Slowed by winter storms that closed factories and left roads and airports unusable at times, manufacturing output was off 0.8% in January, while industrial production as a whole fell 0.3%, the Federal Reserve reported today.

The bank also lowered its manufacturing production figures for the fourth quarter of 2013, to 4.6% from its first estimate of 6.2%. Steel, semiconductors, motor vehicles and organic chemicals were the largest contributors to the downward revision for October through December.

The January data was "particularly disappointing given the strong increases in demand and output that we saw at year’s end. Indeed, manufacturing production rose 3.0% at the annual rate in the second half of 2013, providing some momentum for 2014," said Chad Moutray, chief economist for the National Association of Manufacturers. But he added, "To the extent that weather was a contributing factor, I would expect for manufacturing production to rebound in the coming months."

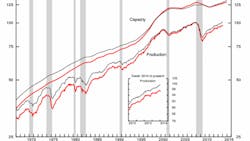

The level of factory output in January was 1.3% above its year-earlier level. However, capacity utilization for manufacturing moved down 0.7% in January to 76.0%, a rate 2.7 percentage points below its long-run average.

Durable goods production fell 0.8% in January, with most categories contributing to the decline but production was 2.8% higher than in January 2013. The largest declines were in the output of motor vehicles and parts (-5.0%), as many auto plants lost a day or more of production in January, and wood products (-2.6%). The bank reported smaller losses were registered by primary metals; fabricated metal products; electrical equipment, appliances, and components; aerospace and miscellaneous transportation equipment; furniture and related products; and miscellaneous manufacturing.

Gains in durable goods were recorded in nonmetallic mineral products, machinery and computer and electronic products. Capacity utilization for durable goods manufacturing declined 0.8% to 76.0%, a rate 1.0 percentage point below its long-run average.

Nondurable manufacturing output also was declined in January, by 0.8% after a 1.2% increase in December. The largest declines—from 1% to 2%—occurred in food, beverage, and tobacco products; textile and product mills; and printing and support. Capacity utilization for nondurable manufacturing moved down to 77.4%, the Federal Reserve reported, a rate 3.3% below its long-run average.

"A correction was bound to happen, and the fundamental drivers of industrial activity still remain positive," said Daniel J. Meckstroth, chief economist for the Manufacturers Alliance for Productivity and Innovation (MAPI), who predicts manufacturing activity will increase 3.2% in 2014. "Consumer after-tax income will accelerate this year, there is pent-up demand for durable goods and business investment, and government spending will not be a drag on growth."

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.