Dollar for dollar, healthcare has the biggest perceived (and real) value for employees. At the same time, it is an employer’s biggest headache.

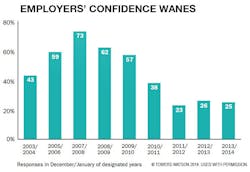

Skyrocketing costs and the uncertainties surrounding Obamacare are leading many industry executives to consider abandoning healthcare benefits in favor of the 401k route, paying lump sums to employees, and letting them get whatever coverage they can on the individual or exchange markets.

We are clearly at a crossroads regarding private, commercial health insurance. At risk is the quality healthcare coverage companies have provided for decades. If employees are left to fend for themselves in the individual or exchange markets, they will find that available coverage is significantly inferior and often more costly. Moreover, downloading this responsibility onto employees and their families will have negative unintended consequences, such as under-insuring, unmet family healthcare needs, reduced productivity and lower morale.

There is a better way.

Had employees done a better job of taking care of themselves and accessing the healthcare system more responsibly, we might not be here. Likewise, had the healthcare system done a better job of delivering care, we might not be here. The same can be said about employers not being sufficiently demanding of both insurers and providers. But here we are, and there is much that can be done to preserve and perhaps even enhance the coverage you purchase. My task is to suggest how, and to tell you what you need to do.

A New Way Forward

Now, more than ever, is the time to strengthen, not diminish, company healthcare plans. The good news is that companies still have opportunities to secure superior health coverage at better prices than those on the new healthcare exchanges. And there are still insurers who are motivated to help you do just that.

While the private health insurance industry has been virtually immune to change for decades, its time has come and it knows that. Obamacare has woken the industry to its real challenges. To stay relevant, health insurers (whether for fully or self-insured groups) must create a new paradigm for those employer groups who are willing to do what it takes to continue to provide top flight coverage. An entire industry’s relevance is at risk here, and the insurance industry will move heaven and earth to stay relevant.

Likewise, healthcare providers (particularly hospital systems) understand they are in harm’s way and that they must change how they provide care. The day of being paid more for doing more things without accountability for outcomes is fast ending.

Fortunately, these dramatic changes provide opportunities for industry, employees, and unions to form pacts that ensure companies can maintain existing coverage, co-pays, and deductibles, with the chance of better coverage over time. This will not be easy, but it’s the only way companies can provide value for employees commensurate with the kind of company they want to be.

This offers industry an unprecedented opportunity to transform today’s dysfunctional healthcare spending spree and divisive negotiations by changing how healthcare is delivered, and by getting employees to satisfy their obligations to take better care of themselves and access the healthcare system more responsibly. This approach can enable companies to achieve better quality care, better outcomes, healthier employees, and value for the premium dollar than the current system.

3 Steps to Better Health Care

By creating a mutual pact with employees to do something different (indeed disruptive) and achieve mutual goals of maintaining good coverage by stabilizing, and then reducing, costs without eliminating coverage, companies can show that they deliver value to employees and their families while giving management a moral and financial highground that can attract and retain employees and bolster future labor negotiations.

Most importantly, by not cutting health coverage, but instead delivering superior coverage through improved care and motivated patient responsibility, manufacturers can dramatically boost workplace morale, stabilize healthcare costs, and contribute to a healthy, more productive workforce.

- Step One: Industry Executives Must Take Personal Responsibility

To attack the enemy, you must know the enemy. CEOs owe it to themselves and their companies, shareholders and employees to understand the fundamental drivers of healthcare costs, quality, outcomes, and financing. Executives must understand what’s driving premium increases, including increased use of services by small portions of insured populations, and indeed their own workforce.

To illustrate, approximately 5% of employees/dependents account for over 55% of total healthcare costs, and those costs themselves are accelerating. Employees and their families are getting less and less healthy, they access the system inefficiently, and they are increasing their use of these services at annual rates exceeding 10%. A bad recipe, but one that must be understood if we are to move forward and “repair” it.

