Your Should-cost Number is Wrong, But It Doesn't Matter

There has been a lot written over the years extolling the virtues of “should-cost” in the world of product cost management. There are approximately 10 specialty software products that will help you calculate should-cost; major consulting firms talk about should-cost and, of course, will help you with it. It is a major focus for the U.S. government, as well. In fact, if an executive or manager is asked , “How important is it to know what the parts you buy or will manufacture should cost before committing to a supplier or a make/buy decision?” nearly 100% of the managers will answer that it is very important, or critical, to the profit of the firm.

Very few firms, though, have a standing, well-functioning process for should-cost. For most purchasing organizations, it is not a part of the culture to ask what something should cost BEFORE going out for quote. The best situation is that there are a couple of cost experts, sitting in the back corner of the purchasing department, who are masters of one or two of the specialty product cost management (PCM) software tools. However, these people never have enough capacity to fully serve the buyers in the purchasing department, let alone to support engineering with design-to-cost activities. I have worked in the PCM field for 20 years now, first as a researcher in feature-based costing, then founding and leading one of the PCM software companies, and now as a PCM consultant. I have experienced the situation above in 99+% of the companies that I have encountered.

Why, deep down, no one really cares about should-cost

If we accept that (1) should-cost is very important to creating and improving profit, (2) adequate tools exist to help with the difficult task of should-cost, but (3) almost no firms regularly use should-cost in their product development and sourcing processes, we have to ask “why?” Why is it that no one really seems to care that much about should-cost as a strategic tool for increasing profit?

One answer is that people see should-cost as a “nice to have” and as a theoretical exercise that is often “wrong.” To most people, “wrong” means that the should-cost prediction for a given part was $105 when the part actually cost the firm $86 or $142. The should-cost estimate is not within what the user thinks is a “reasonable” range of estimation error. Therefore, should-cost gets pushed aside in many people’s minds as an imprecise and useless academic tool that provides little value to the firm.

Should-cost as a leverage tool, not a diagnostic tool

In the short example above, the root cause of why people judged the should-cost estimate to be wrong was that they used should-cost merely as a predictive tool. They wanted what I call “absolute accuracy” in the cost estimate. The should-cost tool calculated a part cost of $105, but the part cost $142, making the tool is 35% “inaccurate.” There are a number of reasons why there is a discrepancy between the two numbers that include estimator error, a poor PCM tool, bad data, or most importantly, commercial “noise.” All of these specific reasons are beyond our time in this discussion.

Although this example shows a 35% discrepancy, a much bigger error exists. The error is not a tactical error in estimation technique or calculation; it is the strategic error of using the tool of should-cost itself with the wrong purpose in mind. The error is the reliance on should-cost only as a DIAGNOSTIC tool, as opposed to a LEVERAGE tool to push the price or cost of a part down.

Look at the triangle below. Triangles are famously rigid structures in civil engineering that are hard to deform, and that’s why you will see them all over bridge designs. On the top of our triangle is the quote your firm receives for a part or product, and on the bottom right is the should-cost prediction. You would like to push the negotiated price in the bottom left to be the same as the should-cost estimate, but to do that the quote will have to change. Most people have the expectation that the predictive power of should-cost alone will have the strength to shrink the triangle to the point that all three numbers are the same (i.e. the little orange triangle). That is a great goal, but it is not typically realistic. Often, the value of the should-cost estimate will not be used as a diagnostic, but as a lever to shrink the triangle to a lesser extent, as shown by the dashed line.

Why no one cared that Peter Lynch missed his estimates

Some people object to the idea that should-cost ought to be viewed as a tool for leverage, versus exclusively as a tool for prediction. However, these people don’t expect the same level of fidelity in the tools and/or service providers that govern their personal finances as they do when should-cost is used in product development. One of the most celebrated investors in modern history is Peter Lynch. While running the Magellan Fund for Fidelity from 1977 until 1990, Lynch earned an annualized 29.2% per annum, beating the S&P 500 by an average of 13.4% each year! Lynch used his own version of should-cost models – the investment folks call these “valuation ratios.”

I am sure that Lynch’s predictions of these valuation ratios were often very far off from the actual high or low price of the stocks that he traded. Yet, none of his investors complained about Lynch’s lack of absolute accuracy. Why? Because Lynch gave his investors leverage over the investors’ other alternatives (other mutual fund managers or index funds). There are many people in my parents’ generation who were very glad because they did not dismiss Peter Lynch for his lack of absolute market prediction accuracy, but instead focused on the leverage Mr. Lynch gave them over the market.

