As a growing number of consulting firms have taken up the gauntlet of U.S. manufacturing’s challenges in recent years, manufacturing executives have been inundated with information and explanations on a variety of popular trends, from IoT to 3D printing to the rise of robotics. While all significant issues, here are three trending developments that are rarely discussed but will have an enormous effect on U.S. manufacturers in the coming decade.

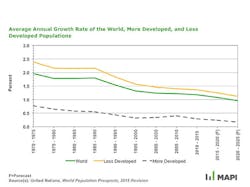

The ongoing shift from a labor rich to a labor scarce global economy. Experts often talk about the aging population and its impact on the labor force. The diminishing population is more acute for manufacturing: while the median age of the American workforce is around 42, the median age of its manufacturing workforce is closing in on 45.

That said, compared to the rest of the industrial world, the United States still has favorable demographics. Not only is our country’s total fertility relatively high, its net immigration tops all other nations. While our society will continue aging, it will do so at a slower rate than in other countries. According to the U.S. Census Bureau’s report “An Aging World,” of the world’s 25 oldest countries (defined by the proportion of citizens aged 65 and over), Europe has 22, led by Germany and Italy. Japan is currently and will remain, the oldest nation in the world through 2050 (South Korea and Taiwan will join Japan at the top of the list by that date). China is also aging rapidly: by 2050 it is expected to have 350 million senior citizens, about 27% of its total population. Meanwhile, the United States ranks 48th in the world in this category, and -primarily due to its more permissive immigration policies- will drop to 85th by 2050.

Urbanization will reshape supply chains and accelerate labor productivity growth. As global population growth slows and the world ages, people are concentrating in metropolitan areas. In 2007, for the first time in history, a majority of human beings lived in urban areas. While the number of people living in rural areas has leveled off at around 3 billion, the number of urbanites will grow from around 4 billion to more than 6 billion by 2050.

Urbanization is a significant trend for several reasons. First, as populations concentrate, growing cities require manufactured products such as steel and cement, and developers need machinery and transportation equipment. According to McKinsey, each year China alone adds floor space 2.5 times the entire commercial and residential square footage of the city of Chicago to meet the requirements of its urban dwellers.

Second, urbanization helps accelerate productivity for the simple reason that it creates geographic economies of scale. For example, research for the World Economic Forum showed that productivity is three times as high in the urban areas of Africa and Asia as in the rural areas. For manufacturers, urbanization reduces transportation costs by shrinking long supply chains and distribution networks, and by ensuring that products with low value density (consumer products, appliances, furniture) don’t have as far to travel. By concentrating the labor supply and factories, and by developing highly networked transportation systems, the amounts of goods and services produced in a given span of time can rise significantly.

While Asia and Africa presently trail the developed world in total share of population residing in cities, the fastest growing urban agglomerations (combined urban-suburban areas) are in those two continents -a trend projected to continue for the rest of this century.

Africa’s promise: favorable demographics and accelerating economic growth shed light on an economically challenging continent. The two previous trends, involving labor supply and urbanization, link closely with the third: the potential for Africa to become a manufacturing hub and a prosperous continent in the coming decades.

For starters, what sub-Saharan Africa has going for it is its relative youth – the median age for the continent is 23, compared to 33 for less developed nations taken as a whole. This will prove highly advantageous for both the labor supply and goods demand. By 2034, again according to the World Economic Forum, Africa will have the world’s largest working-age population.

Moreover, between 2000 and 2015 Africa -long considered one of the poorest regions of the world- experienced higher real GDP growth rates than the overall world economy. The collapse of oil prices -Algeria, Angola, Nigeria, and Sudan are major exporters- has hampered growth in recent years. Still, many African nations were able to maintain stable GDP rates, a reflection of the continuing diversification of many of the economies. While Africa is a very small share of global GDP, its accelerating economic growth is making it increasingly interesting as a manufacturing platform.

Global labor scarcities and population concentrations will provoke a rethinking on production and supply chains. The best bet is to invest in technology because it will only grow in importance, leverage the production potential of growing urban areas, and identify the regions of Africa that have ideal conditions for profitable investment.

About the Author

Stephen Gold

President and Chief Executive Officer, Manufacturers Alliance

Stephen Gold is president and CEO of Manufacturers Alliance. Previously, Gold served as senior vice president of operations for the National Electrical Manufacturers Association (NEMA) where he provided management oversight of the trade association’s 50 business units, member recruitment and retention, international operations, business development, and meeting planning. In addition, he was the staff lead for the Board-level Section Affairs Committee and Strategic Initiatives Committee.

Gold has an extensive background in business-related organizations and has represented U.S. manufacturers for much of his career. Prior to his work at NEMA, Gold spent five years at the National Association of Manufacturers (NAM), serving as vice president of allied associations and executive director of the Council of Manufacturing Associations. During his tenure he helped launch NAM’s Campaign for the Future of U.S. Manufacturing and served as executive director of the Coalition for the Future of U.S. Manufacturing.

Before joining NAM, Gold practiced law in Washington, D.C., at the former firm of Collier Shannon Scott, where he specialized in regulatory law, working in the consumer product safety practice group and on energy and environmental issues in the government relations practice group.

Gold has also served as associate director/communications director at the Tax Foundation in Washington and as director of public policy at Citizens for a Sound Economy, a free-market advocacy group. He began his career in Washington as a lobbyist for the Grocery Manufacturers of America and in the 1980s served in the communications department of Chief Justice Warren Burger’s Commission on the Bicentennial of the U.S. Constitution.

Gold holds a Juris Doctor (cum laude) from George Mason University School of Law, a master of arts degree in history from George Washington University, and a bachelor of science degree (magna cum laude) in history from Arizona State University. He is a Certified Association Executive (CAE).