Offshore Manufacturing Trends for Mid-Market Companies

As manufacturing costs in low-cost countries have increased, there has been much discussion assessing whether it makes sense to re-shore production. However many of the cases have involved large companies. Mid-market companies face unique challenges and risks.

The Keystone Group has conducted a survey of mid-market C-level executives across multiple industries with the goal of documenting the current state of mid-market offshoring and outsourcing.

The survey results suggest that a large percentage of mid-market companies have some experience in offshoring and/or outsourcing. Their motivations for offshoring and outsourcing go deeper than simple cost savings.

For purposes of this article, the term "offshoring" is used to indicate overseas manufacturing and the term "outsourcing" is used to indicate the purchasing of parts and/or products from a non-domestic vendor.

These companies are seeking long-term competitive advantage. Far from a quick fix to the bottom line, offshoring and outsourcing – while delivering bottom-line benefits in the majority of cases – often require much more time, more management oversight, and a more nuanced approach than most companies realize when they first embark on these initiatives.

To create a successful offshoring and outsourcing environment, mid-market companies are looking beyond unit cost savings. They are focusing on the longer-term strategic benefits, as well as the total economic cost of their offshoring initiatives.

They are also doing a better job of uncovering and anticipating the unforeseen costs and liabilities which may include: hidden costs in production and logistics, quality control issues and inventory management, lead times that may fluctuate and be difficult to control, and duplicative management overhead. Investing time up front to assess costs and set realistic expectations will yield better and more predictable results even in a volatile environment.

Primary Motivations: It's not All about the Money

The primary rationale for offshoring and outsourcing is achieving cost savings, and almost all respondents did achieve some savings from their initiatives. However, about one fourth of the respondents did not achieve the level of savings they originally expected. They cite unexpected costs in labor, raw materials and freight as the key drivers of unexpected cost increases. Many respondents also did not anticipate the amount of management time required to control an ongoing offshoring effort.

Those companies that engage in offshoring purely for cost savings are more likely to find that their initiatives fall short of expectations. They are also more likely to have to constantly re-evaluate sourcing as the initial offshore markets experience economic growth and rising labor costs.

Nearly a third of respondents engaged in offshoring reported relocating, or having plans to relocate to new markets due to rising costs in the original offshore locations. That said, most do plan to continue offshoring.

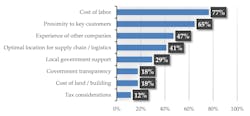

Strategic value ultimately plays a larger role than simple cost savings. When selecting factory location, cost of labor and proximity to key customers are both common criteria that were noted as important to over half of the survey respondents. Prioritization of factory location criteria were as follows:

Final Criteria for Factory Location Selection

Percentage of Respondents who Selected Each Criterion

While lower labor costs will always be a factor in offshoring/outsourcing, a large percentage of respondents cited entry into foreign markets as a key motivator for offshoring. When companies include other factors outside of pure cost savings as part of their decision making, those companies are more likely to have a tolerance for the inevitable rising costs in developing countries and are more likely to stick to their strategy. Companies with more strategically planned offshoring/outsourcing initiatives will take both cost savings and new market entry criteria into account.

Invest time up front

Offshoring, since it usually involves physical construction of plant and facilities in a foreign country, naturally takes up-front planning. Outsourcing also requires significant up-front planning. In either case, planning is essential not only to minimize the impact of unexpected developments, but also to get a better and more realistic prediction of the outcome.

Though almost all respondents reported some cost savings, with over half noting cost savings of over 20%, the general consensus was that it will take longer to start the offshoring or outsourcing initiative than anticipated. Unfamiliar business cultures, unwieldy bureaucracies and the need to establish local management oversight may all contribute to a lengthier than expected rollout.

Eighty percent of respondents reported higher costs than originally incurred in the non-domestic location. Investing time up front to properly assess costs and vendors will pay off in the end, and setting realistic expectations based on the many variables involved, beyond quoted costs, will help keep set realistic expectations.

Management overhead

Mid-market companies usually do not have the dedicated resources to manage offshore vendors nor do they have the same extent of in-country relationships compared to larger companies. This may cause some delays and unexpected results. For respondents engaged in offshoring, rising labor costs in the host country is only one issue; the rising time and cost of management oversight is often even more unpredictable.

Also, overseas shipping and the associated logistics and customs paperwork can be enormously complicated, and a mid-market company not familiar with these costs and processes may seriously underestimate the amount of time and money required.

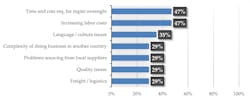

When offshoring, the biggest issues faced included:

Primary Issues Faced When Offshoring

Percentage of Respondents Who Selected Each Criterion

Best Practices

When considering offshoring or outsourcing, a strategic approach will yield the best long-term results. The following best practices have emerged as a result of the survey:

Invest time up front. Taking time to understand the entire infrastructure and supply chain. Learning about the local business culture and expectations will yield a more predictable result.

Put weight on proximity. Near-shoring may be a good solution to cut down on time and expense. In addition, offshoring to close by countries will minimize freight and logistics problems, and make it easier to implement management oversight.

Make internal adjustments. An offshore supply chain will always be more volatile. Make adjustments to sales, operations and inventory planning, and make sure frequent communications is part of the overall process.

Build a contingency plan. There will always be risks. Build in a contingency plan, maintain heavy oversight and keep a second source at hand.

Dedicate appropriate management resources. Strong leadership will be an essential part of offshoring success, and an experienced team should be familiar with local culture and practices.

Learn from others. Evaluate the success of other companies in your industry which have had success with offshoring and outsourcing.

Will it Continue?

The growth of offshoring and outsourcing will continue as long as there is a global economy. While 20% of respondents believed that more companies will begin to repatriate manufacturing back to the U.S., the majority (56%) believed more companies will consider or continue offshoring.

There is and always will be some uncertainty related to offshoring and outsourcing decisions, and many companies continue to evaluate their offshoring and outsourcing strategies.

Despite the uncertainty, mid-market companies are becoming more sophisticated in how they approach offshoring initiatives. If mid-market companies take the time to invest in advanced planning, contingency plans, appropriate management resources and careful attention to freight logistics and proximity, offshoring and outsourcing can become a major contributor to their success.

Amar Shah is a director at The Keystone Group. Danielle Moushon is a senior associate at the firm.