Why It's Not Too Late to Build Your Own Industrial Internet Platform

Over the past three years, the emergence of the Industrial Internet of Things (IIoT) has led to an outpouring of technological cooperation, as more than 350 firms have joined various consortia to hammer out standards around open digital platforms. Yet this leaves industrial companies in an uncertain competitive position in terms of creating and capturing value for themselves. With the industrial internet accounting for nearly $800 billion in commerce last year and growing to a multi-trillion dollar opportunity over the next decade, companies don’t just need to cooperate: they need to focus on forging a digital platform strategy that generates growth.

For a prime example of a company doing both, we need to look no further than General Electric, whose turbines generate 300 data points per second (see image). If GE increases fuel efficiency 1% in its jet engines by analyzing data from embedded sensors, airline industry profits could increase by $3 billion.

At the same time it is providing those kinds of benefits for those who plug into its Predix operating system, GE’s digital industrial business generated about $7 billion in revenue last year and is on track to reach $15 billion by 2020. That is good for GE, but the question for other firms is clear: is there still an opportunity to build your own digital platform, even on a smaller scale, or is the best strategy to simply plug your equipment in and cooperate?

What is your digital platform strategy?

The challenge for companies that want to capture new value is that industrial applications often exist in a ‘systems of systems.’ That is, there are many systems and subsystems from different manufacturers that need to work together. This requires coordination. ‘Platforms’ are a type of solution that enables different systems and stakeholders to coordinate all the various inputs and outputs—and to provide developers the ability to build vertical software applications that are used by end users (see figure 1).

As the central clearinghouse, the company that owns and manages the platform is well positioned to capture a significant portion of the value. Dozens of companies have launched IoT platforms targeting industrial applications, with analysts expecting this new capability to add $14.2 trillion to cumulative global GDP by 2030. According to Forrester Research, 60% of decision-makers at global enterprises are using or planning to use IoT-enabled applications over the next two years.” Gartner has suggested that two thirds of industrial enterprises will be doing so with an IIoT Platform by 2020.

We suggest that there are two types of Industrial Internet systems: broad platforms like GE’s and niche platforms that serve specific industries or applications. To determine where you are best able to play, it helps to begin with a common understanding: First, building an IIoT platform is not cheap. It requires a significant and sustained investment to build infrastructure to develop capabilities required to sustain the platform, and to fund customer acquisition activities. Second, building an IIoT platform is very different from making, say, a jet engine. Industrials considering playing in these new areas will need new strategies, business models, and organizational structures to succeed. IIoT platforms have the potential to widen a company’s competitive landscape while also provide a source of future growth.

To achieve the optimal IIoT platform strategy we believe it is fruitful to study the recent history of platforms, which yield these five lessons:

Lesson #1: Outside hires and agile development cycles are required to deliver constant iteration.

Most industrial businesses have long development cycles that require focused development activities with incremental changes spanning years and sometimes decades. Like most digital opportunities, IIoT platforms entail dramatically shorter, faster development cycles. Whether you’re considering a broad or a niche platform, many industrial companies will need to fundamentally revisit their internal development process and talent base.

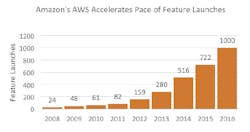

Here we can learn from the cloud computing space, where competitors seek differentiation by constantly adding new features. Recently, Google Cloud has added artificial intelligence and data analysis. The IBM Cloud has focused on tailoring vertical solutions for different markets. Amazon Web Services added 1,000 distinct features in 2016. In all these cases, agile development is core to those cultures.

Constant iteration is necessary for several reasons including staying competitive, increasing revenue from existing customers, and creating features targeted at niches. For example, AWS targeted government customers by adding Criminal Justice Information Services compliance and by launching a “GovCloud” with security for government use.

