Setting Up Data and Analytics Teams to Drive Value

Advanced analytics is playing a more important role than ever as organizations’ complexity and amounts of data use increase. Once a differentiator of top-performing organizations, the ability to leverage a strong data and analytics program is now a necessity. Advanced analytics drives deeper conversations between business leaders and key stakeholders, allows organizations to track their most important KPIs more effectively, and empowers decision makers with deeper insights about what lies ahead.

APQC conducted a survey on data and analytics practices to ascertain how organizations capture the business value from their analytics investments. This article discusses the survey results and will explore:

1. How do manufacturing organizations set up their data and analytics teams for success?

2. How do they measure team success?

Data and Analytics Teams

Many organizations have specific analytics needs that drive their shift to data-driven decision making, such as understanding customer needs better or supporting staffing and policy decisions. For this reason, manufacturing organizations tend (46%) to opt for a federated or hybrid model, which leverages a centralized governance team or center of excellence combined with decentralized or embedded implementation teams within each business unit. This model is especially attractive to organizations with enterprise-wide data initiatives, mandates by executive management, or a desire to leverage pre-existing analytics and data-driven capabilities.

Though there is truly no one-size-fits all approach for program structure, there are several reasons why best-practice organizations tend toward a hybrid or federated model. APQC’s best-practice research on analytics capabilities found that:

- Centralized governance provides strategic alignment, governance, accountability and consistent communication and implementation planning.

- Decentralized implementation creates accountability within each business unit for the adoption of new behaviors, processes and responsibilities.

Decentralized teams also ensure that analytics projects meet each business unit’s unique needs and integrate subject-matter expertise into the process as needed. The result is a winning combination: The centralization of governance provides enterprise-wide standards and guidance, while decentralized teams provide flexibility, customization and business-specific expertise for the program.

Reporting Structure

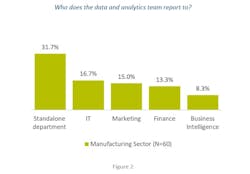

In the past, data and analytics programs were spin-offs of existing analytics capabilities and consequently reported directly to departments like IT, business intelligence or finance. However, as data and analytics become more vital to how the organization executes work and makes decisions, this reporting structure has changed (figure 2.)

Nearly a third of manufacturing organizations’ data and analytics programs are dedicated, standalone departments. The elevation of data and analysis departments from finance is a welcome development, since finance traditionally has played the role of reporting warehouses with a narrower scope of focus. For many organizations, data and analytics are now recognized as unique contributions that provide direct insights for the entire organization and consequently no longer a subset of other departments but a distinct function.

In the absence of a standalone department, manufacturing organizations, teams tend to report to IT, which makes sense given the fact that many of their analytic needs are likely connected to supplier management or other systems.

Measures of Success

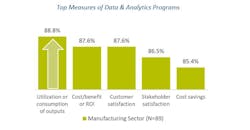

Like any other program or team, organizations need to ensure they have targeted measures to monitor their data and analytics programs. This not only helps the organizations manage performance and identify improvement opportunities, but it also helps ensure they reach their long-term goals of a data-driven, decision-making culture. However, understanding that you need measures and a cycle of structured review is easier said than done. Many organizations struggle with the following:

- What are the right measures?

- How do you tie the outcomes of analytics projects to success measures?

However, manufacturing organizations are more likely to focus on financial measures of performance such as ROI or cost/benefit comparisons. This makes sense when taking the top drivers for using data and analytics into consideration. Manufacturing organizations emphasize cost reductions—in their top five drivers for analytics use. Consequently, the measures around cost and ROI are a natural fit with that objective. However, manufacturing organizations measures mainly focus on business drivers and overlook measure that help monitor employee adoption and program performance—which helps uncover improvement opportunities.

Three Best Measure Types

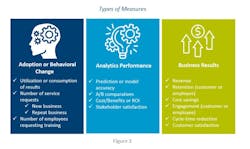

Typically, best-practice organizations use a combination of measures in three categories: adoption or behavioral change, performance and business results measures (Figure 1).Adoption or Behavioral Change Measures

Because shifting to a data-driven culture is about changing behaviors and norms, organizations include behavioral change measures in their mix. These measures help monitor the adoption rates or changes in norms and practices within the organization. They also monitor the organization’s use of analytics outputs to support its decision making.

Analytics Performance Measures

Performance measures focus on how well the analytics program is accomplishing its goals, and can include things like model accuracy which indicates how close the prediction of the changes in activity X was if you took Y action(s).

Business Results Measures

It is important to use measures that decision makers find important—typically, this means business results measures such as revenue, costs, customer retention or cycle time. This way, you measure the difference in a manner that demonstrates the value of analytics. Often, these business performance results link to the goals or measures for specific analytics projects. However, you can then roll up the performance improvements to show the overall business performance gains.

Conclusion

Organizations are working to mature their analytics programs through changes to program and reporting structures and steadily increasing their investments in this area. Organizations will find that these investments are well-spent, especially because data is the foundation for many of the technologies—from automation and machine learning to cognitive computing and artificial intelligence—that are helping drive deeper insights and better business results for organizations.

Even though manufacturing organizations understand how crucial it is to link their efforts to the outcome and business results, they need to expand their measures mix to capture more performance and adoption measures. Because, while measures on value-drivers and provide buy-in with management, they are not the best fit to ensure organizations tackle the biggest challenge—establishing a data-driven culture.

In the next article we will discuss the drivers behind program effectiveness.

Holly Lyke-Ho-Gland is process and performance principal research lead with APQC, a member-based nonprofit and one of the leading proponents of benchmarking and best practice business research.

About the Author

Holly Lyke-Ho-Gland

Holly Lyke-Ho-Gland is a principal research lead who conducts and publishes APQC research on process management and improvement, quality, project management, measurement, and benchmarking for APQC’s Process and Performance Management research team. Her research supports APQC members and clients across disciplines and centers on helping professionals and project managers solve business problems with strategy, process and measurement.