Manufacturing ended 2013 on a strong note with the Institute for Supply Management’s monthly PMI index registering 57%, the seventh consecutive month of growth. A reading of 50 or more in the survey of supply chain officials indicates expansion in the sector.

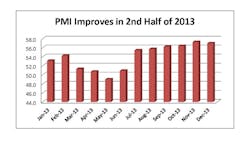

The reading was just 0.3% below November’s reading, slightly exceeding analysts’ consensus forecast for the month. Chad Moutray, chief economist for the National Association of Manufacturers, noted the “manufacturing PMI measures averaged 56.3 in the second half of 2013, a nice improvement from the 51.5 average seen in the first half of the year.”

Signals on future business were positive as the new orders index increased in December by 0.6% to 64.2%, the highest reading since April 2010. Said one apparel manufacturer: “Amazingly enough, we are seeing meaningful increases in our sales in nearly all segments and regions.”

The employment index also gained ground, increasing from 56.5% in November to 56.9% in December. This was the highest reading in the survey since June 2011.

ISM’s Bradley Holcomb said purchasing executives comments “reflect a solid final month of the year, capping off the second half of 2013, which was characterized by continuous growth and momentum in manufacturing.”

Of the 18 industry sectors, 13 reported growth in December, led by furniture and plastics & rubber products. Four manufacturing industries reported contraction in the last month of 2013: nonmetallic mineral products; machinery; chemicals; and electrical equipment and appliances.

“Industrial activity is being driven by the ramping up of the housing supply chain and strong motor vehicle production as consumers meet pent-up demand for shelter and transportation,” said Daniel J. Meckstroth, chief economist for the Manufacturers Alliance for Productivity and Innovation (MAPI). “Investment spending is accelerating for energy projects, aerospace equipment, medical equipment, and industrial machinery. While government policy gridlock is not conducive to investment, the uncertainty seems to be somewhat less of a barrier since the short-term federal budget agreement.”

While manufacturing industrial production increased 2.2% in 2013, Meckstroth noted, he predicted ”an acceleration to 3.1% growth in 2014, and even faster growth in 2015.”

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.