More US Manufacturers are Coming Home

The numbers are growing.

More U.S. companies are moving production back from China, according to a new survey from The Boston Consulting Group (BCG).

This year 20% of the senior manufacturing executives at companies with sales of $1 billion said they are heading home from China. That compares to last year’s number of 13% to 16%.

And these plans are already in the works as 24%, compared to 17% -20% last year, said they will take action within the near future.

Furthermore a majority (54%) expressed interest in reshoring, validating last year’s result (also 54%.)

“These findings show that not only does interest in repatriating production to the U.S. and creating American jobs remain strong but also that companies are acting on those intentions,” said Harold L. Sirkin, a BCG senior partner.

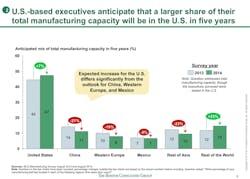

The U.S. is a formidable global competitor as well this year as it has surpassed Mexico as the most likely destination for new manufacturing capacity to serve the U.S. market. While the percentage of executives who chose the U.S. rose from 26% to 27%, the percentage who chose Mexico slipped from 26% to 24%.

The future is looking bright as well. Respondents predicted that the U.S. would account for an average of 47% of their total production in five years, reflecting a 7% increase in U.S. capacity compared with last year’s results.

Only 11% of their capacity would be in China, a 21% decrease from last year. Respondents forecast that the share of production in Mexico, Western Europe, and the rest of Asia would also drop.

The impact on jobs will be a 5% increase as these companies plan on hiring more workers. The study found that only 17% predicted that their companies would be employing at least 5% fewer manufacturing workers in the U.S. five years from now. The survey findings reinforce a previous BCG estimate that reshored production, along with rising exports, could create between 600,000 and 1 million direct manufacturing jobs by 2020.

Reasons for Reshoring

While we often hear of a talent gap or shortage, 70% of manufacturers in this study said that better access to skilled talent as a reason for moving operations to the U.S.—more than four times as many respondents as those who cited access to talent as a reason for relocating production outside the U.S.

Logistics plays a part as well. For goods that would be sold in the United States, around 80% cited logistical reasons such as shorter supply chains and lower shipping costs as primary reasons for moving operations to the U.S. from other countries.

Technology also has a hand in improving the U.S. manufacturing landscape. The survey also found that large U.S. manufacturers see a payoff from investing in advanced manufacturing technologies, such as 3-D printing, robotics, and digital manufacturing. Fifty-six percent of respondents said they either “strongly agree” or “somewhat agree” that the declining costs of automation have improved the competitiveness of their products against those made in low-cost countries. Seventy-one percent said that advanced manufacturing will improve the economics of producing locally. And 72% indicated that their companies plan to invest in automation or other advanced manufacturing technologies in the next five years.

"The survey results are consistent with what we are recording as actually happening," explains Harry Moser, president of the Reshoring Initiative. "Net annual reshoring (reshoring minus offshoring) has improved from losing about 150,000 manufacturing jobs/year in 2003 to about zero in 2013. FDI (Foreign Direct Investment) makes the net total around +30,000 jobs in 2013."

"But there are still 3 to 4 million U.S. jobs offshored!," Moser added. "BCG emphasizes how important it is for companies to consider the total cost, not just wages or ex-works price. The Reshoring Initiative’s Total Cost of Ownership Estimator is available no-charge for companies to quantify all of the relevant costs, make more accurate sourcing decisions and bring back more of those offshored jobs while increasing profitability.

However not everyone agress with this rosy outlook.

"Certainly there are some cases of manufacturers reshoring operations to the United States, and this does signal the potential for America to once again become an industrial powerhouse," says Stephen Ezell, senior analyst at The Information Technology & Innovation Foundation"However, the reality is that America’s value added of manufacturing goods, when measured properly, declined 4.5% from 2007 to 2013, even as GDP rose 5.9% over the same period," he added. "So we can’t rely on market forces alone to achieve American manufacturing renewal; rather it will also require a serious U.S. competitiveness strategy that includes tax reform, trade policies that simultaneously open international markets while combatting foreign mercantilism, and significant government investment in manufacturing innovation."