What Is Manufacturing’s Greatest Challenge?

Technology is the single greatest challenge (and opportunity) for the manufacturing industry … or is it? It’s true that technology has evolved and changed how manufacturers—especially small and medium-sized manufacturers—operate their businesses, in ways that even a few years ago didn’t seem possible.

The physical and cyberbased systems that run today’s factories and supply chains are increasingly interconnected through advanced networking and computing technologies that enable products and production capabilities to far exceed what was available in previous generations. And manufacturing’s digitization is only going to increase.

But a recent survey shows us that technology-related challenges aren’t what keep business owners awake at night—it’s who will do the work and how to train them.

For the past 10 years, the Manufacturing Extension Partnership (MEP) National Network has annually surveyed thousands of its U.S. manufacturing clients to identify the top challenges these companies will face over the next three years. This data is a pulse check on manufacturing and helps us better understand what is critically important to business owners and CEOs. Understanding the business and economic factors that influence companies can help the Network prepare for a new decade of supporting the U.S. manufacturing industry.

Employee recruitment and retention are a glaring outlier in our data. Manufacturing companies’ CEOs and owners are increasingly concerned about the future of their workforce. MEP clients reporting this as a challenge has more than doubled, and it is now the second most frequently reported challenge companies report facing.

Identifying and hiring a skilled workforce is a challenge that spans all industries, with the U.S. economy having 6.8 million job openings but only 5.8 million people unemployed and looking for work as of November 2019. Our data confirms just how hard the workforce shortage is hitting U.S. manufacturers. As we enter a decade where U.S. manufacturing should evolve at an even faster pace than the previous decade, manufacturers know they need a skilled workforce and a talent pipeline to support current and future business operations.

Some challenges for MEP clients have remained consistent over the past 10 years—such as continuous improvement. Other issues have become increasingly important. The shifting economic environment has resulted in the adoption of more technological advances, but also resulted in workforce shortages. Interesting shifts we see in our survey data include:

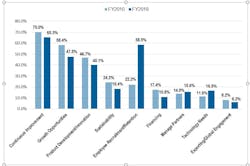

1. Ongoing continuous improvement and cost reduction issues remain the challenges most frequently cited by MEP clients through the decade, although the percentage of respondents reporting this has dipped nearly 7%.

2. Identifying growth opportunities is the challenge that has experienced the largest decline among MEP clients, dropping nearly 11% between the beginning of fiscal year (FY) 2010 and end of the decade in FY 2019. Growth opportunities is still the third most common challenge cited as of FY 2019.

3. Technology needs and managing partners and suppliers are two challenges that are now more frequently cited at the end of the decade, compared to the beginning of the decade. While both challenges are reported by about 16% of clients, the change from FY 2010 is significant. These shifts seem to reflect the increased pace of technological change and a greater need for supply chain management.

4. Innovation/product development is one of the more consistent challenges for MEP clients. The share of clients citing innovation/product development as a challenge declined by 6% between FY 2010 (46.7%) and FY 2019 (40.1%). However, this is still the fourth most reported challenge by MEP clients by a significant margin, with the next most frequently reported challenge—sustainability—reported by only 18.4% of respondents in FY 2019.

5. Financing and sustainability both fell as client challenges over time. They dropped by more than 6% between FY 2010 and FY 2019. The financing shift may reflect more stable economic conditions nationally coming out of the recession, which would mean easier access to capital and financing.

6. Exporting remains the least-cited challenge and was reported by only 6% of respondents in FY 2019, versus 8% of respondents in FY 2010.

While the U.S. manufacturing industry is entering a new era of opportunity, the industry is still grappling with the speed of technological change, increased customer demand for more customized products along with the ability to provide real time information. With the intersection of these challenges comes the need for a workforce to seamlessly deliver quality products that meet evolving customer needs in a globally competitive market. This will continue to define how other opportunities are realized and how businesses overcome challenges.

Industry evolution and advancement should not mask the everyday challenges U.S. manufacturers face, and instead should help solve some of these challenges. This response is already seen with the growth of smart interfaces, cobots and virtual/augmented reality. Each of these technological advancements can help focus the training needed for the workforce of tomorrow.

So, as we enter the new decade, it is important to take a step back and listen to what manufacturers are telling us. Being responsive to the needs of U.S. manufacturers and helping to mitigate their challenges are important reasons the MEP National Network was created. Integrating client feedback so that MEP Centers can help manufacturers merge existing challenges with an evolving environment and technological landscape is important to strengthening the industry and nation in the upcoming years. We are looking forward to seeing how these changing dynamics will influence manufacturers’ challenges over the next 10 years.

Nico Thomas is a performance analyst for the Program Evaluation and Economic Research (PEER) Group of the National Institute of Standards and Technology’s Manufacturing Extension Partnership (NIST MEP).