Manufacturers Remain Anxious Says NAM/IndustryWeek Survey

The global economy has slowed significantly over the past few months. Manufacturers remain anxious about the upcoming fiscal abyss, with the prospects of tax increases and budget cuts potentially sending the economy into a downturn going into 2013.

Meanwhile, with Europe in a recession and economic growth lagging around the world, the demand for manufactured goods has lessened. For manufacturers, these and other headwinds have reduced manufacturing activity to a near standstill, with the Institute for Supply Management’s Purchasing Managers' Index indicating a contraction for three consecutive months.

The most recent NAM/IndustryWeek Survey of Manufacturers reflected the changing dynamic of the year so far—a dramatic shift in which manufacturers reflect their concerns with the uncertainty facing them.

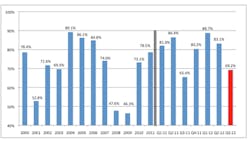

In the first quarter, manufacturing activity was strong, helping to drive the overall economy with both outsized output and employment contributions. At the time, nearly 89% of manufacturers were either somewhat or very positive about their company’s outlook (Figure 1).

This fell to 83% in the second quarter, and now, it is down to 69%. The shifting sentiment was increased uncertainty about the economic climate. In fact, the percentage of respondents who were “somewhat negative” nearly doubled from 15.8% in June’s survey to 29.6% in the current one.

Figure 1: Manufacturing Business Outlook, 2000-2012

Note: Percentage of respondents who characterized the current business outlook as somewhat or very positive. Percentages are annual averages.

Industrial Production

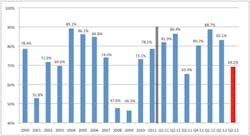

The drop from 83.1% to 69.2% of manufacturers viewing their business outlook as somewhat or very positive is a significant one. Using regression analysis, we are able to predict industrial production two quarters from now—in the first quarter of 2013—in the manufacturing sector.

While year-over-year growth in production should be 4.1% higher, it also suggests that manufacturers will produce 1.2% less at the beginning of the year than they do now (Figure 2). This might be consistent with a fiscal abyss scenario, or it is simply the statistical result of the overly pessimistic responses. Time will tell. Nonetheless, this model has a fairly solid track record, explaining roughly 90% of the variation since 1997.

Figure 2: Predicted Industrial Production

Note: Industrial production is predicted two quarters in advance by regressing NAM/IndustryWeekSurvey of Manufacturers data as one of the independent variables, with data stretching back to Q4:1997. Other explanatory variables include current values for housing permits, the interest rate spread, personal consumption and the S&P 500.

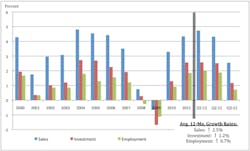

Sales Projections

This more downbeat assessment carries through to other variables as well. Sales are now expected to increase 2.5% on average over the next 12 months (Figure 3). This is down from 4.7% and 4.3% forecasts in the first two quarters of the year, respectively.

On the positive side, about one-third of manufacturers anticipate their company’s sales to grow by 5% or more, which remains a decent number even if it is below the 50% who said the same thing three months ago. Just 16.6% of respondents said that they expected their sales to fall.

Manufacturers continue to invest in their businesses, but at lower rates. Capital spending and employment should increase 1.2% and 0.7%, respectively, over the next year. In both cases, this figure is well below the average growth rates observed in the last survey (down from 2.5% and 1.9%, respectively).

A large swath of businesses said that they were keeping their investment and hiring levels unchanged, with a fair number of companies downgrading their overall expectations. For example, the percentage of manufacturers stating that their capital spending should increase by 5% or more shifted from about one-third last time to almost one-fourth this time. Likewise, 16.7% of companies anticipate lower employment, up from 10.8% in June.

Figure 3: Expected Growth of Manufacturing Sales, Investment and Employment, 2000-2012

Note: Expected growth rates are annual averages.

Wage Expectations

Manufacturing wages are expected to rise by 1.5% over the next 12 months, just slightly below the 1.8% stated in the past two surveys.

Almost 60% of respondents planned to provide raises of up to 3%, with another 20% planning wage increases of between 3% and 5%. This does not include the additional costs of benefits, which have been significant, particularly for health insurance. Forty-three percent of manufacturers cited rising insurance costs as a primary challenge.

Inventories are expected to decline by 0.6% over the next year, with 49% of respondents saying that their inventory levels would stay the same. Meanwhile, the prices for final goods are anticipated to increase by 1.4% on average. This is only slightly below the 1.5% gain suggested last time.

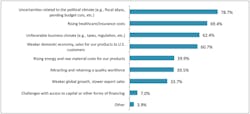

Nearly half of all manufacturers, however, plan to keep their prices about the same, with around 35% suggesting final price increases of up to 5%. Almost 8% expect to lower prices. In terms of overall pricing pressures, 39.9% of manufacturers worry about rising energy and raw material costs for their products (Figure 4).