Most industrials presently lack the ability to ship hundreds of features per year, so this means a new agile software capability must be built. Agile development is an iterative approach to building software that accelerates the delivery of finished projects. Many industrial companies, including John Deere, have moved their existing software groups to an agile workflow and seen delivery timelines drop by 92%. In addition to agile many industrial companies are pursuing what is known as bimodal IT. According to Gartner, bimodal refers to the practice of managing two separate IT work styles. One group is focused on predictable, well understood legacy products. While a second group explores new problems in a fast-moving, assumption driven manner.

Strategic acquisitions are one way to rapidly build an agile software capability. Bosch used a technology acquisition to form its Intelligent Solutions Group which has since developed an IIoT platform.

But for most industrials, achieving agile development or bimodal IT to build a viable IIoT platform requires consistent hiring of outside talent. GE CEO Jeffrey Immelt has said that GE never made progress in digital “until we brought people in from outside.” Despite employing over 10,000 software developers, GE still chose to initially staff its software center of excellence with 98% outside hires. To attract talent, GE has located offices near software hubs, which included moving its headquarters from Connecticut to Boston. In doing so, GE also changed compensation packages and launched advertising campaigns focused on the potential impact GE’s work can have.

Lesson #2: Leveraging B2B relationships are essential for incumbents to gain a fast foothold.

When discussing market entry strategies, many players focus on technology development strategies and ignore the human side of IoT. Incumbents with customer relationships have multiple advantages that new entrants will lack in this regard. First, existing relationships provide a source of first mover advantage and serve as potential platform validators. GE has relied on existing customers to serve as validation stories for its Predix platform. Second, customer trust built over time will help incumbents address customer’s top concerns around security and compliance.

The same lesson is reinforced in the cloud computing environment. More than a decade into the cloud revolution, many large enterprises are still in the early stages of adopting a cloud computing platform. But the transition is quickening; a 2015 study found that 77% of companies primarily used traditional on premise data centers for at least one workload, but that by 2018 the percentage will drop to 43%. The shift is being driven by cost savings, decreased time to market, and the quality of cloud systems. This lag has provides incumbents that can leverage a sense of trust to address concerns around security and compliance with an opportunity to catch up to early entrants.

That’s because a minimum viable platform needs a significant customer base to be financially sustainable. For example, Johnson Controls shuttered its Panoptix platform after failing to attract enough interest to justify development costs. Thus, IIoT platform operators should focus on attracting customers, knowing that the lifetime value will be high. Google recently used incentives to help provide capacity to host the Spotify music service and even Apple’s own iCloud platform. Customer acquisition in the early stages of the industry lifecycle is crucial for the platform to gain critical mass in the long term.

Lesson #3: Niche platforms can differentiate by focusing on critical customer-job-circumstance combinations

Even if your organization can’t sustain the investment and operational speed that is required to grow a broad-based IIoT platform, smaller companies can win by focusing on narrower customer jobs, or problems that crop up in specific circumstances. This requires a more targeted feature set, which are not sufficiently addressed by the broad IIoT platforms.

A good way to start is with a simple mapping of jobs, or needs, addressable by IIoT versus the circumstances that specific customers may encounter. This map can allow you to understand where general platforms compete and highlight opportunities where your unique capabilities and knowledge can provide an advantage.

SKF Group, the Sweden-based leader in the ball bearing systems industry, has developed IIoT solutions designed to increase the performance of its products. SKF Insight provides real time updates to customers alerting them to when conditions such as temperature or lubrication levels may cause a system to fail. SKF Insight is able to provide this service by collecting data generated by tiny sensors embedded in bearings that are powered by kinetic energy generated by the motion of the bearings. Preventing bearing failures is an important job many SKF customers have. Replacing the main bearing on a wind turbine is so costly that doing so can undermine the business case for building the turbine.

