Keep Up with Changing Market Conditions with Rolling Forecasts

Dynamic planning and forecasting are vital analytical techniques that can help organizations keep pace with changing economic conditions. Relying solely on an annual budget, set in stone before the fiscal year begins, to measure economic performance over a 12-month period can be ineffectual and may ultimately result in opportunity cost and wasted resources. Throughout the year, the effects of changing performance drivers—such as consumer demand or operating capacity—must be incorporated into a rolling forecast in order to successfully predict the ways in which an organization should adjust to evolving market conditions.

When an organization conducts a rolling forecast, it is anticipating and dissecting emerging observable trends that will impact the business anywhere from (ideally) four to eight quarters into the future. Every quarter or so the organization reviews economic performance and then forecasts trends for another specified amount of time in the future. This provides a continuous cycle of re-forecasting.

A rolling forecast is a better management approach than a static annual budget because it provides the business with a view into future conditions. A growing number of organizations are incorporating this technique into their planning and budgeting processes, and some have even done away with the annual budgeting process altogether.

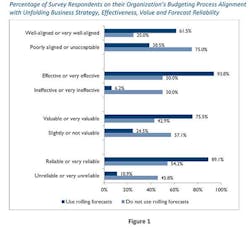

APQC data shows that organizations that do use rolling forecasts are better aligned with unfolding business strategy, are more effective at business analysis, derive greater value from their budgeting processes, and have more reliable forecasts than those who do not use them (Figure 1).

In addition to increased qualitative benefits, rolling forecasts allow finance functions to predict the impacts of changing economic conditions. Management at a manufacturing company, for example, may ask whether the organization needs to revisit budget assumptions in the wake of a rise in commodities prices—and, if so, may determine what would need to be adjusted and by how much. Effective finance functions understand that incorporating the risks inherent in budget assumptions into a rolling forecast means that an organization can adapt quickly to price fluctuations with appropriately measured responses.

In order to achieve truly effective rolling forecasts, finance functions should examine budget deviations and develop an understanding of the underlying assumptions that have changed since annual targets were originally set. Once deviations are identified, the forecast should then be revised to reflect their effects on organizational success. This increases organizational agility and provides a kind of resilience from which many of today’s organizations could benefit.

Elizabeth Kaigh is a financial management research specialist at APQC, a nonprofit business research and benchmarking firm based in Houston.