Management can’t depend on anyone else to be responsible to resolve their company’s healthcare problem. Don’t leave this to brokers or others. Just like with a production problem, you might hire a consultant, but you would never pass responsibility over to a third party. The healthcare debacle is no different. And make no mistake, healthcare is your problem even though it’s been foisted upon you by the healthcare industry, government, insurers and labor.

Fortunately, getting up to speed on the basics of healthcare financing is not a huge undertaking. Several sessions with someone knowledgeable in this area will be sufficient to understand the “what.” That foundational knowledge is critically important for you to make the subsequent decisions on the “how.”

The payoff can be huge. I’ve seen the profound impact an involved CEO makes when he or she shows employees they care, that they understand the drivers, and that they are making it their personal agenda to preserve employee coverage. This provides a platform where companies can ask for and receive significant patient compliance with their obligations.

- Step Two: Build Bridges

Companies, employees, and labor all want the same thing: solid value-based coverage that delivers employees and their families top notch care and peace of mind. This approach gives all concerned something to work toward. Labor is open to change which holds the possibility of maintaining some rational level of coverage.

Management must earn trust and establish common ground by demonstrating that the company is making this a priority. The first step is reaching out to employees and labor, telling them exactly what the circumstances are and the choices that are available. CEOs must explain what the company is prepared to do and what’s expected of employees. If done correctly, today’s healthcare circumstances provide the opportunity for establishing a mutually supportive pact seldom seen in labor/management relations.

The preparation and staging for this is critical. Complete blunt honesty is demanded. Companies will need professionals who bridge between management and labor with the experience and credibility to bring everyone along. The potential partners are varied, but inevitably come down to insurers and providers.

- Step Three: The New Value Proposition

The key is finding an insurer to assemble and implement a benefit design, provider network, and program which maximizes the likelihood that employees and their families will use only proven high quality doctors, hospitals and other providers who charge reasonable rates. This can be demonstrated by publishing data showing that:

a. Provider networks are high quality and deliver better outcomes;

b. Employees’ access to that network is first rate;

c. The full range of employee healthcare needs will be cared for;

d. The health of employees and their dependents is improving over time; and

e. The overall cost of care is stabilizing, and later reducing (which gives employers a number of delicious options).

Why Health Care Will Change and How You Can Make it Happen

Why is there reason to believe that this might happen? Because the federal government in Medicare and Medicaid, and private insurers, are encouraging providers to create accountable care organizations (“ACOs”) which, for reasons we’ll discuss in later installments, will be designed to deliver care differently and be paid based on quality and outcomes. The ACO model (hopefully) will reduce waste and error, and improve quality of care over time, and thus reduce the overall healthcare spend.

Your (the CEO’s) personal and visible involvement and commitment are key...

Insurers know this, and once the data is available to measure quality of care and outcomes, ACOs and providers will be paid on that basis, and benefit design (deductibles and copays) will recognize these differences. This will cause patients to seek care from those demonstrably better providers, and cause providers who are not rated highly to do whatever it takes to change that.

Armed with the above information, CEOs or a senior executive can approach insurers and ask the hard questions. They want your business, but can they deliver what you need? Can they show you how they can get you there over time?

Initial Take Aways.

1. Become educated on the issues. Do not delegate. You can become informed in this area pretty quickly so that you can become a demonstrably knowledgeable executive buyer, and know what to be demanding. This part is critical.

2. Your (the CEO’s) personal and visible involvement and commitment are key in earning the willingness on the part of labor to consider entering into the needed pact. Much will be required of you and much of them. They must know why. You must know how.

3. You and your team must approach insurers and put them directly on the spot. While a broker might be of help, this is non delegable as well. You have to be in on the ground floor here on the fundamentals. Insurers know this is coming.

4. The “Bridges” described above have to be built. There has to be agreement and commitment on the outcomes. Quality care, better outcomes, lower costs over time. Benefit design and networks built on quality and outcomes, with reduced costs over time. Data, data, data. Exactly what on data will be discussed later. But your dashboard of data must be a key report that senior management and the CEO read religiously.

Jim Purcell is the former CEO of Blue Cross & Blue Shield of Rhode Island. He is a healthcare facilitator and speaker on healthcare reform and ACO strategies for hospitals, businesses and physician groups.