A new way to view how should-cost can help your business

It is hard to change from the mindset of should-cost as only being a predictive diagnostic tool to the idea that should-cost is primarily a tool for pricing leverage, but it can be done.

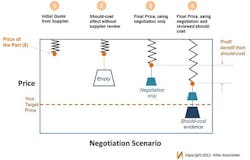

One helpful way to illustrate the relationship between should-cost and part pricing is to imagine that the quoted part price is attached to a spring (see the figure below).

That price is likely dangling above the target price that you would like to pay. Your target price may be informed by the prediction of a should-cost model, or the financial realities of what you feel the price needs to be to achieve your own product’s profit goals. Your goal is to stretch that spring downward to the level of your target price (circle 1 on the diagram).

To pull the price down, you need leverage, which we can think of as a weight hanging below the quote price. The first mistake that many people make is to calculate a should-cost without discussing how it was calculated with the supplier or internal plant. This situation is shown in circle 2 of the diagram. Notice that the weight in circle 2 is just an empty shell. It has no mass and no leverage on the price because the supplier does not understand or believe it. The second mistake that most organizations make is when they do not calculate a should-cost at all and instead, rely solely on negotiation to reduce the price (circle 3). Negotiation can create leverage and pull the price downward, but negotiation is very subjective and dependent on the negotiator.

The right way to approach the pricing situation is to use the leverage of BOTH negotiation and a should-cost estimate – an estimate for which you have, at least, grudging buy-in from the supplier. If you bring your supplier fully into the should-cost estimation process, he may correct poor assumptions that you are making and the should-cost estimate may go up. But, this does not matter because the supplier or plant is already agreeing to some level to the validity (absolute accuracy) in your calculation. Moreover, even if the supplier does not outwardly accept your calculation, it is likely affecting him internally. There are very few cases in which a supplier is so unreasonable that he dismisses your should-cost completely after you review with him.

The spring under circle 4 shows the effect of using both negotiation and should-cost. The negotiation/should-cost cocktail results in the lowest final price. Note, in circle 4, we still have not achieved our target price for the part. However, that is not the end of the world and, at worst, is a temporary problem. Here’s the secret:

The most important outcome of using should-cost as a leverage tool to reduce product cost is to ensure that you always pay less, relative to your competition for the same quality, performance, content, and delivery.

Following this maxim puts you in the enviable strategic position of being able to choose whether or not to reap more profit, or reduce your product’s price to grab more market share. As shown on the diagram, there is a difference between the price we receive through negotiation alone versus the price we receive using negotiation and should-cost together. How big is this average difference for companies who take these two approaches? According to estimates from different product cost experts with whom I talk, the difference is 5% to 20%. However, I know of no official organization, government, or academic study that quantifies this (hint, hint, professors of engineering, supply chain, and business). The expert opinions comport well with my own experience with should-cost.

Success, even in the worst case scenario

What if you are only able to achieve the low end of benefit using should-cost for pricing leverage? How much is 5%? Well, the average manufacturing firm has 75% to 95% cost of goods sold (COGS)-product cost as a percent of sales. Let’s assume a firm with an 85% COGS and a net margin of 5%. Reducing product cost by 5% drives an 85% increase in net profit if none of the price differential is used to gain market share! Is that enough to get management’s attention in your company?

So, the next time you suggest that your firm should have a credible should-cost number for every part on your product, and your boss or buyer says, “Those numbers are always wrong, why should we bother?” tell them, “Yes, I know they’re wrong, but the should-cost number can still increase our profit by 85% anyway. Do you want to hear more?”

Eric Arno Hiller is an authority in product cost management (PCM). Hiller was the co-founder and founding CEO of two high technology start-ups: aPriori (a PCM software platform) and End Around. Previously, he worked in product development and manufacturing at Ford Motor Co., John Deere and Procter & Gamble. He is currently the president of Hiller Associates and the author of the PCM blog www.ProductProfitAndRisk.com. Mr. Hiller holds an MBA from the Harvard Business School and a master’s and bachelor’s degree in mechanical engineering from the University of Illinois Urbana-Champaign.