Why Should Companies Consider Producing and Sourcing More Products in the US?

It makes good economic sense to produce and source products and components in the market in which they are going to be consumed. Localization, producing near the consumer, often reduces total cost due to shortening supply chains and contributing to a lean and agile strategy. The savings on non-manufacturing costs as a result of producing in the market in which the products will be sold can often overcome a 15-20% manufacturing cost gap caused by an 80% wage gap.

Localization, an approach that is used by large firms such as Caterpillar, is driving companies to reevaluate offshoring. U.S. manufacturing is becoming increasingly attractive to U.S. and foreign companies. Rapidly increasing emerging market wage rates, low U.S. energy costs, productivity gains, and recognition of the economic benefits of manufacturing closer to customers are reasons for shifting perspectives and for the growth of the reshoring trend.

W. Edwards Deming, author of Out of the Crisis, offered 14 key principles for management to follow to significantly improve the effectiveness of a business. The fourth key principle embodies the economic logic of reshoring. He said, “End the practice of awarding business on the basis of price tag. Instead, minimize total cost.”

Companies are finding that shortening supply chains and having manufacturing closer to customers improves quality control, flexibility, and time to market while diminishing the costs and risks associated with offshore production.

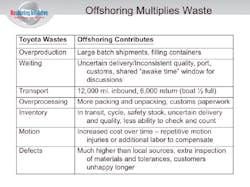

Reshoring lowers total cost by reducing waste. The table below shows how each of the wastes in the Toyota Production System is made worse by offshoring. Reshoring enables companies to develop more efficient processes.

When manufacturing is moved close to engineering, companies can more easily: improve design; eliminate waste; improve quality; and increase productivity. Often the result is a better product at a lower total cost.

This was the case when GE reshored manufacturing of the GeoSpring water heater from China to Kentucky. Design engineers, manufacturing engineers and factory line workers cooperated closely in one location to optimize the product design. Material cost went down, the labor hours required to produce it went down and quality improved. Time-to-market also improved. This collaboration was so successful that they were able to sell the product for 20% less made in the U.S., even though GE’s U.S. labor costs/hour were about 5X higher than in China.

What are the Basics of Total Cost of Ownership (TCO)?

TCO is defined as the total of all relevant costs associated with making or sourcing a product domestically or offshore. TCO includes current period costs and best estimates of relevant future costs, risks and strategic impacts.

TCO analysis helps companies objectively quantify, forecast and minimize Total Cost. It takes into account: transportation costs; travel expense and time; warranty; IP loss; impact on product innovation; and many other factors such as those associated with the risk of supply chain shocks or disruptions caused by natural disasters and political unrest. It also helps to forecast the future impact of wage and currency changes.

Current research shows many companies can reshore about 25% of what is offshored and improve their profitability if they use TCO instead of price to make their decision. Twenty five percent of offshoring is about 1 million manufacturing jobs.

Sustainability

Through reshoring and domestic sourcing we can build strong local manufacturing companies and stronger thriving communities by keeping people in the community employed and providing tax revenue for local governments and schools. Manufacturing has the highest multiplier effect of any sector, so creating manufacturing jobs creates the most jobs in other sectors too.

There are also environmental and legal costs associated with offshoring. Companies may not be aware of offshore practices, which could involve: human rights issues; excessive pollution; and counterfeit parts from which unexpected and costly legal issues or public relations debacles can arise. Offshoring has also been tied to health scares and product recalls including lead tainted children’s toys and toxic dog food.

Can TCO Help Multinational Companies with Capital Investment Decisions?

Multi-national companies are often faced with a decision of where to make capital investments. For the last 10 or 20 years the tendency has been to invest more in the low labor cost countries (LLC) and less in the U.S. or outsource to the LLC countries and not invest at all. This trend was driven by the LLC’s low wage rates and high economic growth rates, which motivated increased interest in the LLC countries’ markets.

Much of the high growth rates were driven by increasing exports to the U.S. and other developed countries. A portion of the wage rate gap is gone. So, the decision on where to locate the incremental capacity is now more difficult. Sometimes companies have to decide whether to invest in-house here or to outsource to a LLC contract manufacturer offshore. If the company finds a 30% difference between in-house manufacturing cost and offshore purchase price, it is almost impossible to make a positive ROI on investment in automation, training and lean here to overcome the cost difference. However, if the company measures with TCO and finds only a 5 or 10% difference, the investment ROI just went up dramatically, sometimes making in-house the most profitable choice.

The Reshoring Initiative is a not-for-profit organization dedicated to helping companies understand the true cost of offshoring by using Total Cost of Ownership (TCO) analysis. The Initiative’s mission is to bring well-paying manufacturing jobs back to the United States and shift collective thinking from “offshoring is cheaper” to “local reduces the total cost of ownership.” In order to help companies decide objectively to reshore or offshore, the Reshoring Initiative’s free online Total Cost of Ownership Estimator can help corporations calculate the real P&L impact of reshoring or offshoring. We recommend “Getting A Company Started with TCO” to plan your TCO analysis.

Together, we can get the U.S. manufacturing renaissance rolling!

Harry Moser is the founder of the Reshoring Initiative.