Companies have also found success partnering with established IIoT platforms. Pitney Bowes, a leader in the mailing equipment industry, has been forced by a long-term decline in mail volume to transform itself. To fortify its legacy mailing equipment business the company has partnered with GE’s IIoT platform, Predix, to develop a suite of software tools for its equipment. These tools are available to customers as a paid subscription. Seeking new growth, the company has leveraged its experience in the mailing industry to simplify the international shipping process for retailers. Pitney Bowes has pursued a conservative IIoT strategy for its legacy business while pursuing new growth opportunities enabled by digital.

In creating nice platforms and partnering, SKF and Pitney have both been successful decreasing downtime—a priority job for many industrial customers.

Lesson #4: Platform operators should build core features and when possible allow partners to provide supporting features.

Regardless of the scope of an industrial IIoT platform, industrial companies should look to partners to provide basic IIoT platform functionality. For example, Apple famously built Apple Maps because of the increasing importance of mapping to mobile platforms. Mapping was becoming a differentiating feature that Apple risked losing control of unless an internal capability was developed. Yet Apple still partners with third parties to provide weather and stock data for their mobile platform. Weather and stock data are basic features that customers expect but not features upon which they base their purchasing decisions.

Another example can again be seen in the cloud computing industry where basic computing and storage has become a basic feature expected by customers. Prices for these features have fallen over time, partly driven by Moore’s law and partly by the willingness of competitors to sell basic computing at prices that allow little margin.

This trend suggests to industrial IIoT platform managers that these features may be best provided through a partner. Digital leaders have already recognized this insight and begun partnering with Microsoft’s Azure, AWS, and others to host their IIoT platforms on established cloud computing platforms. Similarly, General Electric recently paired with Microsoft to host Predix on Microsoft’s Azure platform. This partnership allows GE to focus resources on building core IIoT features rather than dedicating resources to supporting features.

Lesson #5: Not every company is positioned to build an IIoT platform but every company must develop a strategy to remain relevant.

Few companies are positioned to become broad IIoT platform operators, like GE, IBM or Google. Even smaller, more niche solutions like SKF Insight are not an option for every company.

However, companies that do not pursue IIoT platform strategies must still find ways to remain relevant to customers and to protect against disruption caused by digital.

For instance, Yard Club is a startup seeking to de-link the value construction equipment creates from actually ownership of that equipment. The company allows equipment owners to rent their machines to operators during periods of downtime. Yard Club thus has the potential to significantly reduce the demand for new equipment by increasing the utilization of existing equipment. Rather than ignore this potentially disruptive business model, Caterpillar has invested in the company and has instructed its dealer network to list their rental inventories on the platform. This enables it to add the benefits enabled by another IIoT platform while remaining relevant to its customers.

Second to Caterpillar, in construction equipment sales, Komatsu faces a similar threat. Rather than wait to be disrupted, Komatsu has pursued efforts to create disruptive concepts internally. Komatsu’s Smart Construction unit provides a service that semi-autonomously excavates sites. The service combines drones, remote operators, and Komatsu equipment to accomplish a job that previously required ownership of expensive equipment and significant labor. Selling excavation as a service is a significant departure from selling equipment and could eventually reduce Komatsu’s traditional equipment sales.

Moving forward with your digital strategy

Leaders must identify where their company is positioned in the industry ecosystem to determine the optimal strategic action. Incumbents do not have to be the first mover but waiting too long will make it difficult for a platform to reach viability. This is seen in the cloud space the top five or six platforms, from Google, IBM, Amazon, and Microsoft together control about 60% of a giant market.

A successful IIoT platform will begin by targeting existing customers with differentiated features created through constant iteration funded with sustained investments. Not every company should build a general-purpose IIoT platform; opportunities exist for niche platforms as well as in adjacent areas. To determine an optimal IIoT platform strategy, leaders should assess their existing data portfolio as well as the priority jobs of their target customers. But it’s now becoming vital to settle on your strategy soon, as the cloud platform business shows just how momentum can entrench the strongest digital marketplaces.

Michael Brady is an analyst with growth strategy consulting firm Innosight, where Ned Calder is a partner and Joe Sinfield a senior partner.