) can do that and can highlight the areas of priorities to boost your pricing power.

4. Develop an organizational roadmap to achieve the zone of Pricing Power: Pricing Excellence is a journey, not a destination. Once you understand your gaps and areas of strengths among the 30 drivers of pricing power, you can then focus on designing a roadmap for change and key priorities for the short-, mid-, and long-term.

5. Make it an organizational strategic priority and not just a pricing project: “Strategy is about making choices, trade-offs; it is about deliberately choosing to be different”, Michael Porter: One way to generate intention is by including pricing power in the corporate strategic agenda at the top.

The new manufacturing reality is that when managed with attention and intention, pricing power can become an extremely powerful tool to improve profit power. Size does not matter. You do not need to be the size of 3M or Honeywell to start capturing more value from your market. In fact, lots of small and niche manufacturing companies have tremendous competitive advantage versus larger firms.

So are you paying enough attention to your pricing power? Is it time for your organization to better control your pricing destiny? Join the pricing revolution!

Stephan M. Liozu, Ph.D. is chief value officer at Thales Group and founder of Value Innoruption Advisors, a consulting boutique specializing in value-based pricing, digital pricing, and industrial pricing. He is the author of nine pricing books and is a frequent keynote speaker at industrial and digital conferences.

About the Author

Stephan Liozu

Chief Value Officer, Zilliant

Stephan Liozu, Ph.D. is chief value officer at Zilliant, a pricing management and optimization software provider. He brings over 20 years of experience in pricing, innovation and value management. An expert in the global pricing landscape, he is the author of over 15 pricing books, including “Pricing—The New CEO Imperative” (2021) and “Value-based Pricing: 12 Lessons to Make Your Transformation Successful” (2024).