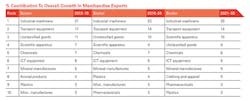

Industrial machinery is expected to be the top driver of U.S. export and import trade now and in the next decade, according to the latest HSBC Commercial Banking Trade Forecast.

According to the report, U.S industrial machinery exports, which range from large power generating machinery to small parts for domestic electrical items, are expected to account for 21% of U.S. export growth this year through 2015, making it the biggest sector contributor to overall U.S. merchandise export growth through 2015.

Further out, industrial machinery is expected to rise to 25% of U.S. export growth in 2016 to 2020, and to 26% in 2021 to 2030, according to the report.

At the same time, industrial machinery is expected to account for 25% of U.S. import growth this year through 2015, according to the report. The report predicts that industrial machinery will decline to 22% of U.S. import growth in 2016 to 2020 before inching up again to 23% in 2021 to 2030.

Transport, Medical and Measuring Sectors Driving U.S. Export Growth

In addition to industrial machinery, other higher value-added sectors, including transport, medical and measuring equipment, are also set to be big contributors to U.S. export growth. In fact, these sectors, together with industrial machinery, are expected to contribute to half of the increase of U.S. exports in 2021 to 2030, according to the report.

HSBC said U.S. transport equipment exports, including motor vehicles and aircraft, are expected to account for 17% of U.S. export growth this year through 2015, making it the second biggest sector contributor to U.S. export. It will remain the second largest contributor to overall U.S. exports in the next decade and beyond.

Medical and measuring equipment, which can include instruments for medical, surgical, dental or veterinary purposes, as well as meters and counters, are expected to make up about 7% of U.S. export growth this year through 2015, making it the fourth biggest sector contributor to U.S. export growth. The sector is anticipated to increase its share of U.S. export growth to 10% in 2021 to 2030. During that decade, it will become the third largest sector contributor to overall U.S. export growth.

Canada, Mexico, China Remain Top U.S. Trade Markets

According to the report, U.S exports will increasingly find their way to rapidly growing consumer markets in developing economies, as growth prospects for industrialized nations remain subdued. While U.S. exports to the United Arab Emirates, India and Vietnam are expected to increase the most over the next several years, the top three markets for U.S. exports continue to be Canada, Mexico and China, according to the report.

The first two are perennial top destinations for U.S. exports as a result of free trade agreements and proximity to the U.S. The report indicates that China’s strong role in U.S. exports and imports activity reflects some of the overall shift in global manufacturing to China over the past two decades, but also forward-looking demand from China for U.S. high valued-added products as the country’s consumption share increases.

“Emerging markets are developing at a phenomenal pace and are set to reshape world trade patterns over the next 20 years,” said James Emmett, HSBC’s global head of Trade and Receivables Finance. “Understanding which sectors are growing in which markets, delivers huge opportunities for businesses.”

In fact, a related HSBC report issued last month showed how some U.S. companies have benefitted from global expansion and export trends. The report, “Spotlight on U.S. Trade,” the first in a series of reports analyzing publicly-traded companies in key regions around the U.S., showed that global businesses based in upstate New York achieved almost three times the growth rates and earned over 10% more in revenue than their domestic peers in the region between 2007-2011. The report included global expansion stories from companies such as Columbus McKinnon, Constellation Brands, Ecology and Environment, Inc., and Moog.

Regarding overall export growth for the U.S, the report anticipates growth to slow to 2.2% in 2013 before increasing moderately to 3.9% in 2014. Similarly, U.S. imports will slow to 1.3% in 2013 before increasing somewhat to 2.7% in 2014.

Emerging Markets Add Value to Supply Chain

Globally, the report notes the shift towards the production of higher value goods is particularly evident in Asia, with a clear pattern emerging as Chinese export growth in information and communications technology and industrial machinery gathers pace.

This balances a declining rate of growth in sectors such as textiles, giving rise to opportunities for companies in the smaller, faster growing countries around the region to win contracts to produce these more basic goods.

Additionally, industrial machinery is the world’s top sector for goods traded and will encompass around 25 % of goods exported among the top 25 trading nations by 2030, and contribute over a third of the growth in total merchandise exports from 2013, according to the forecast.

About the Author

IW Staff

Find contact information for the IndustryWeek staff: Contact IndustryWeek