The Automotive Industry: Economic Impact And Location Issues

The automotive industry is a major industrial and economic force worldwide. It makes 60 million cars and trucks a year, and they are responsible for almost half the world's consumption of oil. The industry employs 4 million people directly, and many more indirectly.

Despite the fact that many large companies have problems with overcapacity and low profitability, the automotive industry retains very strong influence and importance. The industry also provides well-paying jobs with good benefits, has heavy linkages with supplier industries (which gives it an oversized role in economic development), and has a strong political influence.

The power of linkages is given by the following real but anonymous example of forecasted economic impacts of a proposed automotive assembly plant:

| Direct, Indirect And Induced Impacts | ||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

| Employment | 189 | 3,583 | 7,800 | 10,611 | 12,240 | 12,242 |

| Personal Income* | 7,114 | 141,912 | 368,820 | 561,168 | 684,180 | 735,696 |

| Revenue, State Government* | 1,032 | 20,585 | 53,498 | 81,399 | 99,242 | 106,714 |

| Sales* | 16,620 | 318,492 | 1,405,080 | 3,024,000 | 3,792,960 | 3,864,240 |

(*000 of 2002 dollars)

Source: CHLG Study

Assumptions: Plant employment-2,000; Investment-$845 million

The table below illustrates the extent to which states and regions will compete against each other in incentives bidding wars to land a large automotive assembly plant.

| Representative Project/Location | Year Announced | Reported Value Of Incentives Per Job |

| Toyota, Georgetown, Ky. | 1985 | $71,333 |

|

Toyota, Princeton, Ind. Incentives for expansion |

1992 2001 |

$44,091 $21,538 |

| BMW, Greer, S.C. | 1992 | $81,479 |

| Mercedes Benz, Vance, Ala. | 1993 | $167,667 |

| Honda, Lincoln, Ala. | 1999 | $110,290 |

| Nissan, Canton, Miss. | 2000 | $80,208 |

| Hyundai, Montgomery, Ala. | 2002 | $126,400 |

| DaimlerChrysler, Pooler, Ga. | 2002 | $80,000 |

| Toyota, San Antonio, Texas | 2003 | $200,000 |

History And State Of The Industry

The industry is more than 100 years old. It started in Germany and France, and came of age in the U.S. in the era of mass production. Vehicle volumes, efficiency, safety, features and choice have grown steadily throughout the industry's history. It is so synonymous with 20th century industrial development, and so intertwined with its twin marvels, mass production and mass consumption, that it has been called the "industry of industries."

However, all is not well in the automotive world. Worldwide, average margins have fallen from 20% in the 1920s to 5% now, with many companies losing money. This poor profitability performance is reflected in the industry's market capitalization: despite its huge revenues and employment, the automotive industry accounts for only 1.6% of the stock market in Europe, and 0.6% in the U.S. There is a big contrast between the industry's lackluster financial success and its oversized social role, share of employment and political influence.

These facts mask a wide range of operational and financial performance. Toyota, the most successful large auto company, has a market value 15 times larger than General Motors.

Top Automotive Assembly Companies

| Vehicle Sales Per Year (Millions) | Revenues ($US Billions) | |

| General Motors | 9.17 | 192.6 |

| Toyota | 7.97 | 182.9 |

| Ford | 6.82 | 177.1 |

| Volkswagen | 5.24 | 119.1 |

| DaimlerChrysler | 3.85 | 187.5 |

| Nissan | 3.51 | 82.0 |

| PSA/Peugeot Citroen | 3.39 | 70.4 |

| Hyundai Automotive | 3.28 | 38.5 |

| Honda | 3.24 | 80.5 |

| Renault | 2.53 | 51.7 |

Source: Annual reports

The overall performance of the industry can be traced to overcapacity and mature markets in developed countries. In the U.S., Europe and Japan, which account for 80% of world sales, growth has been stalling for many years. The natural response to slowing growth and increasing productivity is to reduce capacity. However, existing plants are very painful to scrap: mass production confers a strong cost advantage, which has traditionally encouraged very large and expensive plants. The result is excess capacity worldwide. Even continuing consolidation in the industry is not resulting in capacity reduction.

Focusing on the U.S., the "Big 3" automakers have been losing market share for three decades, and new plants by non-U.S.-based companies have increased capacity and competition. The two largest domestic U.S. companies are losing money as well as market share. Clearly, this is not a sustainable situation, and the industry is in for very big changes.

Big 3 Vs. Transplants

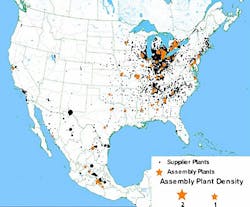

There are some important differences between "Big 3" plants and "transplants." The "Big 3" tend to be large, designed for mass production, and less flexible. They have unionized, older workforces and are clustered in Michigan, the surrounding states, and southeastern Canada. Because of the geographic distribution of Big 3 plants, location in the I-75/I-65 corridor is particularly important.

Transplants, meanwhile, tend to cover a wider spectrum of size, but are designed for flexibility. Toyota, for example, has the largest plants in the world on average, but they are capable of producing many different models. Transplants also have non-unionized, younger workforces, and geographically (with a few exceptions) tend to be in the South.

Beyond assembly plants, parts plants are an even bigger story for economic development. They produce 60% of final vehicle value-added, and employ 3.5 times as many workers as assembly plants. There are many more of them: only about eight assembly plants per decade are built, whereas parts plants number in the hundreds. Parts companies are playing a growing role in subassemblies, research and development, and efficiency (through just-in-time manufacturing). Despite all this, an assembly plant has much larger indirect and induced effect, and is therefore highly sought after by economic development organizations.

Assembly Plants in Operation

| State/Region | 1975 | 2006 |

| Michigan | 17 | 13 |

| Ohio | 5 | 6 |

| Indiana | 0 | 3 |

| South | 5 | 15 |

| Rest Of U.S. | 28 | 11 |

| Total | 55 | 48 |

Michelle Harris is a Project Consultant, P.E. (Professional Engineer) for CH2M HILL.. She worked with the CH2M HILL team to develop a proprietary target industry analysis model and the very popular target company predictive model.

CH2M HILL is a global firm providing engineering, construction, operations, consulting and related technical services to public and private clients. The firm's work is concentrated in the areas of manufacturing, chemicals, pharmaceuticals & biotech, electronics, energy, power, communications, transportation, water and environment. www.ch2m.com