Is Manufacturing Industry Consolidation Stifling Competition and Innovation?

Capitalism is a free market system that is supposed to promote competition. In capitalist theory, competition leads to innovation and more affordable prices for consumers. Without competition, a monopoly, oligopoly or cartel may develop.

A monopoly occurs when one firm supplies the total output in the market; the firm can therefore limit output and raise prices because it has no fear of competition. If several companies get together to control output and prices, it is known as an oligopoly or a cartel.

An article entitled Monopoly and Competition in Twenty-first Century-Capitalism explains:

“The economic defense of capitalism is premised on the ubiquity of competitive markets, providing for the rational allocation of scarce resources and justifying the existing distribution of incomes. The political defense of capitalism is that economic power is diffuse and cannot be aggregated in such a manner as to have undue influence over the democratic state. Both of these core claims for capitalism are demolished if monopoly, rather than competition, is the rule.”

I would like to make the argument that, in the current economy, capitalism is not promoting the ubiquity of competitive markets; rather it is quickly moving toward consolidation and oligopolies. As well, economic and political power is not diffuse; it is concentrated in the hands of the few, giving them great influence over the democratic state. The growing influence of oligopolies is a primary driver of inequality and redistribution of income. Consolidation and oligopolies have become the norm and are a dangerous threat to the economy.

This formation of monopolies and oligopolies also occurred in the Gilded Age, when the robber barons controlled entire industries, including oil, railroads, steel and the telegraph. The consolidation did not stop until President Theodore Roosevelt broke up the monopolies using antitrust legislation.

Well, a second Gilded Age is happening all over again, and there are many examples, as follows:

Modern-day Oligopolies

- Airlines

In the 1970s, approximately 30 airlines operated in the U.S. Some of them had been around a long time, such as Pan American, Trans World Airlines, Eastern, National, and Braniff, to name just a few. Through mergers, acquisitions and bankruptcies, the number was reduced to six airline companies. In the last decade, with United merging with Continental, and American swallowing U.S. Air, there are now only four major carriers in the U.S.—United, Delta, American and Southwest (and a few minor players).

American and United used bankruptcy to squeeze every dollar they could out of their employees. Now all four of the major carriers are profitable, pay dividends, buy back their stock and are piling up profits. They now have an oligopoly, where they control enough routes that they can raise prices and charge huge fees. In some cases, this has allowed them to raise fares by as much as 65%.

- Banks

As everybody now knows, the big banks also have been merging and consolidating. Though there are more than 7,000 banks in the U.S., only 19 of them control 60.6% of the total assets.

With the repeal of Glass-Steagle Act, these big banks have refocused their business on proprietary trading—essentially gambling with depositor’s money. Today, the big banks contribute more money to proprietary trading then they do to loans to consumers and businesses. The irony is that the big banks are still too big to fail, and they can rely on the fact that nobody will go to jail and the government will always have to bail them out.

After the big banks created toxic mortgages and then securitized them to be sold all over the world, causing the start of the Great Recession, they got themselves into a financial position where the government had to loan them trillions of dollars to stay afloat. The amazing thing is that the government allowed them to use the money to broker and subsidize mergers such as Wells Fargo's takeover of Wachovia; JP Morgan Chase's acquisition of Washington Mutual; and Bear Sterns and Bank of America’s absorption of Countrywide Financial and Merrill Lynch, which accelerated consolidation and created the bank oligopoly we have today.

The top four banks in the U.S. are J.P. Morgan Chase, Bank of America, CitiBank and Wells Fargo. They are still too big to fail and in a position to do it all over again. Senator Sherrod Brown explains: "The four largest behemoths, now ranging from $1.4 trillion to $2.3 trillion in assets, are the result of 37 banks merging 33 times. In 1995, the six biggest U.S. banks had assets equal to 18% of GDP. Today, they hold assets of about 63% of GDP.”

- Search Engines

The search engine business is dominated by Google, which, according to Forbes, owns 90% of the market in non-mobile search worldwide. By any definition, Google is a monopoly that purchased more then 100 companies to gain and retain market share.

- Media Companies

In 1983, 50 companies controlled the vast majority of news media including newspaper, magazines, radio and TV stations, books, movies, videos, and wire services. Consolidation reduced the original number to 24 companies by 1992 and to six companies by 2000. Today, five corporations—Time Warner, Disney, News Corp., Bertelsmann (of Germany) and Viacom control the majority of the U.S. media industry. Cable providers like Time Warner and Comcast have raised the price of their subscriptions at close to three times the rate of inflation since 2008. American cable customers pay twice as much for a cable subscription then European customers.

- Hospitals

In the last 30 years, hospitals in most cities have been merging and consolidating in local markets. Though not national examples, they have formed local monopolies in cities, often leaving only a few hospitals to choose from. These mini-monopolies are also able boost the prices for most of their services. Hospital pricing is the leading cause of healthcare cost increases, and we've seen prices of 50% to 100% on services from blood tests to chemotherapy. This is a major reason that health care costs have risen so high.

