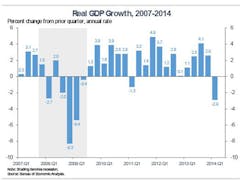

With U.S. gross domestic product falling 2.9% in the first quarter of 2014, what are the chances that the United States is headed for a recession?

For a nation still recovering from a massive recession hangover, that’s a question almost no one wants to entertain. But the National Association for Business Economics asked a panel of economic forecasters in early July what the probability was that the U.S. would enter recession either this year or in 2015. More than 59% said the chances were less than 10% and nearly a third (32.7%) said it was only 10-25%. Only 2% said there was better than a 50-50 chance of recession occurring in the next year and a half.

In fact, the NABE panel was upbeat about the second quarter of 2014, expecting to see GDP grow at a rate of 3.0%. However, that was a half point less than NABE economists had predicted in June.

“Likewise, the full-year growth forecast for 2014 was trimmed to 1.6% from June’s 2.5% rate,” said Timothy Gill, deputy chief economist of the National Electrical Manufacturers Association, who overlooked the special July outlook survey.

A sign of a mending economy: 90% of the panelists expect the Federal Reserve will begin raising interest rates sooner than expected previously. Gill noted that half the panelists were “expecting a hike in the first half of 2015. In the June survey, a majority expected a rate increase during the second half of 2015.”

While not forecasting a recession, Cliff Waldman, senior economist at the Manufacturers Alliance for Productivity and Innovation (MAPI), said the magnitude of the first quarter GDP contraction “suggests that the economy’s weaknesses remain well in place more than five years after the end of the worst downturn of the post-World War II era.”

A less than robust rebound in business equipment spending is a particular concern, Waldman said.

“Capital spending has been atypically weak since about 2000. During the first quarter of 2014, business equipment spending contracted by 2.8%. While the durable goods data do point to a second quarter bounce, it does not look like it will be a particularly strong one,” he warned.

The downward revision in the first quarter GDP (from an initial 0.1% estimated gain to the 2.9% drop) was concentrated in two areas, noted Jason Furman, chairman of the White House Council of Economic Advisers: consumer spending on health care services and net exports.

Furman put a positive spin on the health care figures, noting that health care prices grew at an annual rate of only 0.5% in the first quarter and utilization (real health care spending) fell 1.4% on an annual basis. “On a year-over-year basis, health care prices are up just 0.9%, while utilization is up 2.6%,” Furman observed.

While noting the volatility of much of this quarterly data, Furman said “more up-to-date indicators from April and May suggest that the economy is on track for a rebound in the second quarter.”

About the Author

Steve Minter

Steve Minter, Executive Editor

Focus: Leadership, Global Economy, Energy

Call: 216-931-9281

Follow on Twitter: @SgMinterIW

An award-winning editor, Executive Editor Steve Minter covers leadership, global economic and trade issues and energy, tackling subject matter ranging from CEO profiles and leadership theories to economic trends and energy policy. As well, he supervises content development for editorial products including the magazine, IndustryWeek.com, research and information products, and conferences.

Before joining the IW staff, Steve was publisher and editorial director of Penton Media’s EHS Today, where he was instrumental in the development of the Champions of Safety and America’s Safest Companies recognition programs.

Steve received his B.A. in English from Oberlin College. He is married and has two adult children.