Finance: CFOs Are Getting Plenty of Job Satisfaction -- Maybe Too Much

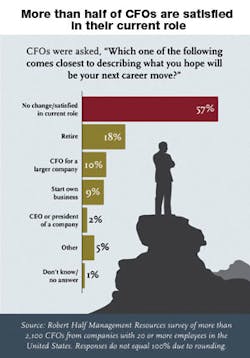

CFOs, for the most part, tend to be satisfied and contented with their companies and their chosen professions. When asked in a recent Robert Half survey to describe their next career move, the majority (57%) said they're satisfied in their current roles and have no plans to make a change.

"Why do CFOs seem so content? A better question might be: Why not?" comments Paul McDonald, Robert Half's senior executive director. The CFO role, he points out, is a prestigious one, with a diverse range of responsibilities and the opportunity to influence nearly all business areas of a company. And, it doesn't hurt that CFOs are not only the highest-paid financial professionals in their companies but are often among the highest-compensated employees, period (particularly at public companies), he adds.

"Succession planning is a critical business process that should be implemented throughout the organization," McDonald says. "Even if there is no immediate need to fill a position, identifying future executive talent helps companies prepare for the unexpected, develop a pipeline of strong leaders and build a more capable staff."

Problem is, at many companies -- especially smaller ones -- the available talent pool for budding financial executives is pretty shallow. In another study of 2,100 CFOs, one-third (34%) told Robert Half their employees know little to nothing about their company's strategic objectives. It can become a self-fulfilling prophecy: By failing to train their staffs to work toward the company's goals, CFOs find there's nobody suitable to mentor as an eventual successor.

"Employees who know about their company's strategic goals are more motivated to help the business reach them," McDonald points out. "Managers need to go beyond simply sharing the vision, however, and show workers how their contributions support the efforts to reach organizational objectives. Even organizations still refining their vision should communicate to staff their initial business goals and the company's progress toward achieving them."

Not surprisingly, then, an emerging trend within corporations is for a tighter linkage between finance and human resources. Although there is already some degree of partnership between the two functions -- particularly when it involves reward programs for employees -- the amount of collaboration in such areas as setting an overall workforce strategy and talent management is somewhat lacking, according to a study conducted by professional services firm Towers Watson. What's more, HR respondents are more likely to believe there will be more collaboration in the next three years than their finance counterparts (70% vs. 49%, respectively).

| The latest trends in talent development can be found at www.businessfinancemag.com. |

"HR/finance collaboration can and should go beyond rewards to encompass the full strategic workforce agenda," says Emmett Seaborn, senior consultant at Towers Watson. "Ultimately, sustaining and improving performance must be a shared responsibility between the two functions since it depends so heavily on the relationship between what an organization can afford to invest in its people and the financial goals it has to deliver."

About the Author

Dave Blanchard

Senior Director of Content

Focus: Supply Chain

Call: (941) 208-4370

Follow on Twitter @SupplyChainDave

During his career Dave Blanchard has led the editorial management of many of Endeavor Business Media's best-known brands, including IndustryWeek, EHS Today, Material Handling & Logistics, Logistics Today, Supply Chain Technology News, and Business Finance. He also serves as senior content director of the annual Safety Leadership Conference. With over 30 years of B2B media experience, Dave literally wrote the book on supply chain management, Supply Chain Management Best Practices (John Wiley & Sons, 2010), which has been translated into several languages and is currently in its second edition. He is a frequent speaker and moderator at major trade shows and conferences, and has won numerous awards for writing and editing. He is a voting member of the jury of the Logistics Hall of Fame, and is a graduate of Northern Illinois University.