Businesses, at the best of times, will find it difficult to navigate through the sometimes conflicting messages and slogans espoused by the press and politicians. This task is made all the more difficult by the brinksmanship and bickering that currently characterize the U.S. political process.

That is why we rely heavily on leading indicators, logic and our proven economic theories. The leading indicator input for more economic expansion as 2013 comes to a close is unequivocal. There are also key indications of a general economic slowdown in the U.S. in 2014. These indicators are impartial and nonpolitical and can thus be believed for their dispassion and historical accuracy. It is a good idea to adjust your budgets and expectations around slow growth next year. However, slower growth does not mean you should restrain your planning and implementation of growth strategies. Perhaps make inroads into a new market or geography, start training the workforce you will need in 2015, or take a close look at your own internal processes to find and remove bottlenecks. Waiting until 2015 when the economy accelerates will be too late -- you will lose customers and profits.

See Also: Global Manufacturing Economy Trends & Analysis

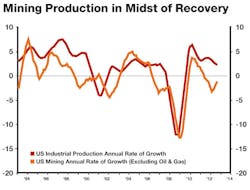

Finding growth markets here in the U.S. won't be that difficult. Non-defense capital goods orders on an annual basis are 0.8% higher than one year ago, and trends in the quarterly data suggest that orders will expand further in the coming months. This increased willingness for businesses to invest in new equipment has trickled down to mining machinery new orders, which are 5.6% ahead of last year. Mining machinery inventories are currently up 9.6% from 2012, but the rate of change is slowing, which is a good sign for equipment production.

Outside the U.S. the metals and mining industry has seen uneven growth. On an annualized basis, world steel production has increased to a growth rate of 2.9% above year-ago levels. Most major international producers, however, are seeing slowdowns in their steel production rates of growth: South Korea, -5.2%; Europe, -5.1%; the U.S., -4.9%; and Japan, -0.1%. Two countries are bucking the trend: China and India. Steel production in India is 5.0% above last year. In China it is 9.1% higher.

China is not only one of the largest producers of steel, but also one of its largest consumers. Industrial production in China has increased to 9.6% above last year. We expect China's economy to grow further in the coming quarters, bringing with it increased demand for not just steel, but copper, pig iron and other nonferrous metals. China's recent announcement of the formation of a free trade zone in Shanghai will be a further boon to the area.

Despite the nascent resurgence in the growth rate in China, metal prices have weakened compared to last year. Aluminum prices are 13.9% lower than September 2013, prices for copper are 12.0% lower, and steel prices have contracted 2.8% over the last 12 months. Iron ore prices, on the other hand, are 34.9% higher than 2012. We expect metal prices to firm up by mid-2014 due to stronger global demand.

| Stay up-to-date with economic news and trends on Alan Beaulieu's Make Your Move blog at iw.com/blog/make-your-move. |

As the chart at left shows, mining production in the U.S. is recovering. Stronger demand from China and the nascent economic recovery in Europe will increase the demand for metals and allow prices to firm up and production to increase in the coming quarters. However, as I mentioned at the outset, we expect the U.S. economy to slow in late 2014. This will result in slower global economic growth and, by late 2014, reduced demand for metals.