Manufacturing has seen ups and downs over the last century, from its heyday at the peak of America’s industrial might to a low point in the mid-1990s when offshoring, outsourcing and the tarnished image of the rust belt left some declaring it dead. Today manufacturing is resurgent and as it harnesses new technology some see a factory of the future taking shape that will astound prognosticators who’ve dismissed its role in the modern economy.

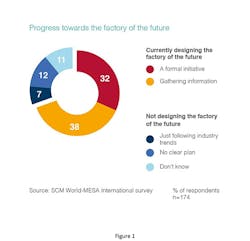

SCM World, in cooperation with the non-profit association MESA international, recently completed a survey of 174 supply chain and operations executives to understand perspectives on the future of manufacturing (Figure 1). The key takeaway from the research is that manufacturing is now entering a new phase of customization-oriented production that is less concerned with productivity and efficiency and more focused on agility and responsiveness. The emphasis going forward will be on making to individual requirements, sometimes thought of as mass-customization, rather than high throughput, low variability mass production.

The Consumerization of Manufacturing

Forcing this shift is a dramatic increase in the complexity of demand coming from consumers. Surveys on the impact of digital demand—including e-commerce, mobility, social media and omnichannel retailing—all point to a big increase in the number of SKUs, variety of fulfilment modes and range of options expected by the modern shopper. Retailers struggling to keep up are putting pressure back on manufacturers to deliver more customized formulations, packages,and configurations for all kinds of products. Intense personalization like that offered by Nike, whose NIKEiD initiative lets consumers customize their running shoes and then have them made and shipped direct, is typical of a wave of customization that all manufacturers are seeing.

The good news in this shift is that manufacturing technology trends reinforce it. Fast increasing rates of investment in advanced robotics, additive manufacturing and advanced digital simulation of manufacturing processes all lend themselves to shorter production runs and more unit-level customization. BMW, for instance leads the auto industry in the use of sophisticated factory automation to produce precisely configured individual vehicles on flexible production lines. Not to be outdone, automakers including Hyundai and Tesla have similarly employed robotics to enhance flexibility in production. Multi-purpose robots, many of which have been designed to work alongside human beings safely, now make it possible to manufacture unique items at nearly the pace of high-speed repetitive manufacturing using traditional hard automation.

The increasing use of additive manufacturing is also important not only for high-value, low volume parts as is common in aerospace, but also production parts. Among the most successful applications of this technology is the case of Invisalign, which manufactures nearly 40 million unique dental molds each year for people looking to straighten their teeth. As a pioneer in this area Invisalign’s production engineers have improved not only the materials and tooling, but finishing processes and initial design phases to improve output while still making each set of aligners uniquely. In four years output has been quadrupled, unit costs cut by 48% and time to ramp new production reduced by half.

Also critical to the future of manufacturing is an increasing reliance on digital supply chains which “ship” final configuration elements very late in the production process. Consumer electronics devices are especially appropriate for this technique with the ability to add software or app enhancements to a product platform well after all physical manufacturing has finished. Android mobile devices, for instance, can be equipped with hardware before leaving the factory, but then deliver functionality even after the point of sale with a digital key downloaded as an app or software update. This same effect serves buildings controls manufacturers like Johnson Controls, whose Panoptix platform allows independent app developers to “ship” product to building owners already equipped with JCI hardware.

The key design principle is identifying where manufactured products’ value can be isolated as intellectual property and digitized. Such digital value-add—whether in the form of a 3-D CAD model, a machine control algorithm, or an artwork file—can be engineered into the manufacturing process at incredibly small scales, allowing almost infinite customization. This principle applies to motion paths and action commands for robots, 2-D images and color palettes for packages or labels, and of course software coding that controls electronic processing and display.

