Viewpoint: Managing Currency Risk in the Supply Chain

The term "global supply chain" is a popular tautology. We live in a global economy and there are no supply chains that are not global in some fashion. One of the many risks that come with the global nature of supply chains is the risk of currency fluctuation. Foreign exchange rates can fluctuate dramatically over the course of a supply agreement and it is important to consider their impact upfront.

When doing business with suppliers or customers that operate in other countries, here are several tips for managing exchange rate risk:

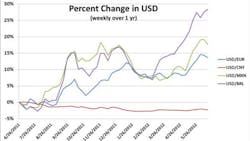

You will never remove the effect of foreign exchange rates. The goal of managing exchange rate risk in the supply chain is not to eliminate the long-term impact of a shift in rates. As the graph shows, the U.S. dollar over the past year has been slowly and steadily dropping against the Chinese yuan and has moved dramatically up against other currencies. Large jumps or long-term trends will catch up with pricing eventually regardless of your market power or clever contracts.

There are three basic goals of managing exchange rate risk in the supply chain:

- To allocate the risk of short term fluctuations in rates (this includes the effect of exchange rate fluctuations on payables and receivables).

- To achieve price stability over a reasonable time period.

- To understand the level of exposure so that strategic decisions can be made regarding location strategy and corporate risk management.

Contracting in your own local currency is not the same as eliminating currency risk. I work with many clients who require foreign suppliers to quote in U.S. dollars but then do not address the issue of exchange rate fluctuation in their supply agreements at all. Just because you don’t see it doesn’t mean it isn’t there. Suppliers will price in currency risk, or they will find ways to adjust price over time to account for it. If the currency moves in your favor, you will miss cost saving opportunities. There are more options to manage risk if the exchange rates and terms are made explicit in the agreement.

Agree on the baseline exchange rate of the initial quote. This is obvious but often missed. If there are no ground rules for the exchange rates, suppliers will make their own assumptions about the rates, leading to variation between suppliers and unexpected price changes over time.

Know your supplier’s exposure. My clients are often surprised to find that the foreign exchange exposure is much different than they expect. Most companies are operating other currencies as well. In my experience with U.S. companies outsourcing overseas, it is often the case that a large portion of the supplier’s cost is in USD because the materials they buy are already priced in USD. The only exposure to the supplier’s local currency may be in paying the local labor force, and that can be a small fraction of total cost.

Another twist is when the customer, supplier and the supplier’s factory are all operating in different currencies. I managed a relationship between a customer in the U.S., and a Singapore-based supplier with factories in Malaysia, China, Eastern Europe and Brazil. We managed the pricing differently in each region based on the volatility of the exchange rate. In Brazil, where there was the highest fluctuation, we even had a true up process to account for the exchange rate effect on receivables. There is not a “one-size-fits-all” answer to supply chain currency risk management.

Set reasonable working parameters. The most common contractual terms for allocating exchange rate risk involve four factors:

1) The functional currency (used for the transaction) and the “local” currency in which there is exposure to rate fluctuation.

2) The exposure to that local currency – i.e. how much of the cost is denominated in the local currency.

3) The baseline rate and the up and down boundaries for fluctuation. Often this is expressed as a percentage change. Inside the range, the pricing is fixed. When the rate goes outside the range, pricing adjusts.

4) The timeframe during which the baseline rate and pricing are valid.

There are several ways in which risk shifts from customer to supplier: Putting narrow limits on the exposure; increasing the boundaries for fluctuation; or extending the timeframe during which pricing is fixed. Any of these changes increases price stability for the customer, but require the supplier to price in the cost of carrying more risk. Because risk is directly tied to cost and price, it is important to negotiate foreign exchange terms concurrently with pricing and other payment terms.

Coordinate with your company’s finance risk managers. It is generally not the job of the supply chain manager to manage overall currency risk and exposure. The supply chain manager needs to understand the exposure being created, and work with the finance function to manage it. Depending on the company’s total exposure, on both the sell side and buy side, and the options available for hedging, the strategy for supply chain risk will vary.

I have a client who is a large global apparel manufacturer that has the market power to push a great deal of risk back on the supply base. However, they have made a choice to take on completely the currency risk of their suppliers – to the point of having a complicated process of exposure reporting and true up. They have determined that they can do a much better job of managing risk in aggregate at a corporate level than their suppliers could do, and they would rather have better pricing than less risk.

Good luck managing your foreign currency risk. I welcome your feedback.

Jeff Wallingford is vice president, Supply Chain Strategy, for Riverwood Solutions.