Argentina's Mine Industry Doubles Down on Lithium

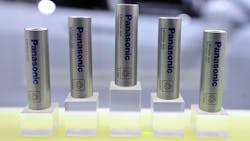

BUENOS AIRES — We need lithium for cell phones, electric cars and just about every long-life battery gadget we use: It’s a key ingredient of the modern economy, but new mining concessions can be hard to find.

Except, that is, in Argentina, where a lithium rush is in full swing.

Argentina, Chile and Bolivia hold 70% of the world’s reserves of the soft, silvery metal. But Chile is not currently granting new concessions, and Bolivia has suspended lithium mining after opposition from local residents around the Salar de Uyuni salt flats, which hold enormous lithium deposits.

“Argentina has, in the provinces of Catamarca, Salta and Jujuy, the most fantastic quantity and quality of lithium the world can boast today,” Argentine mining secretary Jorge Mayoral said. “It’s a mineral Argentina is betting heavily on. Argentina sits on resources that may surpass 128 million tonnes of lithium carbonate, which is a vital component in manufacturing lithium batteries.”

At the foot of the Andes mountains, in the windswept region of Puna, the “salares,” or salt flats, hold vast deposits of lithium. In 2014, the world consumed 170,000 tonnes of lithium carbonate equivalent. American, Japanese and South Korean companies are already mining Argentina’s deposits.

“When we started promoting lithium in 2005, we never imagined we would have such success in attracting investment to Argentina,” Mayoral said. “All the big auto makers have been present in Argentina trying to get a foot in lithium development.”

‘Golden triangle’

Toyota, Mitsubishi and Posco have already begun production in the province of Jujuy, on the border with Chile and Bolivia — the so-called “golden triangle” of lithium. In 2013, French group Eramet also got in the game with two deposits in Salta province covering nearly 200 square miles.

“It’s a beautiful deposit. We discovered a significant level of resources — more than seven million tonnes of lithium carbonate equivalent,” Eramet’s Hughes-Marie Aulanier said.

Eramet has not yet entered the production phase — expected to last more than 40 years — but its geologists are busy assessing how much of the deposit is commercially viable.

Aulanier said the firm would use an innovative, “world-first” procedure to avoid harming the environment, developed by Eramet’s research department with the French Institute for Oil and New Energies (IFP Energies Nouvelles).

Thirty to 40 French and Argentine employees are at work on the site, with just llamas and vicunas for company in an unpopulated desert region at an altitude of more than 13,000 feet. The nearest village, Santa Rosa Grandes, is more than 35 miles away.

Eramet, which has partnered with the province’s public mining company on the project, plans to invest $260 million once the feasibility study gives the green light. It expects output of 20,000 tonnes of lithium carbonate equivalent a year through 2019. The mined lithium carbonate yields 20% lithium after processing.

By Alexandre Peyrille

Copyright Agence France-Presse, 2015

About the Author

Agence France-Presse

Copyright Agence France-Presse, 2002-2025. AFP text, photos, graphics and logos shall not be reproduced, published, broadcast, rewritten for broadcast or publication or redistributed directly or indirectly in any medium. AFP shall not be held liable for any delays, inaccuracies, errors or omissions in any AFP content, or for any actions taken in consequence.