NAM/IW 2015 1Q Survey: Outlook Positive for US Manufacturing

Sluggish growth abroad, a stronger U.S. dollar, the West Coast ports slowdown, still-cautious consumers and sharply lower energy prices have combined to provide a significant headwind for many manufacturers. However, manufacturing demand and output improved throughout the course of 2014, providing some momentum and cautious optimism for 2015. We have also seen softer-than-desired levels of activity in a number of economic indicators. As a result, the sector continues to expand, albeit at a slower pace. Still, we continue to expect real GDP and industrial production growth of around 3% or more for this year, which is encouraging.

Manufacturing Leaders Retain a Positive Outlook

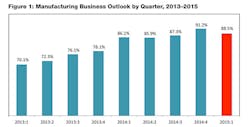

Respondents to the latest National Association of Manufacturers (NAM)/IndustryWeek survey continued to be mostly upbeat in their assessments of the economy, but the challenges discussed above have dampened some of that enthusiasm. In this report, 88.5% of manufacturers said that they were either somewhat or very optimistic about their own company's outlook (Figure 1). This was down from 91.2% who said the same thing three months ago, and yet, it continued to reflect relatively strong sentiment overall. Dividing this data up by firm size, medium-sized manufacturers (i.e., those with between 50 and 499 employees) were the most positive, with 91.0% having a positive outlook. Interestingly, larger manufacturers (those with 500 or more employees) were the least positive, with 83.7% being positive.

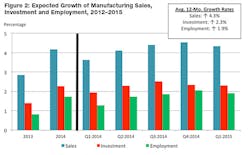

The deceleration in the overall outlook carried through to other measures as well. For instance, manufacturers predict sales growth of 4.3% on average over the next 12 months, down from 4.5% in the last survey (Figure 2). While the vast majority of those taking the survey anticipate increased sales over the next year, the difference can be best illustrated by noting that 8.7% foresee declining demand this time, up from 5.3% last time. Moreover, medium-sized firms were more upbeat in their forecasts for sales, expecting 4.7% growth on average over the next 12 months. This compared to averages of 4.1% and 3.8% for small and large businesses, respectively.

Expected hiring also pulled back a little in this survey. Employment was anticipated to increase by 1.9% over the next 12 months, down from 2.1%. Nonetheless, just over half of those taking the survey see positive gains in employment over the next year. In addition, fewer manufacturers predict declines in hiring in the months ahead, down from 14.2% in December to 6.9% this time. As such, the employment statistics were pretty encouraging despite the slight drop in the cumulative average.

Capital spending should increase 2.3% on average over the next 12 months, unchanged from the previous survey. Nearly 48% of those taking the survey plan to increase their expenditures on capital in the coming months, with 30% predicting increases of 5% or more. This indicates decent growth in investment spending overall. At the same time, larger manufacturers are more upbeat in their capital spending plans than their smaller counterparts. Large firms expect to increase their investments by 2.8% on average over the next year, or more than twice the rate anticipated by small manufacturers with less than 50 employees, who plan for 1.3% growth.

Of course, one of the bigger headwinds of late has been the global market, with slower economic growth in international markets and a stronger U.S. dollar. Indeed, 36.3% of respondents said that the dollar was a significant challenge for them right now. Moreover, the pace of expected export growth decelerated sharply over the past few surveys, down from 1.6% in June to 1.2% in December to 0.9% this time. In this survey, 32.7% of manufacturers expect export sales to rise over the next 12 months, down from 39.4% three months ago.

Meanwhile, manufacturers expect their inventories to increase 0.4% over the next 12 months. This marks the fifth consecutive quarterly increase in stockpiles. While 47.2% of those taking the survey predict inventory levels to remain unchanged, almost 30% predict increased inventories in the next 12 months.

For several quarters now, we have used the NAM/IndustryWeek outlook data in a regression model to predict manufacturing production two quarters ahead (Figure 3). Other variables include current values for housing permits, the interest rate spread, personal consumption and the S&P 500. This model explains 90% of the variation since the data began in the fourth quarter of 1997.

The current model is very encouraging and suggests that manufacturing production should continue to accelerate, growing 3.0% over the next two quarters. The rising stock market, better housing permits data and decent growth in consumer spending help push this figure higher, with the manufacturing outlook figure remaining relatively strong as well.

Manufacturers Remain Frustrated with Washington

Despite the stronger economic outlook, manufacturers continue to express frustrations with the political environment. In fact, 73.6% of those taking the survey said that the United States was on the wrong track, with 11.7% feeling we are headed in the right direction. The remainder were unsure. This was slightly more downbeat than the 72.7% who responded that the country was on the wrong track in the past survey, but it was also better than the 79.3% who said the same in June of last year.

