Rivian Announces Soft Production Outlook, Job Cuts for 2024

After three consecutive stellar quarters, Rivian Automotive may be on the downswing after announcing its Q4 and full-year 2023 results and sharing its 2024 outlook.

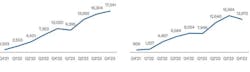

In Q4 2023, the company produced 17,541 vehicles, bringing its full year total to 57,232, exceeding its original production goal by just over 7,000 units. This was the fourth straight quarter of rising production, and most analysts expected executives to shoot for 80,000 in 2024. Instead, they announced the considerably lower goal of 57,000 vehicles.

Production wasn’t the only thing slashed for the new year: 10% of Rivian’s salaried employees as well as a “limited number” of non-manufacturing, hourly employees will be laid off in the coming months. CEO RJ Scaringe called the decision “difficult” but said that the cuts, along with other measures, would help “maximize the amount of impact” the company can have. Rivian currently has 16,700 salaried and hourly employees.

This marks the third round of layoffs in recent years for the company; in February 2023 it laid off 6% of its workers, and the same amount in July 2022. Scaringe said Rivian would support those affected through various means including severance, benefits coverage and access to job placement services.

Rivian’s financials took a hit as well, although there were positives. The company generated $4.4 billion in revenue for the year, a nearly 170% increase from 2022. But, its net loss was $5.4 billion, an improvement from 2022’s $6.7 billion.

Earlier Rivian Coverage

From IndustryWeek

- EV Notes: Ford Cuts Lightning Production, Rivian Inks Telecom Partnership

- Hot or Not: How Have EV Start-Ups Fared So Far This Year?

From FleetOwner, part of IndustryWeek parent company Endeavor Business Media

- AT&T piloting Rivian EVs for fleet electrification

- Amazon adds 5,000th Rivian electric delivery van to U.S. fleet

From Ratchet+Wrench, part of Endeavor Business Media

From Construction Equipment, part of Endeavor Business Media

Gross margins for the company were rough, coming in at -46% for the fourth quarter, the lowest all year. This worked out to a $43,372 loss per vehicle delivered. Operating expenses also ballooned in the quarter compared to last year, totaling $975 million.

Going forward, CFO Claire McDonough still expects to reach a positive, moderate gross profit by Q4 of this year, primarily through further cost reductions. Along with the job cuts, there will be a planned shutdown at the company’s Normal, Illinois, facility during Q2 to integrate new, in-vehicle “technology and increase the R1 line’s rate by approximately 30%.”

She added, “We believe these changes will meaningfully reduce our material costs and position Rivian to exit 2024 with a much-improved margin profile.”

On the delivery side, though, executives anticipated deliveries would only grow by “low-single digits,” something Scaringe also addressed in the call, attributing it to a larger global environment.

“Our business is not immune to existing economic and geopolitical uncertainties. Most notably, the impact of historically high interest rates, which has negatively impacted demand,” he said.

Rivian (Ticker: RIVN) reported earnings after the bell, and shares of the company currently sit at $13.16 per share for pre-market trading, a nearly 15% drop from closing at $15.16 per share the previous day. Over the past six months, the price of Rivian’s shares have fluctuated, peaking at just over $24 per share in September and December.