Finance: Manufacturers Set Their Sights on Emerging Markets

Where will U.S. manufacturers be spending their money in 2014? Chances are good that a lot of it will be invested in global expansion, particularly in high-tech markets and emerging economies outside of the U.S. This doesn't necessarily mean that the push for reshoring has slowed, but rather that U.S. manufacturers -- weary of a sluggish domestic recovery -- are setting their sights on what they see as the next big growth opportunity: geographic expansion.

"U.S. businesses are seeing positive momentum in the domestic economy and now appear ready to loosen their purse strings to invest in emerging and high-growth markets to fuel growth in years to come," explains Mark Barnes, national leader of global consulting firm KPMG's U.S. High Growth Markets practice. "Not surprisingly, these businesses are honing in on vast markets with strong growth rates."

See Also: Manufacturing Industry Finance News & Trends

While U.S. manufacturers continue to target the BRIC countries, they're also exploring the potential of smaller nations, such as Colombia, Indonesia, Korea, the Philippines, Turkey, South Africa and Vietnam. These countries, Barnes points out, "possess natural resources, a hunger for goods and services such as healthcare and financial services, and a need for vital infrastructure. While some of these countries may not generate immediate returns, they have bright, long-term growth prospects and companies that establish an early presence can gain a competitive advantage."

Expectations among respondents are heavily on the optimistic side, as 77% expect their company's revenues in these emerging markets to increase over the next year, while 22% believe revenues will remain the same. Just 1% think revenues will decline in 2014. What's more, of those expecting revenue growth, 14% estimate it could be as much as a 21% to 30% gain, 30% are looking for a 11% to 20% improvement, and 37% think the increase will be from 1% to 10%.

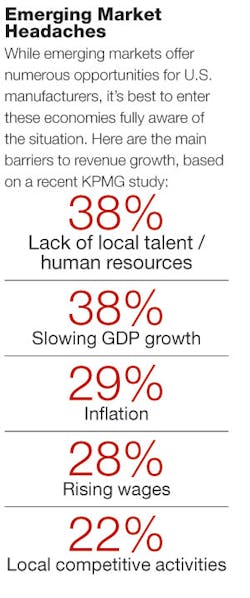

It's important that U.S. manufacturers temper their enthusiasm somewhat, Barnes says. "While many companies anticipate revenue growth in emerging and high-growth markets, we've seen plenty of companies -- especially smaller companies -- struggle to succeed, usually because they didn't conduct the necessary due diligence or identify the right business partners," he notes. "Companies need to enter into these markets with their eyes wide open and a deep sense of cultural understanding of how business gets done because these markets are highly entrepreneurial and competitive."

|

Learn what it takes to become a successful finance leader at |

"While expanding into other countries is attractive, doing business globally brings many challenges and often requires a wide range of financial solutions," adds Alastair Borthwick, head of Global Commercial Banking at Bank of America Merrill Lynch. From his perspective, U.S. companies need more help than ever with accessing capital, managing risk, maximizing cash and increasing efficiency as they attempt to grow their businesses.

About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.