The Rise of Manufacturing Industry Consolidation

Manufacturing industries also have consolidated; here are a few examples:

- Meat Packers

In 1982, the five largest meatpackers controlled 16% of the meat industry. Today four firms control 85% of the beef market, an oligopoly that includes National Beef, Cargill, Tyson (IW500/39), and JBS (which purchased Swift).

- Microsoft

Microsoft (IW500/16) has dominated the operating system market since the inception of the IBM personal computer in 1981. As recently as 2008, it had 95% of the market and, as of 2011, 90%. They are an obvious monopoly and have controlled pricing and made it difficult for competitors to enter its market. Legal efforts to break its monopoly both in the U.S. and in Europe have failed.

- Intel

Closely allied to Microsoft is Intel (IW500/24), which dominates the microprocessor market. Intel has captured 80.3% of the microprocessor market, while its closest competitor, Advanced Micro Devices (IW500/192), has 12.1%

- Beer

The beer industry is an almost a perfect example of consolidation. Those of us who were drinking age in the 1970s can remember going to the supermarket and seeing and entire aisle full of beer brands to choose from. At that time, there were 43 firms making beer, and the largest had 25% of the market. Today two firms—Anheuser Busch and Miller/Coors—own 90% of the non-craft beer market.

- Autos

The auto industry is now a global industry where five multinational companies have 50% of the world market. The top 10 auto manufacturers control 70% of the world market. The 50th largest auto producer has one tenth of 1% of the world market.

- Oil and Gas

There are currently 50 oil and gas producers in the U.S. producing 2,736 million barrels of oil per year. Exxon merged with Mobil Oil (Exxon Mobil, IW500/1), and Conoco merged with Phillips (ConocoPhillips, IW500/22). Along with Chevron (IW500/2) and Occidental Petroleum (IW500/48), these four giants have 70% of all oil produced in the U.S. (1,919 barrels).

Manufacturing Consolidation Facts & Figures

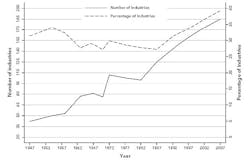

These are not the only examples of oligopolies. Consolidation occurred in almost every industry and hundreds of market niches. The following chart shows that the percentage of companies controlling at least 50% of an industry has grown from 5% to 37% in more than 200 industries

The Rise of Manufacturing Industry Consolidation

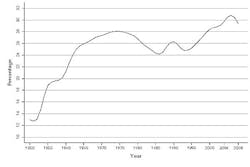

Corporations continue to complain about their profits and unfair corporate taxes, but the following chart shows that the gross profits of the top 200 corporations have grown from 13% in 1950 to 32% in 2008. The growth of profits corresponds to the growth of oligopolies shown in the previous chart.

The Rise of Corporate Profits

Why Increasing Industry Consolidation Matters

- Oligopolies and monopolies are the antithesis of how capitalism is supposed to work. Capitalism is based on the ubiquity of competitive markets.

- Under oligopoly and monopoly conditions, investment slows down. Because competition is weaker, corporations are better able to raise prices and profits without investing in new technologies and products—and declining investment can lead to declining innovation and economic stagnation.

-

Industry consolidation controls income redistribution.

- Oligopolies have the power to reduce employee wages and benefits on the one hand, and increase consumer prices on the other. It is the perfect formula for shifting income from the worker to the oligopoly companies. This has led to the decline of middle-class income and wages. Mark Thoma in an article in the Fiscal Times put it this way: “Inequality in the U.S. is approaching levels that could begin to undermine economic growth, and there are those who argue we are already there." He goes on to say that not understanding inequality and redistribution could have dire consequences for the economy.

- Oligopolies have the power to reduce supplier prices. As consolidation continues to grow, there are more sellers (suppliers) and fewer buyers (oligopolies), so the buyers gain. If you were a pig farmers today, you primarily can sell to four major pork producers. According to reports, the average price a farmer can get for a hog has dropped 31% from 1989 to 2008.

If you are a small manufacturer selling to Wal-Mart, it will pressure you to lower your price by comparing it to its Chinese suppliers. Wal-Mart has 1,000 American suppliers and 6,000 Asian suppliers.

In my own experience as a General Manager manufacturing automatic machines for production lines in large public company factories, I was introduced to the “online auction,” where the buyer essentially could share competitive bids with all the sellers to force price reductions.

- Oligopolies have the power to reduce employee wages and benefits on the one hand, and increase consumer prices on the other. It is the perfect formula for shifting income from the worker to the oligopoly companies. This has led to the decline of middle-class income and wages. Mark Thoma in an article in the Fiscal Times put it this way: “Inequality in the U.S. is approaching levels that could begin to undermine economic growth, and there are those who argue we are already there." He goes on to say that not understanding inequality and redistribution could have dire consequences for the economy.

I think it is in the DNA of capitalism to create oligopolies and monopolies, and they can only be restricted by government regulation.

But there is something missing from this story; something very important that is supposed to accompany oligopolies and monopolies—antitrust actions. Ever since the break-up of AT&T, there have been few antitrust cases. Whether Democrats or Republicans are in the Whitehouse, the justice department has remained inactive in terms of antitrust activity. I'll explore that in my next article.

Mike Collins can be reached through his website mpcmgt.com