Tracking the financial impact of any support function is necessary in order to illustrate its value and garner continued support and resources from senior management. This struggle is vitally important for quality management departments that continue to struggle with competing for resources. Once organizations get clarity on the financial impact of quality, the next step is to understand what practices and applications help improve the financial value.

In 2016, ASQ and APQC partnered to conduct a survey that would provide a comprehensive look at intercontinental quality and continuous improvement methodologies and to explore organizational practices used for quality governance, management, and measurement.

This four-part series will look at what helps drive financial benefits from quality, including looking at the relationship between financial benefits and:

- the role and uses of quality,

- governance and standardization of quality,

- quality training for suppliers, and

- quality incentives and training for staff.

This first article looks at the role and uses of quality and its relationship to driving financial benefits from quality.

Quantifying the Benefits

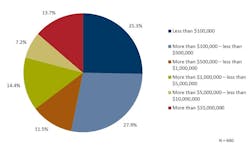

As noted in the full report, “approximately 60 percent of organizations say they don’t know or don’t measure the financial impact of quality. This lack of measurement may be attributed to not having a common method for capturing the financial impact.” However, that leaves 40 percent of organizations that have clearly linked their quality efforts to profitability (Figure 1).

Of the organizations that track the financial impact of quality, the majority report benefits less than $500,000 from using quality to drive profitability. However, that raises the question, what are these organizations doing and how does the role of quality, and its applications, really help drive improved financial value?

Role of quality and its relationship to financial value

Quality’s Role in the Organization

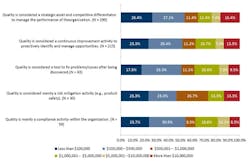

Respondents were asked to identify what role quality has within their organization. For a third of the respondents, quality is used as a tool for proactive continuous improvement efforts or for compliance. However, the role of quality has changed over the last few years and a growing percent of organizations (36 percent) consider quality a strategic asset and competitive differentiator.

Research has shown that as organizations (especially large, globally diverse ones) move away from quality’s being merely ”checking the compliance boxes” to really using quality practices to impact the daily decisions of staff, there is opportunity for a greater return on investment. To quantify this relationship, we ran correlation analysis between the role of quality and financial benefits. Our assumptions that the role, in fact, matters were validated. Organizations that leverage quality as a strategic asset were more likely to report higher levels of financial gains from their quality programs (Figure 2).

However, that does not mean the foundational purposes of quality no longer have a role. Developing a solid foundation of quality assurance for continuous improvement, risk mitigation, and compliance provide immeasurable value. However, once that solid foundation is established, organizations can then leverage quality for the benefit of the customer and enhance brand image, thus serving as a competitive differentiator.

Applications of Quality for Profitability

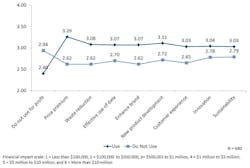

To understand the relationship between quality and profitability, respondents were also asked to identify what applications of quality they used to drive profitability. The majority of organizations tend to use quality to focus on the customer experience, enhance their brand, and reduce waste. To pinpoint which uses actually drive financial benefits, we conducted correlation analysis between the ranges of financial benefit and the potential uses. Unsurprisingly, all of the quality uses significantly impact the financial benefits. To create clarity and guidance on where organizations should focus their efforts, we also conducted a gap analysis on the median financial benefit between respondents that did or did not use a specific application (Figure 3).

The first thing of note is a confirmation that organizations that do not specifically use quality for profitability tend to have much smaller financial benefits from quality. However, the second largest gap—or in this case benefit—supports the findings from the previous section. Organizations that use quality as a differentiator see improved profitability—in this case, their ability to leverage quality for price premiums. On the flip side, organizations continue to see bottom-line improvements and can grow their financial benefits by applying quality for waste reduction. It was, however, surprising that the some of the common uses of quality for profitability—innovation and the customer experience—had a smaller impact.

Conclusion

Mature organizations’ quality systems tend to focus on proactively creating value rather than simply being relegated to compliance or improvement activities. By doing so, the quality function becomes a strategic partner and can quantify the financial value of its efforts. Driving profitability through price premiums or waste reduction creates a direct ROI on the value of quality. In the next article, we will cover the relationship between governance and quality standardization and the financial benefits of quality.

Holly Lyke-Ho-Gland is process and performance principal research lead with APQC, a member-based nonprofit and one of the leading proponents of benchmarking and best practice business research.