GM Rising, Nissan Falling in New Supplier Relations Survey

Both General Motors and Nissan have made cost-cutting a priority—but with very different results, according to this year’s Supplier Working Relations Index study.

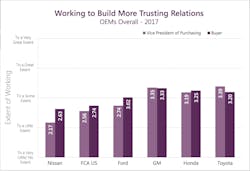

GM has improved its relationships with its suppliers by leaps and bounds, its score up from “Poor” two years ago to the high end of “Adequate” this year, closing in on “Good.” Meanwhile, Nissan is heading in the other direction, ranking lowest of the six U.S. and Japanese OEMs measured in the study.

GM actually puts more pressure on its suppliers but it treats them better and the payoff is better," said John Henke, president of Planning Perspectives, the Michigan research firm that conducted the study.“Down at the buyer level at Nissan, they’ve just been very adversarial,” cutting ties with suppliers who don't meet steep profit demands, said Henke. Over at GM, however, Global Vice President of Purchasing Steve Kiefer “is always talking at supplier meetings about the need to build better relations,” said Henke. A veteran of automotive supplier Delphi, “he wants GM be a better partner. He talks about it publicly and he practices it on a day-to-day basis.”

Toyota and Honda held steady in the survey over last year, ranking first and second respectively, while GM edged out Ford. FCA was fifth this year, slipping past Nissan only because the Japanese automaker continued its descent.

Suppliers named Honda the “most preferred” OEM this year, for the third year running. “They’re just good people to work with,” said Henke. “They put all kinds of pressure on their suppliers, but they do it the right way, and they do it in a kinder and more friendly way, and they and Toyota work more with their suppliers than anybody else.”

Still, even Toyota and Honda have some catching up to do. Though they’re still at the top, their approval ratings with suppliers are considerably lower than they were before the auto crisis of 2008-2010.

Henke attributes their lower rankings in part to having to make new hires in purchasing to keep up with growth in North America. Toyota also began the process transferring its purchasing staff from Erlanger, Kentucky, to Pittsfield, Michigan, in 2015, and had to replace about 30% of employees who declined to move.

“I expect they will improve again,” said Henke. Nissan, on the other hand, “has got to get back to the basics, just as FCA has to. Because if they don’t, it’s just going to be harder and harder for them to continue to make money. Because if there’s a downturn—and things are slowing down a bit—it’s going to hit them hard if suppliers are not contributing as much as they can possibly contribute.”

About the Author

Laura Putre

Senior Editor, IndustryWeek

As senior editor, Laura Putre works with IndustryWeek's editorial contributors and reports on leadership and the automotive industry as they relate to manufacturing. She joined IndustryWeek in 2015 as a staff writer covering workforce issues.

Prior to IndustryWeek, Laura reported on the healthcare industry and covered local news. She was the editor of the Chicago Journal and a staff writer for Cleveland Scene. Her national bylines include The Guardian, Slate, Pacific-Standard and The Root.

Laura was a National Press Foundation fellow in 2022.

Got a story idea? Reach out to Laura at [email protected]