With more than 1 million customers who buy everything from uniforms to restroom supplies and fire extinguishers, Cintas Corp. can provide a glimpse into the broader economy like few other businesses. So when executives tell analysts to expect a slightly slower growth rate in the first half of 2024, they can expect to be asked for an explanation that goes beyond mere prudent forecasting.

“Growth is still good. Momentum is good. And so, we like where the business is going,” CFO Mike Hansen said in late December about the rest of Cintas’ fiscal year, which ends May 31. “But look: As we look into calendar ’24, there certainly is a little bit of uncertainty as to what the new economy may bring, what the Fed movements may bring. And so we think it is wise to be prudent as we look out.”

The Cintas team’s combination of confidence and a little caution is a theme in this, our latest survey of the quarterly earnings conference call transcripts of 50 members of the 2022 IndustryWeek U.S. 500 list of public companies. After generally dialing down expectations in the middle of last year, many executives have since suggested that the second half of 2024 will bring a broader and more pronounced step up in activity. More on that below.

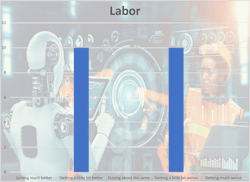

Questions about workforce availability, quality and—most pressingly these days—cost have overtaken inflation concerns as the most vocal pain point among the executive teams we track for this overview. That our overall gauge still moved in a positive direction from the third quarter was due to encouraging comments about the availability of workers. Getting those candidates to actually sign on, though, is costing a few pretty pennies.

“Sort of 3% or 4% annual wage inflation is sort of normal. We offset that through our efficiency programs in our plants,” Lear Corp. CFO Jason Cardew said last month. “It’s certainly running considerably beyond that at this stage, roughly 2x what we’ve experienced historically.”

And in what should be a big, bright red flag for those wanting the Federal Open Market Committee to cut rates soon and often, chatter about labor is becoming increasingly tied to broader inflation dynamics. TransDigm Group Inc. President and CEO Kevin Stein may have best crystallized the dynamic for many corporations.

“Our ability to pass along inflation means that we ought to be able to respond to labor in the marketplace and make sure that we always have the best people and adequate resources to drive our business,” Stein said on the aircraft parts maker’s call.

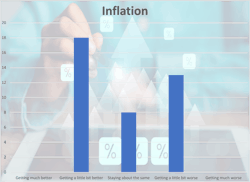

Inflation: 0.06 (-0.07 in Q3 and -0.11 in Q2)

The headline number shows our inflation sentiment reading moving into positive territory for the first time since we launched this feature in mid-2022 thanks to many executive teams gladly proclaiming an end to the materials and transportation cost hikes of the pandemic-and-beyond era.

A deeper reading of the data and accompanying commentary shows a growing split between the it’s-over camp and businesses still expecting mid-to-high, single-digit hikes in input costs in 2024—and not just in the form of wages and benefits.

Count the teams at Procter & Gamble Co. and Sherwin-Williams Co. in the latter camp. And think of Applied Industrial Technologies Inc., a distributor of industrial motion, power, control and automation technologies, as being typical of the lingering situation still facing many big names.

“While having moderated from heightened levels seen the last two years, the overall number and magnitude of supplier price updates year-to-date remains elevated compared to historical levels,” President and CEO Neil Schrimsher said.

There’s a potential double-whammy here for companies’ margins, too: Some buyers have had enough of costs being passed on, Dana Inc. CFO Tim Kraus told analysts in late February.

“We’re certainly starting to see […] customers reverting back to their traditional way of looking at recoveries,” Kraus said of Dana’s automotive OEM clients. “We need to go and get recovery around inflation and other costs through added productivity improvements within our own cost structure.”

Demand: 0.09 (0.07 in Q3 and 0.16 in Q2)

Holding steady. Treading water. Marking time.

No CEO or CFO used any of those exact phrases, but their commentary about 2024 demand often got at two ideas: Not much has changed from last fall—sectors with tailwinds then still have them now, industries dealing with weakness then haven’t seen a bounce and inventory restocking still hasn’t kicked into gear—and things should get better come summer.

Rich Tobin, chairman, president and CEO of conglomerate Dover Corp., spoke for many of his manufacturing peers: “We expect demand conditions to progressively improve off the fourth quarter exit rate through the year.”

More conspicuous this quarter that in the past were delineations between the U.S. economy and its counterparts in Europe, East Asia and Latin America that have consistently put up weaker growth in recent years. For some management teams, that’s actually going to be a positive in 2024: Executives at Alcoa Corp. and Deere & Co. joined Tobin—who pointed out that Dover’s organic bookings grew late last year for the first time in eight quarters—in saying that European customers are broadly stepping up their activity.

The Chinese economy, however, hasn’t rebounded as many expected a year ago, which has become a pain point for some companies in our universe. Carrier Global Corp. Chairman and CEO Dave Gitlin said the world’s second-largest economy “is kind of a watch item” for his team after a Q4 with fewer orders than expected. But he also quickly added that industrial and infrastructure work there should provide a lift in 2024.

“We’re actually banking on strong growth in China this year,” Gitlin said. “We have some level of optimism because we continue to go where the customers are.”

Supply chain: 0.11 (0.21 in Q3 and 0.20 in Q2)

This indicator remains the most positive of the group but it has just about regressed to the pack. The turmoil in the Red Sea contributed to that, but the big contributor is similar to what’s driving labor sentiment: Cost. Yes, the system has largely normalized but it is now—and looks set to continue—operating at a higher price level.

“I would call it more supply chain normalization than I would significant deflation,” said Peter Jackson, CFO of Builders FirstSource Inc. “I think [suppliers are] still challenged with a lot of the inflationary operating costs that we all are. So I don’t expect that they’re going to be able to significantly reduce price.”

Short of being able to pass on those higher costs—which is no longer an option for many companies after multiple pandemic-era hikes—the next phase in the business of supply chains might be what Dana CFO Tim Kraus talked about above: Buyers and suppliers look to be in for some spirited discussions.

“As supply chains have normalized, it’s giving our team an ability to really go back and challenge the supply base in understanding what is the real cost and where are we able to drive productivity in cost savings,” Agco Corp. CFO Damon Audia told analysts in early February.