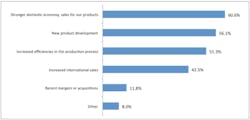

More than 42% of manufacturers cited increasing international sales as one of their primary drivers of growth (Figure 5). Illustrating the importance of overseas markets, firms that were anticipating higher exports over the next year tended to be more optimistic about their overall business outlook. In fact, 77.8% of these export-increasing firms were positive about their outlook versus 64.7% of those who anticipated slowing or no change in their export sales.

The slowdown of the global economy is a major challenge for the manufacturing sector, which depends heavily on exports for growth. Recent weaknesses have slowed the growth rate of exports, as we have seen in official government data. Here, too, we can see an impact.

Around 22% of manufacturers expect their exports to increase by 3% or more over the next year; this is down from just more than 28% in the past two surveys. Roughly 56% anticipate no changes in their export levels.

Firm size is often an important determinant of business sentiment. In recent surveys, smaller manufacturers were less positive than their larger counterparts. In this survey, however, it was larger manufacturers (e.g., those with 500 or more employees) that were more pessimistic. Just 62.9% of large businesses were positive, with one-third suggesting that they were somewhat negative.

This contrasts with 69.5% for small manufacturers and 72.3% for medium-sized manufacturers. The sales outlook helped to explain the differences. Large manufacturers predict sales gains of 1.8% over the next 12 months, compared to 2.7% and 2.9% gains for small and medium-sized firms, respectively.

Figure 4: Primary Current Business Challenges, Third Quarter 2012

Note: Respondents were able to check all that apply. Therefore, responses exceed 100%.

The top challenge for manufacturers—cited by 78.7% of respondents—was uncertainty related to the political climate. With potential tax increases and budget cuts looming at the beginning of 2013, businesses are following the political stalemate in Washington closely. The top concern in the past survey was an unfavorable business climate, which 62.4% of individuals noted this time. It is clear that politics and frustration with the political process are important, with businesses worried about the fallout that could result from the upcoming election.

In fact, several people mentioned the election, the tax and regulatory climate, budget sequestration and/or the political process on the survey. Clearly, the closer we draw to the fiscal abyss, the more manufacturers’ pessimism grows, fueling their reluctance to invest in their companies. A sampling of some of these comments appears below.

This survey specifically listed healthcare costs as a possible top challenge. Past iterations simply noted insurance costs, with healthcare being implied. Perhaps as a result of this change—or maybe because of the recent Supreme Court decision on the Affordable Care Act, higher insurance premiums, etc.—the number of respondents saying that healthcare/insurance costs were a primary concern rose to 69.4%. With the previous wording, 43.1% of individuals cited this as a primary concern. Regardless of the reason, this was enough to make it the second-most important problem for manufacturers.

Figure 5: Primary Drivers of Future Growth, Third Quarter 2012

Note: Respondents were able to check all that apply. Therefore, responses exceed 100%.

The NAM/IndustryWeek Survey of Manufacturers has been conducted quarterly since 1997. This survey was conducted among NAM membership between August 16 and 31, 2012, with 514 manufacturers responding. Responses were from all parts of the country, in a wide variety of manufacturing sectors and in varying size classifications. Aggregated survey responses appear on the following pages. The next survey is expected to be released in December 2012.

About the Author

Chad Moutray

Chief Economist, National Association of Manufacturers

Chad Moutray is chief economist for the National Association of Manufacturers, where he serves as the NAM’s economic forecaster and spokesperson on economic issues. He frequently comments on current economic conditions for manufacturers through professional presentations and media interviews and has appeared on various news outlets. In addition, he is the director of the Center for Manufacturing Research at The Manufacturing Institute, the workforce development and education partner of the NAM, where he leads efforts to produce thought leadership, data and analysis of relevance to business leaders in the sector.

Prior to joining the NAM, Mr. Moutray was the chief economist and director of economic research for the Office of Advocacy at the U.S. Small Business Administration from 2002 to 2010. In that role, he was responsible for researching the importance of entrepreneurship to the U.S. economy and highlighting various issues of importance to small business owners, policymakers and academics. In addition to discussing economic and policy trends, his personal research focused on the importance of educational attainment to both self-employment and economic growth.

Prior to working at the SBA, Mr. Moutray was the dean of the School of Business Administration at Robert Morris College in Chicago (now part of Roosevelt University). Under his leadership, the business school had rapid growth, both adding new programs and new campuses. He began the development of an M.B.A. program that began accepting students after his departure and created a business institute for students to work with local businesses on classroom projects and internships.

Mr. Moutray is the vice chair of the Conference of Business Economists, and he is a former board member of the National Association for Business Economics, where he is the co-chair of the Manufacturing Roundtable. He is also the former president and chairman of the National Economists Club, the local NABE chapter for Washington, D.C.

He holds a Ph.D. in economics from Southern Illinois University at Carbondale and bachelor’s and master’s degrees in economics from Eastern Illinois University. He is a Certified Business Economist™, where he was part of the initial graduating class in 2015.

In 2014, he received the Outstanding Graduate Alumni Award from EIU, and in 2015, he accepted the Alumnus Achievement Award from Lake Land College in Mattoon, Illinois, where he earned his associate degree in business administration. He serves on the external economics advisory board for the SIUC’s School of Analytics, Finance and Economics.