Separate research conducted by SCM World on the most disruptive and important technologies in the wider supply chain world point to the immense importance of digitization (Figure 2). In terms of the factory of the future, five of the top six most important supply chain technologies all have the potential to revolutionize manufacturing. Big Data and the Internet of Things, for instance are being used today by Intel and Mitsubishi Electric to fine tune the back-end assembly processes in Intel’s assembly and test operation in Malaysia. Here again, digitization of the manufacturing process pays dividends by allowing engineers to analyze production steps at a unit level that had previously been seen only in batches. Yield, uptime and quality all benefit, resulting in higher precision at lower cost.

People Make it Work

One of the prevailing myths surrounding the factory of the future is that there will be no people—just a lights-out box full of robots and AGVs. In fact, as our research shows, it is quite the opposite. When asked about the role of human labor in this factory of the future, over 75% said that people will be “at the center” of the automated factory (Figure 3). The reason for this is essentially tied to the end purpose, which is mass customization. With so much invested in technology to enable high quality, low unit volume production at high speed, manufacturers are increasingly demanding superior human decision-making ability in the factory.

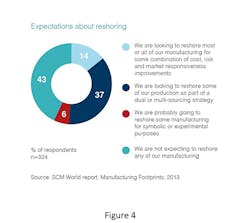

Previous research has shown a strong bias among global manufacturers to bring production facilities “back home,” otherwise known as reshoring (Figure 4). In fact, our 2013 study of manufacturing footprint designs found that 57% of 324 executives surveyed were planning to reshore at least some of their manufacturing work. In the 18 months since that data was collected, we have in fact seen some movement away from low-cost country manufacturing and towards the U.S. and Europe. Examples like General Electric and Mattel in the U.S. and Jaguar Land Rover in the UK are typical.

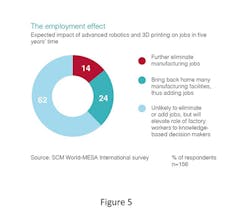

The lesson being learned, however, is that people are vital to the process. Skill gaps have slowed GE’s Louisville, Ky., scale-up and Motorola Mobility, which had relocated production to Fort Worth, Tex., was forced to close when sales volumes failed to meet expectations. Viability depends on both proximity to markets and sufficient operator skill to handle increasingly complex shop floor tasks. Looking ahead, respondents to our recent field study say that the net effect on job creation is likely to be neutral, with automation increasing the skill levels required, but not adding to overall labor headcount (Figure 5).

Make to Individual

Technology trends coupled with consumers’ increasing power to demand personalized products are changing the face of manufacturing. For many companies this requires placing factories closer to end markets even if this means producing in high labor cost locations. Digital technologies in particular promise economically viable mass customization, but only with the help of skilled people, both on the production line and in the design and engineering process.

As the learning curve steepens it seems certain that the factory of the future will redefine what manufacturing means to the world economy.

Robot image: Thinkstock

About the Author

Kevin O'Marah

Chief Content Officer

Kevin O'Marah directs SCM World’s practitioner-driven supply chain content and research, leveraging the combined experience and insight of over 19,000 practitioners within SCM World’s membership. He holds specific responsibility for content relating to sales & operations planning, customer centricity and demand management, digital demand and omnichannel. He also co-chairs the SCM World Executive Advisory Board with Dr Hau Lee.

As a research fellow at the Stanford Graduate School of Business, Kevin helps to shape the direction of supply chain teaching for the next generation of business leaders. Prior to SCM World, he served as Group Vice President for Supply Chain at Gartner following the 2009 acquisition of AMR Research, where he was Chief Strategy Officer. In his 10-year career at AMR, he created the Supply Chain Top 25, wrote over 400 published articles and reports and led a six-year dialogue with business leaders such as Bill Clinton, Colin Powell, Michael Eisner and T. Boone Pickens.

Kevin is based in Boston and travels to London frequently. He holds a Bachelor of Arts in Economics from Boston College, a Master of Science in Industrial Relations from Oxford University and an MBA from Stanford University.