Respondents were also asked about their current business challenges (Figure 4). Once again, rising health insurance costs were cited as the top concern by 69.4% of those taking the survey. In the manufacturing sector, businesses see benefit costs rising an average of 5.3% over the next 12 months, with health insurance premiums increasing 7.2% on average in 2015. Two-thirds of manufacturers noted increases of 5% or more, with 31.8% reporting gains of at least 10%. As one might expect, this varied widely by firm size. The average premium increase for large manufacturers was 6.4%, which was lower than the 8.6% and 12.7% averages seen for medium-sized and small manufacturing businesses.

One other consideration is the fact that businesses will need to pay a 40% tax on high-cost health insurance coverage starting in 2018. The employee benefits tax, which is more commonly referred to as the "Cadillac tax," was part of the Affordable Care Act. Manufacturers were asked if they were considering changes to their existing plans to avoid the tax. Nearly 10% of respondents said that they had already altered their coverage, with another 15% planning to do so. Still, almost 40% currently plan to make no changes to their coverage as a result of the tax, and 35.7% were uncertain. Increased co-pays and deductibles were mentioned most frequently as examples by those who planned to change their plans.

Health insurance concerns were closely followed by the business climate, cited by 69.1% of manufacturers as their top problem. Businesses would like policymakers to enact comprehensive tax reform and address rising regulatory burdens. In addition, more than half of the respondents said that workforce development continues to be a significant obstacle. The sample comments tend to echo these findings, mentioning the difficulty in finding qualified workers but also noting the uncertainty that comes from the tax and regulatory environment. Beyond these factors, the West Coast ports slowdown and reduced energy prices were the issues most mentioned by those who offered their own pressing challenges.

Special Questions on Estate Tax Changes and Increased Shareholder Activism

President Obama has proposed several changes to estate tax provisions. Specifically, he would increase the top tax rates from 40% to 45% and reduce the exclusion amount from $5.0 million to $3.5 million. In addition, he would repeal what the administration is calling a "trust fund loophole" by eliminating "stepped-up basis," with heirs to family businesses paying a third level of tax when they sell any inherited assets.

All told, 68.3% of respondents said their family-owned businesses would be adversely impacted by these changes to estate tax provisions. Of those entities, 72.3% said that these changes would make it harder for them to pass along their manufacturing businesses to future generations, with 71.9% noting that it would increase the tax liabilities of the firm and their descendants at the time of their death and/or when the business was eventually sold. In addition, 48% mentioned that it would force them to reduce investment in their businesses in order to redirect resources to estate and succession planning, and 42.5% responded that it would make them consider selling the business rather than pass it along to the next generation.

Separately, manufacturers were asked about the rise of shareholder activism of late. Of those taking the survey, 12.6% were public companies. A majority of public company respondents have seen an increase in shareholder activism over the past two years. Of this activism, nearly 30% stemmed from activism to change social policies within the company (e.g., environmental reporting, human rights, political spending, etc.). Beyond that, 22.8% was directed toward changes in corporate governance and 12.3% related to executive compensation.

About the Author

Chad Moutray

Chief Economist

Chad Moutray is chief economist for the National Association of Manufacturers (NAM), where he serves as the NAM’s economic forecaster and spokesperson on economic issues. He frequently comments on current economic conditions for manufacturers through professional presentations and media interviews. He has appeared on Bloomberg, CNN, C-SPAN, Fox Business, Fox News, and Reuters television.

Prior to joining the NAM, Dr. Moutray was the chief economist and director of economic research for the Office of Advocacy at the U.S. Small Business Administration (SBA) from 2002 to 2010. In that role, he was responsible for researching the importance of entrepreneurship to the U.S. economy and highlighting various issues of importance to small business owners, policymakers and academics. In addition to discussing economic and policy trends, his personal research focused on the importance of educational attainment to both self-employment and economic growth.

Prior to working at the SBA, Dr. Moutray was the dean of the School of Business Administration at Robert Morris College in Chicago, Ill. (now Robert Morris University of Illinois). Under his leadership, the business school had rapid growth, both adding new programs and new campuses. He began the development of an MBA program that began accepting students after his departure and created a Business Institute for students to work with local businesses on classroom projects and internships.

Dr. Moutray is a former board member of the National Association for Business Economics (NABE). He is also the former president and chairman of the National Economists Club, the local NABE chapter for Washington, D.C. He holds a Ph.D. in economics from Southern Illinois University at Carbondale and bachelor’s and master’s degrees in economics from Eastern Illinois University. In 2007, he was named a distinguished alumnus by Lake Land College in Mattoon, Ill., where he earned his associate’s degree in business administration, and in 2014, he received an Outstanding Graduate Alumni Award from Eastern Illinois University.